Wednesday January 25, 2023 | LANGFORD, BC [Updated at 1:45 pm]

Economic insights by Mary P Brooke | Island Social Trends

Another Bank of Canada interest rate increase of just 0.25% might seem small. That’s the increase announced today by Bank of Canada Governor Tiff Macklem and Carolyn Rogers, Senior Deputy Governor. It goes into effect immediately.

Bank loans, lines of credit, and variable rate mortgages will see the increase applied immediately. Credit card interest rates often follow in the same direction.

Macklem heavily implied that this eighth increase within a year is likely the last for a while. The Bank will now observe to see how the demand-supply balance corrects itself.

Inflation in Canada was at 6.3% in December, down from a peak of 8.1% in June 2022. This has given the Bank of Canada room to ease up on its program of hikes. The squeeze by higher interest rates is intentional, to dampen demand (spending) and encourage correction in supply (both creation and distribution).

Core inflation:

Essentials like grocery prices (currently at about 11% inflation) and what Macklem called ‘rent’ (which includes mortgages, or any cost to put a roof over one’s head) are measured as part of ‘core inflation’.

“Short-term inflation expectations remain elevated. Year-over-year measures of core inflation are still around 5%, but 3-month measures of core inflation have come down, suggesting that core inflation has peaked,” it was stated by the Bank today.

Global economy:

The Bank aims to keep inflation between 2.0 and 3.0% percent. So there is still a ways to go for correction.

The Bank estimates the global economy grew by about 3.5% in 2022, and will slow ‘back to target’ to about 2.0% in 2023 and 2.5% in 2024. This projection is slightly higher than back in October.

Today Macklem cited the war in Ukraine and the disruptions and now sudden economic activity in China (after COVID-zero lockdown) as factors impacting various supply chains.

Steady grinding rate increases:

It was only a year ago that the Bank of Canada rate was at 0.25% so it has been pushed up — deliberately — by 425 basis points in one year. Back in January and February of last year, the interest rate was only 0.25%, then saw the first hike — a quarter-point to 0.5% on March 3, 2022. On April 14 it jumped to 1.0%.

Another hike by half a percent saw the bank rate at 1.5% on June 2. That was followed by a full-point rate on July 14, pushing the rate to 2.5%. On September 8 the rate was pushed to 3.25%, jumping to 3.75% on October 27.

On December 8 there was another hike, pushing the rate to 4.25%. Now it’s at 4.50%. That’s the highest it’s been since 2007 (low rates were in place for many years after the 2008 financial crash).

Today’s Bank of Canada rate increase is “going to hurt Canadians,” said NDP Leader Jagmeet Singh in his press conference in Nanaimo today. “The sharp dramatic increase in rates has made things worse for people,” he said in response to a question from Island Social Trends. The NDP are calling this eighth rate increase in 11 months a “budget-buster”.

Aware of impacts:

But all these rate hikes have produced hardship on the Canadian economy. Economists see inflation as the enemy, and the central bank has only one blunt tool — setting their benchmark interest rate. Today Macklem eventually said in a long media session that he realizes this is hard on Canadians.

When the cost to borrow goes up, everything will cost more (if not immediately, then soon or eventually, as businesses and service providers feel the pressures on their own cost of operations).

“Services price inflation rose quickly through the first half of 2022, reaching about 5% this summer,” the Bank of Canada said back in October. Today Macklem says he expects the price of services to lag behind the evident increases in products, but it will come.

Economists and government are now warning of a challenging financial year all the way around during 2023. The turnaround is expected in 2024.

A technical recession is two consecutive quarters of zero growth. But many people are feeling their financial realities as a recession already.

More difficult for the middle:

People who are in middle-income scenarios — who place themselves on the edge of the mainstream financial system (e.g. first-time and nearly-new homebuyers, as well as small businesses that rely on relatively small amounts of credit) — are figuratively pushed off the edge of the cliff if they can’t accommodate the increase.

Today’s additional pinch will very likely now be setting in motion some additional deep concern about a grinding recession that won’t be easily weathered by financially vulnerable Canadians. That also includes small businesses that are often impacted by rate changes which shave away at their margins.

It’s a myth that there is income equity in Canada. The federal government tacitly acknowledges that fact, by having entrenched various financial programs that do help many Canadians: GST rebate, Child Benefit, Guaranteed Income Supplement (for low-income seniors), and very recently (under the ‘duress’ of political pressure by the NDP through the Liberal-NDP supply and confidence agreement) the dental coverage for children under age 12 in low income families, and the $500 one-time renter’s bonus.

Maintaining the status quo of how all this works is entrenched in the Canadian economic system. Notably, just one person — the bank of Canada Governor, makes the interest rate decision. And until now, the reasons for that decision are never itemized in writing (that’s about to change soon, starting February 8, 2023). It shows the unspoken but obvious counterpoint between the head of the Bank of Canada and the head of government; they may not always see eye to eye, but can certainly be impacted by decisions the other makes.

There’s more ‘talk’ behind the scenes than is usually let on. Today Macklem said that the federal government will allow the Bank of Canada to pause on making remittances to the federal government coffers, as a way to stabilize the bank. This puts pressure on how much the government can spend on supporting Canadians (Budget 2023 is coming up soon).

Inflation is damaging, pause may help:

A business instructor with the Centre for Business & Access at Camosun College, Keith Yacucha says that “the market is looking at a pretty flat next year or so”. A few days ago, in an interview with Island Social Trends, Yacucha predicted that if a rate increase were to happen this week (which it did) that “it’s probably going to be the only one we see this year”.

Yacucha says this could be “a sigh of relief” for people with variable rate mortgages and other credit products. Then people can “get used to where it’s at, for a bit of time”, he suggests.

Bank of Canada Governor has called it a ‘pause’ to “see if they’ve raised rates enough” to combat inflation.

For people at the low-end of financial security, who are just barely hanging on now, there is really no way to catch up for them; even with eventual financial recovery, time is lost to build wealth for the long-term including retirement.

As the only Bank of Canada policy tool is setting interest rates “is a bit of a sledgehammer, it’s a big tool meant to shock the economy,” says Yacucha. The impact is “primarily on prices” he says, until the Bank of Canada sees “inflation being where they want it to be”.

“No matter how you cut it, inflation is damaging is going to hurt many people,” says Yacucha. He describes the bank’s choices as “letting inflation run high or working to combat it”. He says “they start putting more and more pressure on households, which are increasingly indebted, arguably more indebted than they have ever been”.

Yacucha is also a City of Langford Councillor so it will be interesting to see what additional economic insights or recommendations he might take to the municipal council table.

Grocery retail:

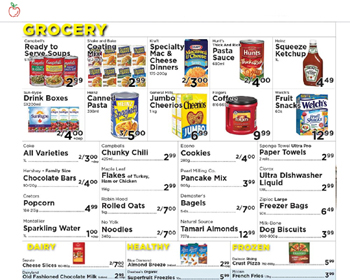

Grocery retail is where many consumers meet inflation face to face each week.

The federal NDP are providing what they say is evidence of grocery stores profiteering off the fear of inflation, a point repeated by NDP Leader Singh today in Nanaimo.

The long-established locally-owned Village Food Markets grocery store in Sooke generally makes a conscious effort to be highly sensitive to local customer needs in a community that has a consistent lower-income sector.

The manager at Village Foods, Ed Banys, says his store is trying to bring customers in with competitive pricing on “things they are actually looking for”. The store loses money on milk and “makes next to nothing” on bread. Beans and pasta, when on sale, “make nothing or up to 5%,” said Banys this week in an interview with Island Social Trends.

Village Foods also supports their customer base with offering a weekly giveaway, presently a $100 store gift card.

Public input:

Public input to the process of Budget 2023 is open to February 10, 2023. Both online and by email.

Input to the Minister of Innovation, Science and Industry about the pending Rogers-Shaw merger would also be timely.

Next rate announcement:

The next scheduled date for announcing the overnight rate target is March 8, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, on April 12, 2023.

===== RELATED:

Proposed Rogers-Shaw merger decision now with Innovation Minister (Jan 25, 2023)

Bank of Canada increases policy interest rate by 25 basis points, continues quantitative tightening (Bank of Canada – Jan 25, 2023)

Government of Canada welcomes budget submissions from Canadians (Government of Canada link | Dec 14, 2022)

Pre-Budget Consultations on Budget 2023 – public input (Dec 2022)

===== ABOUT THE WRITER:

Mary P Brooke is a long-time journalist, delivering news through a socioeconomic lens through Island Social Trends.

Based on the west shore of south Vancouver Island, IslandSocialTrends.ca covers news of the Greater Victoria area, south Vancouver Island with insights on BC and national issues.

===== ABOUT ISLAND SOCIAL TRENDS:

Island Social Trends emerged in mid-2020 from a preceding series of publications edited by Mary P Brooke and published by Brookeline Publishing House Inc. The series: MapleLine Magazine (2008-2010), Sooke Voice News (2011-2013), and West Shore Voice News (2014-2020).

Subscribe: Free IST ENews | Become a Premium Subscriber

Archives: POLITICS | ECONOMY | VANCOUVER ISLAND