Tuesday February 28, 2023 | VICTORIA, BC [Updated 11:15 am March 2, 2023]

by Mary P Brooke | Island Social Trends

Today in Victoria, the BC Government announced their Budget 2023.

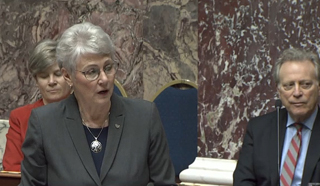

This is the first budget delivered by Finance Minister Katrine Conroy. She was appointed as Finance Minister in December when Premier David Eby announced his first Cabinet after becoming BC’s 37th Premier the month before.

This budget sees the pandemic farther into the rear view mirror, but takes BC into a 3-year overall deficit ($4.2 billion in 2023-2024, $3.8 billion in 2024-2025, and $3 billion in 2025-2026). The Province enjoys a Triple-A credit rating from one rating agency with several others giving a double-A-plus rating (this is the highest overall rating of any province in Canada).

Conroy described the surplus of 2022-2023 as likely the last one for a long while (the surplus was essentially from income and sales tax resulting from the pent-up demand resulting from the economic restrictions of the pandemic years).

“When times are tough, you need government in your corner,” said Conroy today, playing on a remark by Eby on the December 7 Cabinet appointment day when he described Conroy as “rural tough”.

Inflation still high, with economic growth slowdown:

Conroy said that (having discussed inflation with Bank of Canada Governor Tiff Macklem in recent weeks) that she has confidence that the Bank of Canada is likely to maintain their intention to pause on increasing the central bank rate any further. She feels that increases in inflation will level off by 2024. The Bank of Canada rate is presently 4.25%. Any impact of higher interest rates in the next year would increase the BC deficit in 2023-2024.

Economic growth was 2.8% in BC this year, but that is projected to grind down to 0.4% next year in the face of an overall global economic slowdown (generally thought to be under pressures of the continued war in Ukraine and supply chain interruptions).

Investing in people:

In the fiscal year 2023-2024, which commences on April 1, the BC NDP government continues with its ‘investment in people’ in a number of ways.

The list includes hiring, training and new directions in health-care delivery, as well as a range of credits (e.g. another BC Affordability Credit in April 2023, a new income-tested renter’s tax credit of up to $400 per year, and various levels of relief on student loans).

There is also indirect support to British Columbians through the expansion of educational/training seats at post-secondary institutions (based on what job sectors need workers).

Opposition viewpoints:

BC Liberals: This sort of investment in people is more nuanced than what the BC Liberals might deliver. After the budget delivery, BC Liberal Leader Kevin Falcon somewhat derided the ‘giveaway’ approach of the NDP, and delivered the expected harangue of how NDP doesn’t understand how to “get big things done”.

A business-first approach was not seen by Falcon in the 2023-2024 budget although Conroy said there are supports for business through the massive investment being made in training in trades and at the post-secondary level to provide the ‘talent’ and workers that businesses need.

The following day, during Budget Debate in the Legislative Assembly, Peter Milobar (Opposition House Leader and Finance critic) went on at length but some of the standout points are:

- This budget “does precious little” for seniors who he says were among the hardest hit during the pandemic, and that this is “the worst place in Canada to be a senior”.;

- It’s a disappointing budget for teachers and BC’s K-12 sector, lauding the expansion of the food program in schools “but there are more fundamental problems in K-12 than this government wants to admit” saying there aren’t enough new schools being built.

- That the NDP Government’s “default response” is to hire more people as a way to address gaps and shortages in the work force, particularly health care.

- Despite more funds into Clean BC, he paraphrases the Canadian Home Builders Association that says there is “no lower market transformation in residential construction”.

- The promised renter’s rebate has become a tax credit, the benefit of which won’t be felt by recipients (people with personal income up to $80,000) until the 2023 tax-year.

BC Greens: “The BC NDP government’s 2023 Budget acknowledges the current challenges in British Columbia but fails to shape a better future for British Columbians.” The BC Greens challenged once-a-year tax credits “instead of actually making the cost of living more manageable” (even though the BC Affordability credit has been issued now twice in 2023 – once in January and the next coming in April).

The BC Greens say that BC Government investments in housing “don’t match the scale of the crises” but continues: “We are happy to see investments in housing solutions for students, low-income renters, seniors, and unhoused people.”

The BC Green Party leader urges the BC government to deliver support measured by well-being parameters not GDP, noting that BC takes direction from bankers (12 of 13 advisors in the December 2022 Economic Outlook discussion with the Finance Minister were economists or heads of banks).

Looking at individual and collective well-being is important as a measure of government leadership success, she says, noting that the federal government has a quality of life index.

Business viewpoint:

No overt economic stimulus for business was in the budget, even thought the affordability credits help keep struggling low-income workers afloat and the mid-to-long term view to generating skilled workers (through the upcoming Future Skills) will provide trained workers to employers.

The Greater Vancouver Board of Trade claims there is a lack of economic strategy to increase investment to their region.

After the speech, a similar ‘no help for business’ message was issued by the Greater Victoria Chamber of Commerce, citing “a lack of new investment aimed at improving the province’s business climate”. The Chamber — which will host the Finance Minister tomorrow at a lunch meeting to address Chamber members — said “the province is forecasting deficits for the next three years but has chosen to increase spending this year”.

But the Chamber which represents many of the businesses in the province’s capital city did note the BC Government’s budgeting of $1 billion in “new money” for mental health and addiction services, new funding to improve food security, and $480 for the yet-to-be-unveiled Future Ready plan (which will help equip people gain the employee skills that are needed by employers).

Big expenditures 2023-2024:

The top big-budget items in the 2023-2024 budget (for over the next three years) are transportation at $13.2 billion (including subway line and bridge expenditures in the Lower Mainland); $11.2 billion for health facilities (including three major hospitals); post-secondary is getting $5.5 billion (that includes student housing, including at the University of Victoria); and $3.4 billion for K-12 schools (the Ministry is now Education and Child Care, as of spring 2022, so the overhead for many new child care centres is now included in this line item).

Future-looking views: “Building schools in fast-growing areas” was highlighted by the Finance Minister in her speech today, as well as “building homes for generations of British Columbians”.

Spending the outgoing budget’s surplus:

The BC Government’s $3.6 million surplus left over from 2022-2023 needs to be spent by March 31. That has recently included an additional $170 million to the BC Cancer Foundation for cancer prevention/treatment/services (in addition to a base funding lift of $270 million), $180 million to municipalities through the Community Emergency Preparedness Fund (as announced February 21), and $500 million to BC Ferries with the intention of keeping fare hikes affordable. Here is the full list of ‘supplementary estimates’ to spend what’s left from the surplus:

| 2022-23 Surplus Fund spent on: | $ million |

| Growing Communities Fund | 1,000 |

| BC Ferries Fare Affordability | 500 |

| Critical Community Infrastructure | 450 |

| Food Security Initiatives (upgraded on March 7 to $200 million) | 160 |

| BC Cancer Foundation | 150 |

| Local Government Next Gen 911 Readiness Fund | 150 |

| Watershed Security Fund | 100 |

| Highway and Community Cellular Connectivity | 85 |

| Accelerating Funding for First Nations Agreements | 75 |

| Public Libraries | 45 |

| Total | 2,715 |

Increasing food supply resilience:

Not a lot was said about food security in BC during the Minister’s speech today, other than to highlight in-school food programs.

But in the Budget 2023 documentation, it says it appears that province will be digging deeper into the various parameters of food sustainability, in light of weather impacts which threaten crops and supply chain interruptions which intrude upon reliability of supply. Dedicated funding will increase the availability of fresh food in Indigenous communities, increase food processing capacity in BC, and support the development of new and expanded local food production businesses.

Polite on the big crises:

Highlighting school food programs as the lead point on food sustainability is telling as to how the government hopes to not overdo any explanation of their awareness of the increasing fragility of the food supply system.

There was also no mention or wildfires or floods today, but the fact there is a new ministry under this new Premier called Emergency Management and Climate Readiness rather speaks for itself.

Housing crisis:

A new housing strategy is in the works by Housing Minister Ravi Kahlon, which Conroy says will be coming in the next few weeks.

Budget 2023 includes various housing initiatives including a property transfer tax incentive for developers who would build purpose-built rental buildings. BC is “hearing that’s what developers want”, so Conroy is hopeful about the success of that initiative for seeing more apartment buildings in BC’s larger cities.

One-third of British Columbians are renters, Conroy stated today.

Some funding will be provided to help municipalities sort out rezoning so that secondary suites can be developed by homeowners.

Building more on-campus student housing will continue to free up secondary suites and other types of accommodations in the community for local families and newcomers.

The renter’s tax credit (formerly promised as a renter’s rebate) will be income-tested to a maximum of $400 per year, which is minimal considering the cost of rent in most communities. Nonetheless, Conroy says about 80% of renter households will benefit by the tax credit. Renters making up to $60,000 per year are eligible for the credit; there will be partial credit for renters making between $60,000 and $80,000 per year.

Seniors who get rent support:

Seniors in BC who benefit with income-tested rental support from the Shelter Aid For Elderly Renters (SAFER) program will see ‘more people served’ by that program, it was stated in today’s budget announcement. But the details are not yet fleshed out.

BC Seniors Advocate Isobel Mackenzie who attended the media’s budget lockup (background information session) today, said that she hears from seniors who wonder why their rent has gone up but are seeing their SAFER monthly payment has gone down (that’s because the income-testing became more strict without any review of how rent levels are increasing). SAFER recipient applications are reviewed annually, so any big drop in the monthly support level must be somehow accommodated for an entire year (an appeals process is available but does not always result in an adjustment as the rent cap is fixed).

Last week the BC Seniors Advocate delivered a detailed report highlighting the need for more home care workers and a shift to no-fee home care services for British Columbians (as is done in other provinces).

K-12 Education:

According to information provided to Island Social Trends on background on budget day, most of the increase in the K-12 budget is to cover ‘wage lift’. The amount in the per-pupil funding formula that school districts rely on to afford the operations side of their budget essentially shows no sign of increase. For fast-growing school districts (like in the west shore of Greater Victoria and in Surrey on the BC Lower Mainland) that generates on-the-ground challenges (particularly when more students arrive through the school year after the September 30 enrollment count cutoff date).

The Ministry indicated to Island Social Trends today that ‘most school districts have a surplus’, and implying that the approximately 10% of the funding left over after meeting wage obligations is enough. This may not be the experience of fast-growing school districts like SD62 in the west shore area of Greater Victoria, where the budget theme is usually how rapid growth generates additional overhead operational costs (such as adjusting catchment, creating ‘new’ classroom setups, or hiring more teachers or EAs).

Meanwhile, the BC Teachers Federation (BCTF) says that “BC teachers are disappointed to see the provincial government’s 2023–24 budget released today lacks the targeted funding needed to address the acute teacher shortage in a meaningful way”. BCTF sees a teacher shortage looming, as stated in a news release today: “In a survey of members by the BCTF, 73% of teachers working in person in BC schools reported their workload had increased since before the pandemic. More than one-third said they were now more likely to leave the profession in the next few years.”

BCTF also says that special education funding that aligns with identified needs s missing from the budget. That would include “targeted funding for early identification and designation of students with disabilities and other unique learning needs and per-student funding amounts for high-prevalence designations”.

Meanwhile, BCTF acknowledges these K-12 budget highlights:

- $3.4 billion in capital funding to build new schools to respond to enrolment growth, and maintain and seismically upgrade schools

- $1.96 billion to fund public school wage lifts related to the 2022 Shared Recovery Mandate

- $214 million in new funding for school food programs to help families with rising food costs

- $161 million in funding under the Classroom Enhancement Fund.

Approval from the BC NDP Caucus:

Delivering her budget speech in the BC Legislative Assembly this afternoon, Conroy received applause on some key points: that the budget supports people who are “working harder than ever but just getting by”, that prescription birth control will now be free in BC, and a foster care lift of 47% so that “people who look after our more vulnerable people” are well supported (she got emotional over that one).

She also had the smiling approval of the Premier, seated next to her.

===== Other articles on Budget 2023:

BC food security resilience directions in 2023 (March 1, 2023)

Shift to Next-Gen 911 driven by use of mobile phones (March 1, 2023)

$500 million boost to keep ferry fares affordable (February 26, 2023)

Seniors home care needs more workers & shift to no-fee (February 23, 2023)

Growing Communities Fund shovels $1 billion out the door (February 10, 2023)

===== ABOUT ISLAND SOCIAL TRENDS:

Island Social Trends emerged in mid-2020 from a preceding series of publications by founder/editor Mary P Brooke and published by Brookeline Publishing House Inc, covering news of the Vancouver Island region, BC and national issues through a socioeconomic lens.

The publication series began with MapleLine Magazine (2008-2010), then morphed to a weekly print newspaper Sooke Voice News (2011-2013), and then into the weekly PDF/print West Shore Voice News (2014-2020). The news at IslandSocialTrends.ca (2020 to present) is entirely online.

Among many other qualifications, long time journalist Mary Brooke, B.Sc. holds a Certificate in Public Relations and an industry certificate in digital marketing. She reports with the BC Press Gallery.

ARCHIVES: POLITICS | EDUCATION | ECONOMY | TRANSPORTATION | FOOD SECURITY