Monday April 10, 2023 | LANGFORD, BC [Updated April 12, 2023]

by Mary P Brooke | Island Social Trends

Links to the April 2, 2023 workshop video recording: on YouTube | on Facebook

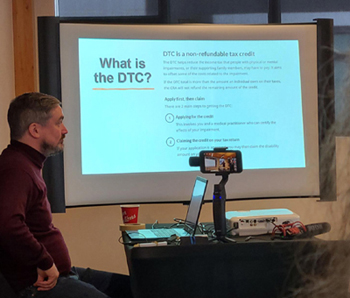

A free workshop on the federal Disability Tax Credit (DTC) was held in downtown Langford on Sunday April 2.

The seminar-style workshop was hosted by Alistair MacGregor, MP (Cowichan-Malahat-Langford) along with Peter Julian, MP (New Westminster-Burnaby), in the second floor meeting room at the Langford Business Centre.

About 30 people attended the two-hour session, from across the Cowichan-Malahat-Langford area, based on a show of hands. Most appeared to be in their 40s or 50s. One local Langford tax advisor also attended in the audience.

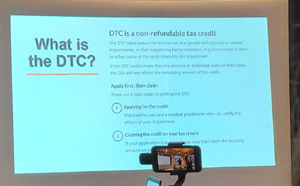

Disability Tax Credit (DTC) is a non-refundable tax credit:

The federal Disability Tax Credit (DTC) process includes these factors:

- The DTC helps reduce the income tax that people who physical or mental impairments, or their supporting family members, may have to pay. It aims to offset some of the costs related to the impairment.

- If the DTC total is more than the amount an individual owes on their taxes, the CRD will not refund the remaining mount of the credit.

- The DTC can be applied retroactively.

- The DTC amount is $1,400 per year.

- The DTC amount can be transferred to a family member who pays taxes (spouse, sibling, child, or parent of spouse), if they live with the applicant.

Eligibility and filling out the form:

- The application form number is T-2201.

- Eligible impairments must have been in place for at least one year, and must have impacts on daily life.

- Eligibility profile includes having a severe and prolonged impairment in one of the categories, significant limitations in two or more categories, or receive therapy to support a vital function.

- The form may be certified by a health professional such as doctor, nurse practitioner, optometrist, audiologist, occupational therapist, physiotherapist, psychologist, or speech language therapist.

- Send the form by mail to the designated Tax Centre address. Doctors may also submit it electronically.

- If the application is rejected, take it to your local MP’s constituency office for help with resubmitting it.

Why this workshop?

“I want to make sure that every eligible Cowichan-Malahat-Langford resident knows how to access this important tax credit,” says MacGregor.

“Many people living with disabilities are struggling with rising inflation. It’s time for the federal government to make them a real priority in Canada,” says the third-term MP who is also the NDP Critic for Food Price Inflation.

Disabilities include impairments having to do with vision, speaking, hearing, walking, elimination, feeding, dressing one’s self, and mental wellness impacts. People who require life-sustaining therapies may also apply.

“You or someone you know may be eligible for the Disability Tax Credit (DTC) which is retroactive for up to 10 years. Being eligible for the DTC can open the door to other federal, provincial, or territorial programs such as the Registered Disability Savings Plan, the Canada Workers Benefit and the Child Disability Benefit.

NDP push for people’s benefit:

During the 43th parliament and now in this 44th parliament, the NDP as the fourth party (with 25 seats) in the House of Commons, have used their policy influence (including a Supply and Confidence Agreement with the minority Liberal government) to push through benefits for everyday Canadians, many of them benefiting low- and middle-income individuals and households.

That list includes bumping CERB up to $2,000 per month as a livable support income during COVID, pushing for the dropping of interest on student loans, and recently the dental benefit for children under age 12 in families with income below $90,000 (being extended to include seniors by the end of this year).

Bill C-22 — an Act to reduce poverty and to support the financial security of persons with disabilities by establishing the Canada disability benefit and making a consequential amendment to the Income Tax Act, passed in the House of Commons on February 2. C-22 was supported with the knowledge that working-age persons with disabilities are more likely to live in poverty than other working-age Canadians. It notes that they often face barriers to employment.

Recording available:

A recording of the workshop session was made, and will be available to constituents. These are the links in social media: on YouTube | on Facebook

===== RELATED ARTICLES:

- Invitation to Disability Tax Credit workshop in Langford (Mar 23, 2023)

- Harsh economic realities at the mercy of political leadership (Mar 23, 2023)

- Food prices remain high, consumers hear more about grocery sector (Mar 11, 2023)

- Three grocery CEOs to address federal agriculture committee (Feb 26, 2023)

- Eby preludes Budget 2023 in 100-day speech (Feb 25, 2023)

- Food inflation riding high at 11.4% (Feb 21, 2023)

- Grocery chain CEOs being summoned to address Agriculture-AgriFood Committee (Feb 14, 2023)

- Alistair MacGregor leads NDP investigation into high food prices (Feb 13, 2023)

- Small bank rate increase is still an economic shock (Jan 25, 2023)

- Cost of living efforts: BC Hydro bill credit & BC Affordability Credit (Nov 18, 2022)

- CERB gets extended thanks to NDP pressure in minority scenario (June 15, 2020)