Tuesday April 16, 2024 | NATIONAL NEWS ANALYSIS (view from Vancouver island) [Updated April 18, 2024]

Political analysis by Mary P Brooke | Island Social Trends

Political and economic sectors — and probably every Canadian household at some level — paid attention to the 2024 federal budget today. Surprises were not expected. Most of the major new spending was pre-announced by Prime Minister Justin Trudeau and his highest-profile cabinet ministers over the last few weeks.

“This budget is about fairness for every generation,” said Prime Minister Justin Trudeau in an media session in the House of Commons. The Liberals are trying to stave off challenges in the polls.

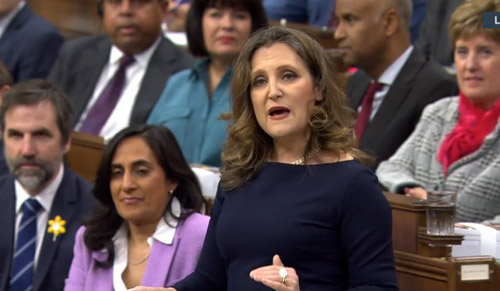

“Today our country is making our choice. We will unlock the door to the middle class for more Canadians,” said Deputy Prime Minister and Finance Minister Chrystia Freeland after articulating that “democracy is not inevitable” but that it exists because Canada “has delivered a good life for the middle class.”

Taking a swipe at the Conservatives who always pitch for an accounting-style balanced budget approach, Freeland said: “Tax policy is not just the province of tax accountants… it belongs to all of us. It’s how we decide what kind of country we want to live in and want to build.”

Last full budget ahead of 2025 election:

This is probably the last full budget of the current Liberal government before the next federal election (currently scheduled for October 20, 2025).

Appeasing the NDP demands (vis-a-vis the Supply and Confidence Agreement) and trying to win back a significant following of young adult voters were the key political goals. The budget fulfills a range of recent announcement promises and perhaps genuinely aims to fix the housing crisis.

There is $52.9 billion in new spending over five years but the deficit stays at the same level this year (just under $40 billion). There is currently no path to balance but the deficit is projected to decrease to $20 billion by the end of 2029. The debt is currently $1.2 trillion.

The deficit got pegged at $39.8 billion, just under the $40 billion that the federal government said it would not exceed.

A reduction of federal office space by 50% over 10 years will save $3.9 billion (spending $1 billion to achieve that which is a good example of spending as investment).

Economic and political commentators evidently see very little that will increase economic productivity. That requires a willingness for businesses to invest.

Dealing with inflation:

The federal government needed to show the Bank of Canada that they’re not spending too much more, in case the belief remains that government investment spending contributes to making inflation worse.

The Bank of Canada has stated in recent months that government policy is rowing in the opposition direction as Bank of Canada efforts to tamp down inflation.

But today’s budget notes that revenues from income taxes have been higher than expected in the past year. A post-COVID recession has been avoided; no small feat.

The rate of inflation was 2.9% last month, up from 2.8% in February; that’s well down from a high of 8.1% in June 2022. There were 10 interest rate hikes by the Bank of Canada between March 2022 and July 2023; the interest rate has remained at 5% for almost a year now and might be expected to be lowered by the central bank in June or July this year.

Politicians — both federal and provincial — have noted that keeping the central bank interest rate high has impeded momentum with housing supply activity.

Pitching to young Canadians:

“It’s just harder to establish yourself if you’re a young Canadian”, said Freeland today, in delivering her fourth budget.

The finance minister says the budget will help Millennials (Gen-Y) and Gen-Z “reach their full potential”; these are adults now in their mid-20s to early 40s. This is a voting pool that the Liberals would like to retain from the 2015 election phase who — by various impacts and decisions — tended to lose over the 2019-2023 period (as seen in opinion polls in recent months).

However, this happened under the Liberals watch — a failure that they seem to be disregarding in any public statements. It does support the view of many non-Liberal Canadians that when in power the Liberals just coast along as the ‘rightful governing party’ without paying attention to the details of managing the practicalities of running a country. Case in point: opening the doors wide to immigration without any attention to boosting a concomitant housing supply over the past few years.

Supports for child care and repayment of student loans are in the budget to appeal to young adults.

Gender politics:

Policy reached into the realm of gender politics: “Women in other countries – our friends, our neighbours – are losing their right to control their own bodies. We will not let that happen here in Canada,” said Freeland, as part of remarking on the free contraception in Budget 2024.

Ages across the population:

While the budget leans toward younger generations, the biggest ongoing expenditure is benefits for seniors. Hundreds of billions of dollars over the years ahead (amounts are projected to go up as the population ages).

Is there a moral obligation for older Canadians for pay for younger Canadians? “I really believe that older Canadians (which she described as “slightly older and older-older”) really want younger generations to do well,” said Freeland. “I hear from parents and grandparents (who are) worried about (their children) ever being able to afford a house,” she said in a TV news interview today.

Obviously the cost for supporting benefits for seniors (e.g. OAS and GIS) doesn’t get maxed out beyond the five years of the current budget. The large baby boom generation is aging into their senior and elder years. The cost load for supporting non-working older Canadians will be put on the shoulders of the younger generations. It should be noted, however, that seniors age 65 to 74 who are currently still working receive less OAS than seniors age 75+ (that’s been the case for several years now, under the Liberal government). Seniors in that age bracket likely only work because they have to.

Housing supply:

Budget 2024 includes a loan program for the construction of over 100,000 new rental units. Dropping the requirement for developers to pay GST on construction of apartment buildings (announced in September 2023) has already shown positive results as more apartments are being built.

In an odd admission today, Freeland said she feels “our country has been under-investing in housing for a generation”. But she says the Liberal government has been “focussing on infrastructure since we’ve been in government”.

“We recognize that this is a pivotal moment for young generations,” said Freeland.

“I believe in a growing Canada (with a growing population),” said Freeland in a news interview on CTV today. She “wants to be sure that our housing supply and our population match up”… “that is what our govt is absolutely focused on doing.”

Money from wealthy Canadians:

$19 billion over the next five years will be paid into the federal coffers as capital gains tax (from 40,000 very wealthy Canadians, about one percent of the Canadian population).

Chyrstia Freeland articulated on Global National today that the first $250,000 of a capital gain in every single year that a Canadian might enjoy will be taxed at the current rate of 50% of inclusion. “That really narrow focus is entirely intentional … so this additional tax is focused on those at the very top … people ‘who an afford to pay a little bit more’ for things that Canadians really need,” said Freeland.

Digital & AI:

Freeland says artificial intelligence (AI) is the next driving economic engine for Canada through investments and startups.

“We are going to supercharge our strength in this area, with great jobs for today and the future.” Canada today has the most fiscally responsible politics in the G7, said Freeland, adding that Canada has the lowest debt-to-GDP ratio and lowest deficit-to-GDP ratio.

As of January 1, 2024 with retroactive effect to taxation years beginning January 1, 2022, certain large Canadian and non-Canadian businesses will need to pay a 3% Canadian Digital Services Tax (DST) on their “in-scope” digital services revenues earned from customers located in Canada.

Conservatives on the attack:

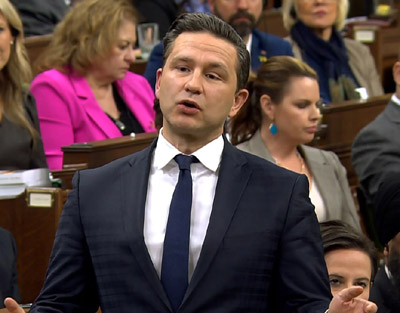

“Everything on which the prime minister spends gets worse and more costly. He has spent and Canadians are broke. The country is broken,” Conservative Leader Pierre Poilievre told the House of Commons as he responded to the federal budget this afternoon.

It was an unsurprising critique. Poilievre noted the doubling of housing costs under the Liberal government over the last seven years. He illustrated his case about the cost of living by describing a Facebook group that helps people learn how to get food out of a garbage bin.

He says voters what a country based on common sense. He says that “spending is out of control” and that Budget 2024 is “wasteful” and “inflationary”.

Back to his mantra of the past several months: “We need a carbon tax election.” He wants an end to ‘Liberal spending’, identifying this budget as the ninth deficit under the Liberal government since 2015.

Indeed there are many challenges in Canada but that doesn’t mean ‘the country is broken’. It means we’re a socioeconomic venture in transition. Canada offers the realization of some important intrinsic values including democracy, opportunity, and education (all of which are indeed in trouble at the moment). Chaos offers the opportunity for change.

NDP response:

The federal NDP was pleased about supports for renters in Budget 2024 as well as the national school food program.

The NDP feels that capital gains tax to raise revenues doesn’t go far enough. That’s because there is not enough of an attack on ‘corporate greed’ which NDP Leader Jagmeet Singh says is the root of the Canadian cost of living crisis. Singh says the NDP still plans to address those concerns.

The NDP leader says he is concerned about losing 5,000 public sector employees through attrition (job vacancies created by people moving to other jobs or retiring), in that he would want to ensure good service for Canadians. He wants to ensure that Indigenous communities will still get adequate funds for infrastructure and housing. He said today in national media interviews that the disability support payment is insufficient (set at $200 per month by the Liberals in this budget).

In the House of Commons today Finance Critic Don Davies said Canadians are facing both an economic and climate crisis. He said that the NDP “won real supports” in Budget 2024 including affordable housing, Pharmacare and a school food program. “I challenged the Liberals to make corporations pay their fair share to raise money for the services Canadians need,” said Davies.

Nuts and bolts:

According to economist and former parliamentary budget officer Kevin Page (as interviewed today on CBC-TV) the budget is “overwhelming”. He said today that it’s a “large document with a big tax increase”. He sees efforts in the budget to help young Canadians break into the housing market, and also try to help families that are “struggling with poverty and looking for income assistance”. As well, “we see a substantive amount to NATO commitments”, said Page who was Canada’s parliamentary budget officer during 2008-2013 under Conservative Primer Minister Stephen Harper.

“It’s still a very weak economy,” said Page, noting a growth rate 1% (says it would normally be 2% to 3%). Wealthy Canadians and corporations will be hit in three months, he said, but says financial market activity could start in response as early as tomorrow.

“The government is expecting $6 billion revenue in revenue in this budget ($18 to $19 billion over five years). Page notes the program spending this year goes up to $480 billion (up from $450). Programs are not just discretionary pet projects, but categorically include supports for seniors.

Page says that inflation is going down though people are still struggling with very high price levels. “It’s really hard for the finance minister to find balance in this market,” he conceded. He pointed out “an enormous amount of money in direct program supports and loans”, including housing capital stock. “Now we have this liquidity,” said Page. “Will municipalities and provinces all work cooperatively? We have to do the building. Half the job is done, and half the job remains to be done.”

Development community:

“The new Capital Gains inclusion rate will significantly dampen housing formation by making it harder to convince long-term owners to sell long-held property for efficient land assemblies,” said Vancouver-based developer Jon Stovell of Reliance Properties, in social media this afternoon.

Other commentators note that the proposed use of Canada Post properties and other federal land and properties (like unused office space in Ottawa) is a creative use of available property for helping with the need to increase housing supply.

Canadian Chamber of Commerce:

The government’s projections for the deficit are largely in line with previous predictions, says the Canadian Chamber of Commerce today.

They also presented various comments from specialists in various fields, including:

- Scientific Research and Experimental Development (SR&ED): The new funding to help support business research and development and encourage new innovations for Canadian business needs to “made available quickly” so enhancements can be made to the program swiftly and efficiently. [Summary of comment by Alex Greco, Senior Director, Manufacturing and Value Chains]

- Artificial Intelligence: The budget makes significant investments in AI. The Canadian Chamber has been calling for a focus on increased AI business adoption due to its strong link to productivity. New funding for AI compute infrastructure and for AI business adoption in critical sectors is an important step in the right direction. However, we continue to advocate for an AI federal regulatory environment that, in tandem with funding, will allow for that critical AI adoption to materialize amongst all sizes of Canadian businesses and across all sectors. [summary of comment by Ulrike Bahr-Gedalia, Senior Director, Digital Economy, Technology & Innovation]

- Pharmacare: The pharmacare proposal will spend billions of tax dollars, and grow over time, to pay for less coverage than what many Canadians have now through private providers. The government should focus on providing help “for those who really need it”. The Government chose a targeted approach with dental care; same approach could be followed with pharmacare. [Summary of comment by Kathy Megyery, Senior Vice-President]

- Defence Policy: The budget brings Canada closer to meeting NATO spending commitments and addresses some longstanding challenges facing our defence industrial base. It’s important that we’re investing in arctic sovereignty, reviewing how we can grow our defence manufacturing ecosystem, and better protecting Canadians from cyber threats. The Armed Forces won’t be served by more deferred investments. Ever-increasing threats to Canada’s national and economic security requires a defence policy that is ready to respond to tomorrow’s threats, today. [Summary of comment by Perrin Beatty, P.C., O.C., President and Chief Executive Officer]

Union of BC Municipalities:

The Union of BC Municipalities (UBCM) has issued their UBCM comment on Budget 2024. In summary:

“The proposed 2024 federal budget includes a new housing plan, with several programs that impact local governments. Initiatives include supports for renters, homeowners, developers, and other orders of government. The plan broadly fits into three categories: building more homes, making it easier to rent or buy a home, and helping Canadians who can’t afford a home. Details are yet to come, but the plan does address some of the core components in UBCM’s Housing Strategy.”

BC Greens on provincial impact:

The federal Budget 2024 notably omits a windfall profit tax on oil and gas companies, said BC Greens Leader Sonia Furstenau in a statement this afternoon. “This omission represents a missed opportunity to create economic stability across British Columbia and the entire country, while also addressing corporate greed and the impacts of climate change,” said Furstenau.

“The federal government had an opportunity to make our economy more fair for Canadians. The oil and gas industry continues to extract billions in profits, while Canadians pay more and more for everyday necessities. A windfall profit tax, with revenues returned to Canadians, could have eased the financial pressures people are feeling while sending a clear message to the oil and gas industry.

“We are calling on the BC NDP, again, to take a stand where the federal government has not. Implementing a windfall profit tax at the provincial level could set a precedent for responsible economic management and show true leadership in tackling both economic and environmental challenges.”

Post-secondary response: [submit comments to news@islandsocialtrends.com]

- Royal Roads University: “Thank you to Chrystia Freeland (Deputy Prime Minister and Finance Minister), François-Philippe Champagne (Minister of Innovation, Science and Industry), and the Government of Canada for Budget 2024’s commitment to research and graduate student funding. These investments are so necessary to support the innovative Changemaker education our country and world need.” ~ Philip Steenkamp, President, Royal Roads University (April 17, 2024)

- University of Victoria: “A bright spot in the new federal budget is a much-needed increase in scholarship support for graduate students and postdoctoral fellows, who have been living below the poverty line for over a decade. Investments in research, training and infrastructure will help the next generation of innovators reach their full potential and propel Canada forward on the global stage.” ~ Lisa Kalynchuk, Vice-President Research and Innovation, University of Victoria