Monday June 13, 2022 | NATIONAL

by Molly Pearce, with Mary P Brooke, Editor | Island Social Trends

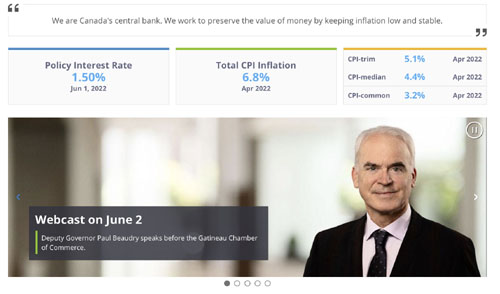

Kicking off what is expected to be a period of continual pressure against inflation in Canada this year, on June 1 the Bank of Canada raised its policy interest rate from 0.5% to 1.5%. This deliberate attempt to combat rising inflation was not unexpected. The Bank of Canada has been rolling out its messaging in a way that there should be no surprises.

Back on April 14, the Bank of Canada made its biggest key interest rate hike in 20 years, hiking the policy interest rate by 0.50. Governor Tiff Macklem said inflation is too high: “The invasion of Ukraine has driven up the prices of energy and other commodities, and the war is further disrupting global supply chains. We are also concerned about the broadening of price pressures in Canada.” The last time it raised its key interest rate by half a percentage point was 22 years ago, in May 2000.

Steady inflationary increase:

The rate of inflation has been increasing steadily (to 6.8% in April) is due to factors such as the rising price of oil products and the sheer cost of supply chain disruption. This in turn has pushed up energy and food costs because of a reliance on oil for transportation; in turn, the cost of just about everything else is heading upwards.

Much of the current inflation is tied to international scenarios — primarily cost and disruption of Western countries supporting Ukraine’s pushback against Russia’s invasion of their country, but also the economic disruptions (labour availability, health care costs) launched by the COVID pandemic.

Don’t think the war in Ukraine is far removed and not affecting us in North America. Economic sanctions against Russia from most of the international community have disrupted some of the supply chains that governments, businesses and consumers rely upon (e.g. oil, potash, and grains).

Russia’s retaliation upon the West by trying to block the Black Sea ports of southeast Ukraine and preventing the export of products like potash and grains (or capturing the supply and selling it for their own gain) is now generating a threat to global food security.

And the sheer cost of providing war munitions and humanitarian aid is of course going to impact the economies of western countries, including Canada as we continue to participate in G7 and NATO attempts to thwart Russia’s aggression.

Inflated prices for essential goods:

While in Canada we may feel safe and removed from the conflict in Ukraine, the overall scenario is leaving Canadians to face inflated prices for essential goods. It could be surmised that over the past 30 years that Ukraine has been an independent nation that the Western world didn’t organize enough supportive policy for their resilience against Russia (the enemy on their doorstep).

There is now a higher risk of elevated inflation becoming entrenched in Canada. Producers and businesses will experience and expect higher costs, and therefore continue to raise their prices. Employees will expect pay raises. The entire cycle could spiral higher and higher.

Inflation in Canada was already at 6.8% in April. The Bank is trying to use its monetary policy tools — primarily continued increases to the base interest rate — to keep inflation within their target (normally between 2% and 3%) in an effort to maintain the pressure on the expectations of both lenders and consumers.

Housing as investment mechanism is flawed:

There is a major flaw in the Canadian economic framework that is only beginning to be acknowledged as a major part of the problem: that the housing market has been used as an investment tool. When mortgage interest rates are pushed upward as a way to ‘cool’ the market, it is always those on the ‘edge’ (first time buyers, and those who’ve overextended themselves financially) who bear the punishing brunt of the so-called market correction.

This essentially forces people out of their homes, as well as out of the opportunity for property-based equity.

Governments that are trying to separate housing from investment (by providing other types of housing, such as rentals and co-ops) are chipping away at the problem, but the fundamental mechanism of housing as an investment vehicle will need to change (which isn’t likely anytime soon).

Impacts on consumers:

This increased interest rate will have immediate impacts for everyday Canadians. Suppliers and businesses will pass on their increased costs to consumers for products and services. Anything that requires shipping or transportation or the use of gasoline-run equipment will see increased costs (as gasoline prices will now stay high, as the oil production and international supply sector is now being disrupted, reorganized, and operating at premium cost).

Though the Bank’s decision to push up rates is a deliberate and carefully calculated method of capping rapid inflation, Canadians will experience the impacts of the multiple rate increases in 2022 on their mortgages, their credit cards, and overall lines of credit. Many people will face losing their homes. Governments will have to step in to provide support for those with low incomes, as well as those with fixed incomes, such as seniors.

Avoiding entrenched inflation:

The Bank of Canada states that core measures of inflation are somewhere between 3.2% and 5.1%. In their statement on the hike in their policy interest rate, they said, “the risk of elevated inflation becoming entrenched has risen.” It is the responsibility of the Bank of Canada to rein in inflation to avoid lasting entrenched inflation. Hence the recently hiked rates. But what exactly does entrenched inflation mean? Paul Beaudry, Deputy Governor of the Bank of Canada, explained the idea on June 1 at a press conference in Gatineau.

“When we talked about entrenched inflation,” he said, “this is the idea that inflation gets self-fulfilling […] people start believing it, and it gets into the system, and it starts living by itself. If we get into this situation, it is very costly to get out.” Meaning that if Canadians begin to accept, say, inflated grocery prices as a fact of life because they see that their wages are inflated by that same percentage, that is when inflation has become entrenched in the economy. Then we have a problem.

Entrenched inflation ended up seeing the Bank push rates beyond 20% in the early 1980s. The Bank is trying to avoid that mistake in 2022.

Beaudry outlined the bank’s efforts to cap inflation at 2%. “We’re aiming for this soft landing,” he said, “but it’s a difficult compromise. You do a little bit too little, and you allow inflation to keep going and to become entrenched, that’s not our goal, and if you do too much you might bring the economy into a recession. So, we’re trying to aim for that in-between, and a large part of that is for people to understand what we’re doing, why we’re doing it.” Beaudry concluded that “with that, we think we can rein this in.”

Personal financial decisions:

If Canadians realize what is happening, they will start (if they have not already) to make strategic financial choices and decisions: perhaps get out of the housing market before incurring major losses; pay down their highest-rate loans, lines or credit or credit cards; forgo or downsize optional expenditures such as travel, cars, technology and appliances; repair, reuse and recycle rather than buy new; and so on.

Unfortunately, there are generally only two areas that people can immediately cut back on — groceries and gasoline. That can only be done so far, without impacts on health and livelihood.

Some people may sell their homes ahead of a possible scenario of being unable to keep up with their mortgage.

Despite that travel is generally a discretionary expense, currently there is a travel boom going on (pent-up demand after two years of pandemic lockdowns and disruptions).

Credit cards and consumer debt:

As the Bank of Canada pushes up the base rate, credit card companies are increasing their interest rates and banks are increasing the interest rates charged on loans and lines of credit.

This month, Equifax revealed that pent-up demand and soaring inflation are contributing to reliance on credit cards. If people don’t have enough income or can’t reasonably expect a pay or personal income increase, the fallback to expensive credit cards will spell trouble for many.

Total consumer debt increased by 8.6 per cent in the first three months of this year, climbing to $2.3 trillion over the last 12 months. According to Equifax, on an individual basis the average consumer debt (excluding mortgages) is now $20,744, an increase of 1.5 per cent compared to Q1 2021. It is the first year-over-year increase since 2019.

Next increase:

Looking ahead into the summer, expect to see another Bank rate increase of a further 0.5% to 0.75%. The next scheduled date for announcing the overnight rate target is July 13, 2022.

The Bank of Canada will continue their quantitative tightening, with their stated goal being to reach a base interest rate of 2.75% by the end of 2022.