Tuesday November 30, 2021 | VANCOUVER ISLAND, BC

Political analysis by Mary P Brooke, Editor | Island Social Trends

Many low-income seniors across Canada have been doing whatever they’ve had to do in response to losing their federal Guaranteed Income Supplement (GIS) this year.

For having taken CERB/CRB income supports during the COVID pandemic in 2020, as many as 90,000 low-income seniors saw that taxable income used by the Canada Revenue Agency (CRA) in a calculation that shows their income above the GIS-allowance threshold for the 2020 tax year.

But the pandemic supports in 2020 were one-time emergency-related income, and in likely almost every case what appears in CRA computer calculations to be ‘higher income’ does not represent a true or actual go-forward income increase for these seniors going forward in 2021.

Seniors age 60+ are eligible for the non-taxable GIS if their income is below $19,248 (if single, widowed, or divorced) or below $25,440 (if their combined income with a spouse or common-law partner where the full Old Age Security/OAS pension is received, or below $46,128 if the partner does not receive OAS).

Somehow riding out 12 months:

If the clawback is not addressed, these seniors will have to go a full 12 months (August 2021 through July 2022) without the GIS support that they would otherwise likely qualify for in most cases.

To deal with this in real-time, the GIS-dependent seniors have been cutting back on the purchase of groceries, medications, transportation and other regular life necessities in order to have enough each month to pay for rent and other bills (see letters at the bottom of this article). This harsh marginalization of almost 90,000 seniors across Canada has pushed many to the financial edge, through no fault of their own.

In a sense, these seniors are paying for the pandemic supports that the federal government so quickly and liberally distributed to a majority of Canadians. It’s a shift in financial responsibility to the shoulders of low-income seniors, where it most certainly does not belong (the pandemic has had society-wide impacts, and the burdens of paying for it should not be loaded upon low-income Canadians, including the families that are now not receiving the Canada Child Benefit through the same process of erroneous tax calculation).

Complaints started immediately:

Letters from CRA were being received by impacted seniors in July of this year, advising them of the reduction or full loss of monthly GIS payments. MPs across the country were hearing about it from seniors in their constituencies.

In early August the NDP started pushing the Liberal government for a change in this scenario. But a federal election was called mid-August (election date September 20; Cabinet announced October 26 and House of Commons resumed sitting November 22, 2021).

Only now is the issue being addressed in the House of Commons — only because the NDP kept pushing. Several letters have been written to various Cabinet members, including to the Seniors Minister, Minister of National Revenue, and Minister of Employment, Workforce Development and Disability Inclusion.

The first such letter about the GIS clawback on August 3, 2021 from NDP MPs Rachel Blaney and Daniel Blaikie landed on Liberal minister’s desks just as the federal election was about to be called, so the prospects were bleak if not zero for any immediate action to rectify the problem. Seniors were now entrenched into a long financially-distressed fall season, or longer, without government leadership in place to deal with it.

Public opinion on this misshapen approach to taxation regarding pandemic supports was consistent and robust during the federal election campaign period (August 15 to September 20), because it had to be. And it’s kept on going since, because of the dire situation for many seniors. And politics is the mechanism by which to fix it.

Walking on the backs of seniors this way (perhaps blindly, but even so it’s a shoddy oversight) has generated an uproar (see many letters and GIS news coverage, including comments from the Seniors Minister on November 8, 2021).

And yet the GIS clawback was not mentioned in the C-2 bill “An Act to provide further support in response to COVID-19” that is presently before the House.

NDP Leader made the keynote pitch:

Last week during Question Period on November 24, NDP Leader Jagmeet Singh made an eloquent pitch that these seniors not be punished nor left behind:

“Right now, this government is cutting the help that vulnerable seniors and families need. They are cutting the GIS and cutting the Child Benefit while vulnerable seniors and families are struggling to put food on the table, they are struggling to keep their homes, because they cannot afford the rent. The prime minister can fix this today. Will the PM today commit, to ending the clawbacks of GIS and ending the clawbacks of the child benefit and stop hurting vulnerable seniors and families.”

It was a simple but genuine instance of rising to the moment, fighting for the people in the people’s House. It’s one of those moments when you know the political system can work for people’s benefit.

Prime Minister edged toward a commitment:

Within his response to the NDP Leader, Prime Minister Justin Trudeau said his government is aware of the problem: “We put the CERB in place to help people at the height of the pandemic. We know it’s having an impact on the most vulnerable now. Ministers are actively working to come to the right solution to support vulnerable Canadians,” said Trudeau.

Trudeau prefaced his comments by “thanking the leader of the NDP for continuing to stand up for Canadians as we endeavour to do on this side of the house. I look forward to working with him on issues such as this.”

This was a quiet victory for people that should have made national headlines. A real point of struggle had been steadily highlighted by the ‘third party’ 25-member NDP caucus for months, and brought to the right moment for political shift, succinctly by their leader, and it was responded to by the prime minister in a way that allowed the government of the day to save face.

It’s also an excellent example of how a minority government can be worked to the benefit of action for the people.

Team effort:

The ball has not been dropped on this issue by NDP MPs, including four from Vancouver Island.

Now three letters have been written by Rachel Blaney (NDP Seniors Critic) and Daniel Blaikie (NDP Employment and Workforce Development Critic), and last week Randall Garrison (Esquimalt-Saanich-Sooke) and Laurel Collins (Victoria) spoke about not clawing back supports from low-income Canadians (including families that normally receive the Canada Child Benefit, who also have lost that support due to the CERB 2020 income calculation).

Alistair MacGregor brings it forward again:

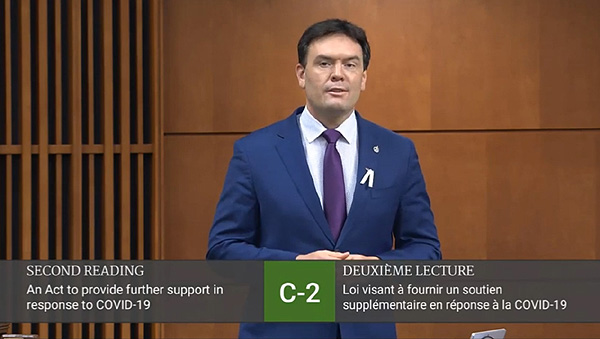

On November 29 in the House of Commons, local MP Alistair MacGregor (Cowichan-Malahat-Langford) kept the ball in the air, and eliciting a response from a Liberal MP. Here’s how the short discourse went (listen to the 3-minute November 29, 2021 House of Commons recording here).

A Liberal MP had been making mention of “targeted assistance” during debate on Bill C-2. In response, MacGregor put it plain and simple — there’s a problem, it’s urgent, and a prompt fix is required.

“We know that many of the poorest seniors in his country, those on GIS, had to have supplemental income in order to pay the bills each month,” MacGregor said. “And they like many Canadians also lost those jobs when the pandemic struck our country.”

“Now those seniors are in a situation where that Canada Recovery Benefit income is being clawed back from their GIS,” he outlined. “Many of them cannot afford to make rent payments or put good quality food on the table.”

Then requesting action: “Why when we have this golden opportunity with Bill C-2 did the government not make any mention of targeted assistance to help the most vulnerable Canadians in this country? And will the Liberal government quickly fix this. This is an urgent problem in my riding and right across the country.”

Liberal commitment is let out of the bag:

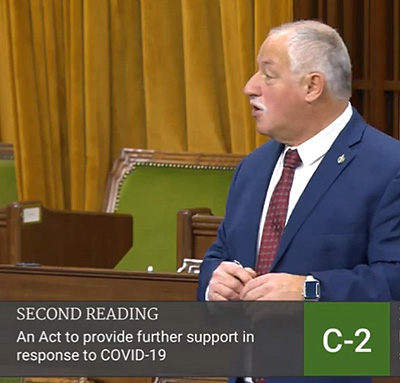

In addition to the Prime Minister’s comment Question Period last week, today Liberal MP Darrell Samson (Sackville-Preston-Chezzetcook, NS) furthered the government’s commitment to look at the problem. He’s not a high-profile MP nationally, but the words got spoken on behalf of the government.

During second reading of C-2 An Act to provide further support in response to COVID-19, Samson said in reply to MacGregor’s call for GIS clawback action:

“I too (as an MP) have been receiving many calls and notes from seniors, faced with that challenge of the GIS and having lost some income due to having received some supports throughout the pandemic. It is a situation that we need to deal with. I believe it was last week, that our minister said they were looking at seeing how they could resolve that issue because we helped seniors who had challenges that were particular to the pandemic. But they need those supports from GIS.”

“We did also have an increase of 10 percent in the GIS back in 2016, and we did commit to more increases as we move forward. But we do have to rectify that situation that he (Alistair MacGregor, MP) presented, absolutely,” said Samson.

Cost of restoring the clawbacks:

In September, the Parliamentary Budget Officer told the NDP that taking the CERB (and the subsequent CRB) out of the equation used to calculate GIS would cost the government $380 million this year and $58 million next year.

In the broader context of the expenditures by the federal government to keep Canadians’ heads above water during the pandemic, that level of expenditure is not large. And technically speaking, it wouldn’t be an expense, but a return of funds owed.

How to issue the funds:

So far, there has been no technical discussion about how the clawback might be reversed. Will impacted seniors receive a rebate cheque in the mail for the months now missed (i.e. August through November 2021, or longer), or will there be a tax credit against their 2021 taxes?

A full rebate for missed GIS payments would recognize the reality that these seniors have in many cases had to borrow from friends or family, or put their life-expense overrun onto credit cards or run a line of credit (which means they’re paying interest and incurring further hardship), and that some may have by now had to move into lesser accommodation or may have even lost the roof over their heads. All of this still during an ongoing pandemic and an inflationary cost of living.

A tax-credit next year would be accurate and responsible on paper, but of little comfort to resolve the immediate need of the situation. The waiting period is now five months (August to December GIS payments not paid or in the works), which will likely run into at least seven or eight months of ‘finding money somewhere’ until the government can figure out an administrative way to make whole these seniors who are now teetering on the edge of high-impact poverty in some cases.

===== ARCHIVE of GIS LETTERS & ARTICLES:

NDP calls for emergency debate around low-income family & seniors clawbacks (November 24, 2021)

NDP rolls into 44th Parliament with priorities to help people (November 22, 2021)

Restoring GIS & Canada Child Benefit important for low-income islanders (November 18, 2021)

LETTER: Losing GIS means needing help to pay the rent (November 17, 2021)

44th parliament: NDP to take on housing, GIS & CERB amnesty within affordability, also climate crisis (November 9, 2021)

Seniors Minister weighs in on what NDP calls GIS clawback (November 8, 2021)

NDP requests immediate government action to reverse GIS clawback (November 3, 2021)

LETTER: senior faces potential eviction due to GIS clawback (Oct 27, 2021)

LETTER: GIS clawback continues after election (October 19, 2021)

LETTER: GIS clawback means food vs rent (September 19, 2021)

NDP candidate mojo: we fight for you (September 19, 2021)

LETTER: GIS clawback means no bus pass (September 13, 2021)

LETTER: Hurting seniors with GIS clawback (September 5, 2021)

LETTER: Retired & depending on GIS (August 19, 2021)

LETTER: Suddenly losing Guaranteed Income Supplement by receiving CERB (August 10, 2021)

LETTER: Seniors suddenly losing Guaranteed Income Supplement if they took CERB (August 7, 2021)

Seniors who took CERB now losing GIS supplement & other benefits (August 4, 2021)

===== Submitting a letter:

To submit a letter to Island Social Trends, send to letters@islandsocialtrends.com