Monday November 8, 2021 | VANCOUVER ISLAND, BC [See original article from November 3, 2021]

Editor’s notes:

- On November 3, 2021 the NDP has taken a next-step to pushing the federal government to reinstate the GIS payments that have been clawed back from seniors who took CERB and CRB.

- GIS is the Guaranteed Income Supplement paid to seniors who are income-challenged.

- CERB was the Canada Emergency Response Benefit as available in 2020.

- CRB was the Canada Recovery Benefit for self-employed and non-EI recipients, available to October 23, 2021.

- Locally, Alistair MacGregor, MP (Cowichan-Malahat-Langford) told Island Social Trends just before the election that he is “surprised that no one in the government could see this was going to be an issue”.

- Update Nov 8, 2021: The clawback cannot be reversed by an Order in Cabinet. if it’s to be changed, that would require legislation.

- The new federal Cabinet was announced October 26, 2021. The Liberals held their first caucus meeting November 8; mandate letters to the Ministers have not yet been issued as of this date. The House of Commons will resume November 22, 2021.

- Links: Letters from readers who have lost their GIS.

Seniors across the country were shocked this summer to learn that benefits they rely on such as the Guaranteed Income Supplement (GIS) have been cut because they received pandemic supports like the Canada Emergency Response Benefit (CERB).

Most seniors were aware the CERB (later CRB) was taxable income, but were not in any way directly advised that the support through the GIS program would be clawed back as a result of receiving emergency support payments like CERB during the worst of the pandemic economic impacts.

The word ‘guaranteed’ is right in the name of the long-standing federal government support program. To almost everyone that indicated (as a general perception) the certainty in receiving the payments (which for low-income seniors are a top-up to the Old Age Security or OAS payments that all seniors receive).

Island Social Trends notes the correction that any changes to the GIS cannot be changed by cabinet order. But we stand by our journalism (from our article November 3, 2021) in reporting how the NDP have sent another letter to the federal government asking for reversal of what is being seen and *experienced* effectively a clawback, as reflected in:

- the continued angst expressed in letters from readers (not just to our publication but also elsewhere across the country),

- the continued mention of this issue by the NDP leader during the Fall 2021 federal election campaign,

- the many of comments to MPs across the country, and

- the many phone calls to the Canada Revenue Agency (CRA) from individuals since the summer.

Important information confirmed by the Minister of Seniors office last week is probably very important for impacted seniors to know: “In limited circumstances, such a loss of certain pension income, a senior on GIS can request that their benefit be calculated based upon their estimated income for the current calendar year, rather than their actual income from the previous calendar year. These requests are handled on a case-by-case basis.”

Statement from the Minister for Seniors:

Canada’s Minister of Seniors is Kamal Khera. She was first elected as the Member of Parliament for Brampton West in 2015, and has previously served as Parliamentary Secretary to the Minister of International Development, Parliamentary Secretary to the Minister of National Revenue, and Parliamentary Secretary to the Minister of Health.

The Office of Canada’s Minister of Seniors, Hon Kamal Khera, (via Press Secretary Daniel Pollak) has submitted “comments and corrections” to Island Social Trends, and we are posting them verbatim, here:

***

===== Every year thousands of seniors have their GIS increased or decreased to reflect changes in their net income. This ensures the benefit targets the most vulnerable seniors. Like EI, CERB and CRB are counted as taxable income in the calculation.

Because GIS benefits are generally reduced by $1 for every $2 of net income, affected seniors would have received more in CERB or CRB than they lost in GIS.

In limited circumstances, such a loss of certain pension income, a senior on GIS can request that their benefit be calculated based upon their estimated income for the current calendar year, rather than their actual income from the previous calendar year. These requests are handled on a case-by-case basis.

Seniors continue to receive their full OAS and CPP pensions, which are not income-tested.

Our government provided financial support for seniors early on in the pandemic, is making the first increase to OAS since 1973, and is continuing to strengthen seniors’ financial security.

===== I’m also flagging some inaccuracies in the article for correction or clarification:

- “The claw back can be reversed by an Order in Cabinet” / “the GIS clawback could be reversed by an Order in Cabinet”

- An Order in Council would not be able to exclude income from GIS calculations; that would require modifications to the legislation.

- “During the election campaign Liberal Leader Justin Trudeau essentially summarized that to his belief people age 65 to 74 were mostly still working”

- This claim is false, the Prime Minister never said that. We are increasing Old Age Security by 10% for ages 75+ because older seniors have different needs. As seniors age, their health and home care costs rise, all while they are more likely to be unable to work, have disabilities or be widowed. Detailed statistics are available at https://www.canada.ca/en/employment-social-development/news/2021/05/backgrounder-increased-costs-for-older-seniors.html

- “To almost everyone, that indicated certainty in receiving the payments (which for low-income seniors are a top-up to the Old Age Security or OAS payments that all seniors receive).”

- This is false. GIS benefits have always been tested based on seniors’ taxable income. This ensures the benefit targets the most vulnerable seniors. That is why they are provided to 2.1 million of Canada’s 6.7 million seniors. Indeed, most seniors on GIS are very aware that they change based on their incomes.

===== There are also several inaccuracies in quotes from NDP MPs:

- “ seniors were not told that accepting emergency benefits would disentitle them to their regular income supports”

- In fact, since the introduction of CERB the Government of Canada was clear that it was taxable income. (For example, see this press release Government introduces Canada Emergency Response Benefit to help workers and businesses – Canada.ca).

- Similarly, the criteria for GIS have been widely available and have always been income-tested based on taxable income.

- Now, some of Canada’s most vulnerable low-income seniors have lost the GIS help they relied on simply for following the government’s advice,”

- CERB and CRB helped millions of Canadians who had lost employment income, including seniors. Seniors who received them and as a result no longer qualify for GIS received more through those pandemic supports than they lost in GIS support.

- Instead of taking action to help low-income seniors and support Canadians through a pandemic, the Prime Minister chose to call an early election.

In fact, the government swiftly helped seniors during the pandemic. To help seniors with their extra costs, we provided one-time, tax-free payments worth over $1500 to a low-income couple.

(In April 2020, more than 4 million low and middle-income seniors received a GST Credit top-up—worth an average of $375 for individual seniors and $510 for senior couples. In July 2020, we provided a one-time tax-free payment of $300 to 6.7 million OAS pensioners and a further $200 to 2.2 million seniors eligible for the GIS.)

In Budget 2021 we continued to strengthen seniors’ financial security by helping Canadians with their higher costs later in life:

- For short-term support, we issued a one-time $500 payment in August 2021 to OAS pensioners born on or before June 30, 1947.

- We are permanently increasing the Old Age Security pension by 10% for seniors aged 75+ in July 2022, providing $766 over the first year to pensioners receiving the full benefit.

NDP fighting for restoration of GIS (as published November 3, 2021):

The federal NDP MPs are calling on the Liberal government to fix what they call a “devastating situation that has left many seniors worried they won’t be able to afford their rent, food and medication”.

NDP Leader Jagmeet Singh repeatedly brought up the GIS clawback issue during the summer/fall 2021 election campaign. None of the other parties mentioned it (except perhaps one brief reference in passing by Conservative Leader Erin O’Toole in response to a media question).

First steps ahead of 44th parliament:

The federal Cabinet was announced on October 26, and NDP critics announced last week. But the 44th Parliament does not get started in the House of Commons until November 22.

Apparently the GIS clawback could be reversed by an Order in Cabinet ahead of Parliament sitting, or by legislation after parliament convenes.

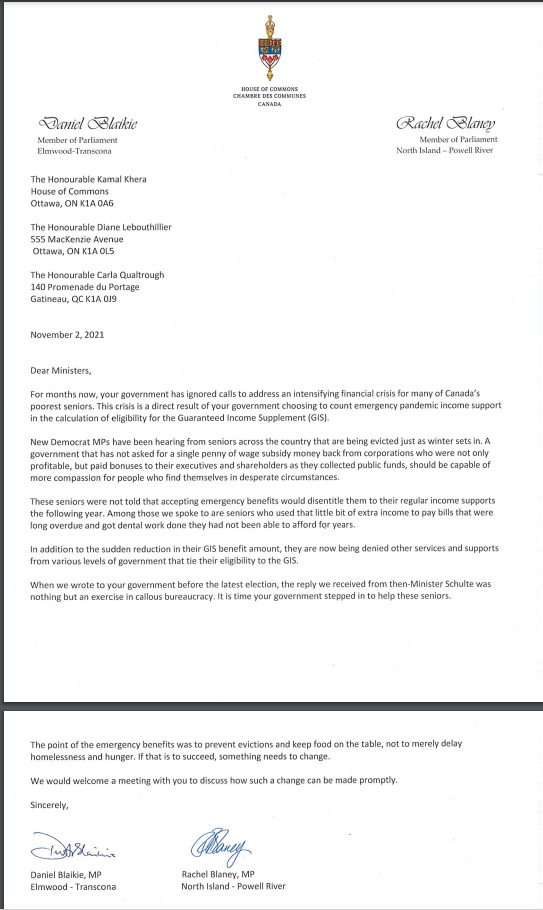

The NDP in their November 2, 2021 letter (see image & link below) to Ministers Khera, Lebouthillier and Qualtrough asking for immediate action to address this crisis facing so many seniors, the NDP’s Critic for Seniors, Rachel Blaney and the Critic for Employment and Workforce Development, Daniel Blaikie, articulate that seniors were not told that accepting emergency benefits would disentitle them to their regular income supports the following year.

“In addition to the sudden reduction in their GIS benefit amount, they are now being denied other services and supports from various levels of government that tie their eligibility to the GIS,” they wrote.

In BC, the seniors rental rebate program (SAFER) could be one of those income-tested support programs that might (as a result of the CERB income) might reduce supports to seniors who’ve been relying on the program for helping to cover the cost of high rent in the private rental market.

Liberals are abandoning seniors:

“Seniors have had to endure a lot during this pandemic, whether it’s been poor living conditions in long-term care homes or being more vulnerable to COVID-19. Now, some of Canada’s most vulnerable low-income seniors have lost the GIS help they relied on simply for following the government’s advice,” said NDP Leader Jagmeet Singh.

“The Liberal government can’t abandon our seniors like this. We’re urging Justin Trudeau to act immediately and ensure Canadian seniors have the help they need,” said Singh in a news release today.

Back in August (just ahead of the election call), NDP MPs sent a letter to the Liberal government asking them to find an urgent solution to fix the problem they have created for seniors. Instead of taking action to help low-income seniors and support Canadians through a pandemic, the Prime Minister chose to call an early election.

Slow to offer support, quick to take it back:

“Was it not enough for Liberals to drag their heels getting financial support to seniors in the early days of the pandemic? Now they’re trying to claw back some of the support that actually made it to seniors in need,” said NDP Critic for Employment and Workforce Development Daniel Blaikie, who is the MP for Elmwood-Transcona in Manitoba.

“While the Liberals rush to give money to the richest corporations without any strings attached, they are nickel-and-diming seniors. It’s just not good enough,” said Blaikie in a news release today.

“We have heard from many seniors across the country who were shocked to learn they would be losing the benefits they rely on to get by. Canadian seniors deserve much better than the treatment they have gotten from the Liberal government, ” said NDP Critic for Seniors Rachel Blaney, who is the MP for North Island—Powell River, here on Vancouver Island.

“We are ready to work with the government to find an immediate fix to the so we can help the seniors they have turned their backs on,” said Blaney in a news release today.

Comments welcome from seniors:

Letters to the editor may be submitted to letters@islandsocialtrends.com

===== RELATED:

44th parliament: NDP to take on housing, GIS clawback & CERB amnesty within affordability, also climate crisis (November 9, 2021)

NDP requests immediate government action to reverse GIS clawback (November 3, 2021)

LETTER: senior who still needs temp work lost GIS (November 3, 2021)

LETTER: senior faces potential eviction due to GIS clawback (October 27, 2021)

LETTER: GIS clawback continues after election (October 19, 2021)

LETTER: GIS clawback means food vs rent (September 19, 2021)

NDP candidate mojo: we fight for you (September 19, 2021)

LETTER: GIS clawback means no bus pass (September 13, 2021)

LETTER: Hurting seniors with GIS clawback (September 5, 2021)

LETTER: Retired & depending on GIS (August 19, 2021)

LETTER: Suddenly losing Guaranteed Income Supplement by receiving CERB (August 10, 2021)

LETTER: Seniors suddenly losing Guaranteed Income Supplement if they took CERB (August 7, 2021)

Seniors who took CERB now losing GIS supplement & other benefits (August 4, 2021)