Wednesday December 8, 2021 | VANCOUVER ISLAND, BC [Posted at 8:50 am PT | Last update 1:33 pm PT]

Political analysis by Mary P Brooke, Editor | Island Social Trends

Many low-income seniors across Canada have been doing whatever they’ve had to do in response to losing their federal Guaranteed Income Supplement (GIS) this year. But for many it’s becoming desperate. Forgoing or reducing purchases of life necessities such as groceries, medication, utility bills and even rent is, for many, what it’s coming down to.

For having taken CERB/CRB income supports during the pandemic in 2020, as many as 90,000 low-income seniors have seen that taxable income used by the Canada Revenue Agency (CRA) in a calculation that shows their income above the GIS-allowance threshold for the 2020 tax year.

But the pandemic supports in 2020 were one-time emergency-related income, and in likely almost every case what appears in CRA calculations to be ‘higher income’ does not represent a true or actual go-forward income increase for these seniors in 2021.

Seniors age 60+ are eligible for the non-taxable GIS if their income is below $19,248 (if single, widowed, or divorced) or below $25,440 (if their combined income with a spouse or common-law partner where the full Old Age Security/OAS pension is received, or below $46,128 if the partner does not receive OAS).

Game-changer:

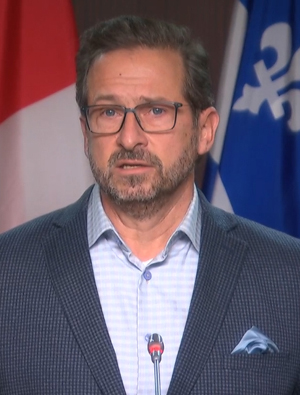

Today Bloc Quebecois Leader Yves-François Blanchet in a press briefing strongly indicated that his party’s votes may not support the minority Liberal government’s Bill C-2. That Bill is intended to offer new or extended pandemic supports, but addresses mostly specific business challenges and any persons who might find themselves under an officially declared COVID-pandemic lockdown.

Blanchet’s tone of ultimatum sets the entire success of C-2 on the brink of failure. C-2 is the first major bill around economic recovery that the Liberal government hopes to pass in this 44th parliament.

The Liberals might hope that seeing the Bloc and NDP voting against Bill C-2 will make those two parties (notably the NDP deemed as ‘progressive’) as voting against the benefits that the Liberals are offering, and against people in general.

But C-2 does not offer the sort of benefits like CERB and CRB which helped sustain low-income employed and self-employed Canadians with direct in-pocket support during the first phases of the pandemic in 2020 (and into 2021).

Canadians are sharper on the details now about federal politics than perhaps they were before the hardships of the pandemic. NDP and Bloc not supporting C-2 will make not make those parties look bad. Au contraire, if communicated well by the NDP, it will help them, in particular, shine.

The pandemic grinds on:

It’s one thing to stop giving pandemic economic supports now, as Canada struggles with a path to recovery.

But it’s quite another to clawback the supports that were given in 2020 (using the mechanism of reducing or eliminating GIS payments).

How the government expects these low-income seniors to cope for a full 12 months (August 2021 through July 2022) has never been articulated by the Liberals.

Today’s bold statement by the Bloc leader comes on the heels of over four months of articulation of the GIS clawback problem by NDP Leader Jagmeet Singh and a continuing round of NDP MPs. [See archive of GIS articles and reader letters here or scroll down to the bottom of this article]

Statement from the Seniors Minister:

“We know just how challenging this pandemic has been on seniors – but every step of the way – our government has always been there to support seniors by strengthening their GIS. We moved quickly to provide immediate and direct financial support to seniors,” said Seniors Minister Kamal Khera today in a statement to Island Social Trends.

“When it comes to CERB/GIS – we know it has been hard on some seniors this year. We are working on this issue to find the right solution to support those affected,” she said.

Meanwhile, the ‘right solution’ still implies having to sort out around the fact that CERB/CRB was stated from the start as taxable income, but that the government still wants to be helpful. Avoiding complications in future as to calling something taxable then giving it back, is a challenge for sure. It does fall short of the NDP saying today that GIS arrears from August 2021 forward should be repaid in full.

Sets C-2 in jeopardy:

The Bloc has 32 seats in the House of Commons, and the NDP has 25. The Liberal minority operating with 159 seats will need one or both of the Bloc and NDP in order to pass the bill (i.e. 170 votes or more). The Conservatives are not likely to offer support for the bill, as generally speaking they want pandemic-economy interventionist mechanisms to cease.

But the pandemic grinds on, with continued economic impacts that morph and evolve, looping in different sectors and aspects of society as it goes along. Notably seniors, women, service-sector workers, various industry sectors, youth, and post-secondary have dealt with impacts unique to their needs.

C-2 treats the pandemic like a fading flower, which it very much is not. Impacts on the economy, various workforce sectors, people’s mental health and social network integrity continue to grind away at the bedrock of a well-functioning economy and society.

C-2 offers a sharp focus on a narrow (though important) range of business supports, but misses the ongoing economic impacts of the pandemic on a wide range of regular Canadians (not just seniors, but also families who are seeing their Canada Child Benefit clawed back). There’s nothing new about the federal government favouring big business over small, but this case of GIS (and Canada Child Benefit) clawback borders on punishment, with a streak of cruelty in its lack of awareness to the realities of low-income Canadian life.

The face that CERB/CRB was clearly stated as taxable income does not change the reality that impacted low-income seniors now face.

NDP continued push:

Letters from CRA were being received by impacted seniors in July of this year, advising them of the reduction or full loss of monthly GIS payments. MPs across the country were hearing about it from seniors in their constituencies.

In early August the NDP started pushing the Liberal government for a change in this scenario. But a federal election was called mid-August (election date September 20; Cabinet announced October 26 and House of Commons resumed sitting November 22, 2021).

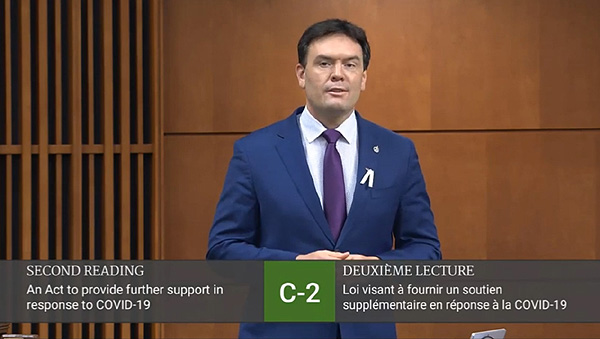

On November 24 in the House of Commons NDP Leader Jagmeet Singh made an eloquent pitch that low-income seniors not be punished or left behind, including that some are now struggling to keep their homes. It was a simple but genuine instance of rising to the moment, fighting for the people in the people’s House. It’s one of those moments when you know the political system can work for people’s benefit.

On November 29 in the House of Commons, local MP Alistair MacGregor (Cowichan-Malahat-Langford) kept the ball in the air, and eliciting a response from a Liberal MP. Here’s how the short discourse went (3-minute November 29, 2021 House of Commons recording here).

The GIS clawback issue is not a fad or a political ploy for its own sake. Real people’s lives are becoming crushed under the weight of this faux-pas by the federal government.

Certainly a lot was done by the Liberal government ‘on the fly’ in the early days of the pandemic (notably the CERB program which kept Canadians afloat in a highly uncertain time), and many are grateful. But throwing so many low-income seniors under the bus now is a train wreck that remains unaddressed.

The issue continues to be addressed in the House of Commons, and today caught fire with the Bloc Quebecois — but mostly because the NDP kept pushing.

For months, several letters have been written by NDP MPs to various Cabinet members, including to the Seniors Minister, Minister of National Revenue, and Minister of Employment, Workforce Development and Disability Inclusion. The Prime Minister was asked directly, in the House of Commons, by the NDP Leader, on November 24.

And just yesterday in the House of Commons, again, two NDP MPs contributed their comments about the GIS clawback, including Daniel Blaikie, Critic for Employment, Workforce Development & Disability Inclusion. The pressure is unlikely to stop unless or until the Liberals include a GIS clawback reversal within C-2.

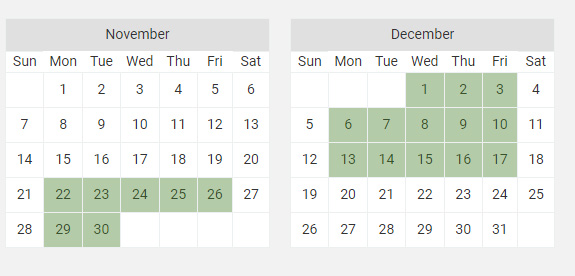

The government hopes to see passage of Bill C-2 before the House adjourns December 17 for the Christmas break which lasts through most of January.

At what cost:

In September, the Parliamentary Budget Officer told the NDP that taking the CERB (and the subsequent CRB) out of the equation used to calculate GIS would cost the government $380 million this year and $58 million next year. In the big picture, these are small numbers within the scope of the federal government’s pandemic management.

Meanwhile, a Christmas season under the increasing weight of financial distress is what many low income seniors now face. If the Liberals can manage to correct this serious error in socioeconomic management, it will be to their political credit.

To take the Liberals at their word that they are “aware of the problem” — as stated by Prime Minister Justin Trudeau on November 24 in the House, and again by Liberal MP Darrell Samson on November 29, and Seniors Minister Kamal Khera (one of the youngest MPs) on December 7 — thereby sees the Liberals taking more time to figure out how to do the clawback reversal without losing face.

Meanwhile, seniors lose health security (e.g. lesser quality or quantity of food purchases, cutting back on medications) and suffer financial instability (e.g. borrowing or using credit cards to cover the rent).

This puts the weight of the pandemic recovery on the backs of Canadians who are least able to withstand it. For low-income seniors (and families affected by the Canada Child Benefit clawback) it presents a bleak Christmas by unfair means.

Even a one-time GIS bonus cheque to seniors (and a family bonus to CCB recipients) before Christmas would put the Liberals in a better light while they justify the clawback and figure out the mechanism to reverse it.

[See archive of GIS articles and reader letters here or at the bottom of this article]

===== ARCHIVE of GIS LETTERS & ARTICLES:

Bloc adds voice to GIS clawback issue, puts C-2 under threat (December 8, 2021)

Liberals again acknowledge GIS clawback issue as NDP keeps pushing (November 30, 2021)

NDP calls for emergency debate around low-income family & seniors clawbacks (November 24, 2021)

NDP rolls into 44th Parliament with priorities to help people (November 22, 2021)

Restoring GIS & Canada Child Benefit important for low-income islanders (November 18, 2021)

LETTER: Losing GIS means needing help to pay the rent (November 17, 2021)

44th parliament: NDP to take on housing, GIS & CERB amnesty within affordability, also climate crisis (November 9, 2021)

Seniors Minister weighs in on what NDP calls GIS clawback (November 8, 2021)

NDP requests immediate government action to reverse GIS clawback (November 3, 2021)

LETTER: senior faces potential eviction due to GIS clawback (Oct 27, 2021)

LETTER: GIS clawback continues after election (October 19, 2021)

LETTER: GIS clawback means food vs rent (September 19, 2021)

NDP candidate mojo: we fight for you (September 19, 2021)

LETTER: GIS clawback means no bus pass (September 13, 2021)

LETTER: Hurting seniors with GIS clawback (September 5, 2021)

LETTER: Retired & depending on GIS (August 19, 2021)

LETTER: Suddenly losing Guaranteed Income Supplement by receiving CERB (August 10, 2021)

LETTER: Seniors suddenly losing Guaranteed Income Supplement if they took CERB (August 7, 2021)

Seniors who took CERB now losing GIS supplement & other benefits (August 4, 2021)

===== Submitting a letter:

To submit a letter to Island Social Trends, send to letters@islandsocialtrends.com