Wednesday June 22, 2022 | VANCOUVER ISLAND & NATIONAL

Editorial Commentary by Mary P Brooke | Island Social Trends

New Democrats say that ‘profit-driven inflation’ is making it impossible for hardworking people to afford the basics of living including food, gas and oil for vehicles and home heating, and housing.

Inflation is at a 40-year high. Today the rate of inflation for May was released… a whopping 7.7%. That far surpasses April’s 6.8% and analyst forecasts of 7.4%, data from Statistics Canada show. Inflation is far above Bank of Canada’s April forecast that it would average 5.8% this quarter.

Recent surveys are showing some people cutting back on how much they eat (let alone buy at the grocery store), and people are taking public transit, carpooling or working from home more if they can as one way to save on fuel costs. Will people who heat with furnace oil be living in colder homes this winter?

In BC the rate of inflation was below the national average in April, but is now higher (at 8.1%), noted Premier John Horgan today in a media session. He reiterates the view of other political leaders that inflation is an international problem, but that doesn’t diminish its impact on British Columbia, he noted today.

Horgan said that BC Finance Minister Selina Robinson will be coming out with some “findings’ shortly. “It’s complex work,” said Horgan, for which a ‘knew-jerk reaction’ should be avoided.

Skillful supports are needed:

NDP Leader Jagmeet Singh today in Ottawa said that for everyday Canadians “it’s getting harder and harder to afford the regular cost of life”.

Citing one in four people “going hungry” and also one in four possibly losing their homes due to rising costs, “we have a real serious problem on our hands”, said Singh in a media session.

Singh has called on the government to double the GST rebate and add $500 to every Canada Child Benefit, to get between $500 to $1,000 back into people’s pockets.

“Send help directly to people who really need it — families, working people,” said Singh today.

That’s a gentler approach than how the NDP pushed for doubling the CERB during the recession — the Liberals were going to set it at $1,000 per month but the NDP succeeded in having it pushed to $2,000 per month which clearly helped keep individuals and families whole during the pandemic.

The NDP proposal is about redistributing current government money, and therefore not contributing to inflation, said Singh today. This past weekend, BNN Bloomberg business reporter Amanda Lang said that targeted supports don’t contribute to inflation, only across-the-board supports (including tax breaks) contribute to inflation because it’s going to everyone regardless of income level.

Liberals staying with mainstream:

Federal Finance Minister Chrystia Freeland outlined various boosts to existing safety net programs last week including inflation-adjusted increases to Canada Child Benefit, Old Age Security for those over age 75, and GST. But that remarkably saw the Liberals immediately shift back to mainstream traditional in-place systems, evidently not having learned about strategic and targeted supports that helped people stay afloat during the pandemic in 2020 and into 2021.

Freeland did say that Canadians have to essentially ‘buckle down’ (which is actually either ‘hunker down’ or ‘buckle up’) to deal with the next months if not years of inflation. Causes are cited as global supply chain issues (which started with the pandemic and have become more complex during the war in Ukraine this year).

Long-term endurance requires a nuanced tack:

If the struggle is for the long-term, Freeland’s reasoning to use existing mainstream financial supports fits within that context. But most people don’t have wiggle room. That is what the NDP is trying to cover off for with their suggestions to the government.

The common spin from media in Ottawa as well as Conservative politicians is that the NDP has ‘sold away their power’ to the Liberals with this year’s Confidence and Supply Agreement, which sees the NDP essentially assuring that they will vote along with Liberals. But the NDP did not sign away their right to speak up, or disagree. It is in the interest of the NDP and (if one feels their actions are helpful to Canadians) then to all Canadians, to have the federal government be stable through to 2025, as these are proving to be tumultuous times.

The Finance Minister and federal Cabinet would do well to heed the tips from the NDP that would possibly soften the blow of this challenging time for many Canadians.

Banks and interest rates:

As well, not just leaving market forces to take care of it will help curtail the free-wheeling profiteering that is open to banks and large corporations under current market conditions.

The Bank of Canada raised interest rates to 1.5% from 1.0% this month, its second consecutive half percentage point increase, and said it was ready to act “more forcefully” if needed.

As interest rates keep going up (a rare 0.75% increase in the Bank of Canada rate is expected on July 13), banks and lenders just happily ride the wave and increase their rates too. People who’ve taken lines of credit, loans and mortgages at variable interest rates will be smacked hard.

An increase of 75 basis points would bring Canada’s prime rate to 2.25% in an effort to tamp down on inflation. This comes after the US Federal Reserve hikes its key rate 75 basis points earlier this month.

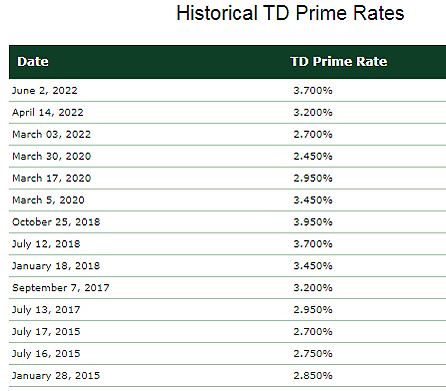

The current prime rate at Canada’s five major banks (including TD, RBC and CIBC) is 3.7%. On top of the prime rate there are varying percentages added on various financial products like lines of credit, loans and mortgages.

A recent survey has confirmed that almost one in four homeowners will be forced to sell their home if the interest rates and costs continue to rise. The dream of home ownership in Canada — as an investment vehicle and achieving middle-class status (launched after WWII) — may have now passed its viability in the Canadian reality.

Political leadership could save people:

People’s wages and the revenues of small businesses in most cases do not keep up. We could see a period of several years — for all age demographics across Canada — where people’s financial well-being truly slide back and some sectors truly suffer.

Solutions lie in the hands of political leaders. Will they rejig their ‘usual ways’ to help Canadians survive this? Some Canadians who fall between the cracks in the next few years may never recover their current financial status.

===== RELATED:

Older Canadians delaying retirement could benefit workplaces (June 16, 2022)

Consumers should be bracing for strong Bank pressure on inflation (June 13, 2022)

Pent-up demand & soaring inflation contribute to reliance on credit cards (June 2, 2022)

===== ABOUT THE WRITER:

Mary P Brooke is the editor of Island Social Trends. She writes the news of our time through a socioeconomic lens.

Ms Brooke through her Brookeline Publishing House Inc publishing company has been delivering local and regional news since 2008 on South Vancouver Island — first with her inaugural publication MapleLine Magazine (2008-2010), then the weekly print Sooke Voice News (2011-2013), and then the weekly print/PDF West Shore Voice News (2014-2022) before shifting mid-2020 to Island Social Trends entirely as an online news portal.

She holds a B.Sc. (in food, nutrition and community education) with a second major in sociology, a Certificate in Public Relations (Cert PR), the U of S McGeachy Prize in Journalism, and at one time held a BC Real Estate Licence. In 2021 she completed the intensive Certificate in Digital Marketing through Alacrity Canada.