Friday September 15, 2023 | VICTORIA, BC [Updated 9:42 am September 16, 2023]

by Mary P Brooke | Island Social Trends

Prime Minister Justin Trudeau announced yesterday that GST (5%) will be removed on new rental construction, effective immediately.

Federal Housing, Infrastructure and Communities Minister Sean Fraser was enthusiastically supportive, and says even more should be done.

Trudeau was addressing media from London Ontario where the Liberals were holding their fall 2023 caucus meeting ahead of the 44th Parliament Fall Session which begins next week.

Provincial role:

Trudeau also said he hopes the provinces follow suit (which would mean dropping the Provincial Sales Tax — which in BC is 7%).

Will BC drop the PST on building materials? Could the provincial budget handle the toll that would take on revenues? Island Social Trends has asked the Finance Minister and Housing Minister if BC will in fact drop the PST on construction materials purchased for purpose-built rental construction; we’ll hopefully hear back on Monday.

PST applies to taxable goods used to fulfill a contract in BC. Contractors who pay PST include builders, carpenters, electricians, plumbers, painters, landscapers and anyone else who installs goods that become part of buildings or land.

Meanwhile, late this afternoon, BC Premier Eby’s office — together with Housing Minister Ravi Kahlon and Nathan Cullen, Minister of Water, Land and Resource Stewardship — announced that on Monday (September 18) in Richmond he will announce “new initiatives to deliver more homes for people faster”. Back in January the same three leaders make an announcement in Vancouver about a new approach to building permits.

GST gets passed on to the cost of housing/renting:

That makes it more affordable for developers to construct purpose-rental buildings, as GST is normally charged on all materials and contracted labour — which of course gets forwarded onto into sale prices (if homes for purchase) or rent levels (if units for rent).

The federal Liberal government’s move to drop the GST payable on all aspects of constructing rental units is a smart next-step to help ease the housing crisis. It won’t solve the whole problem but it’s a good piece of the solution.

BC response is positive:

Yesterday on X (Twitter) former Housing Minister Selina Robinson said she had asked the federal government to do that back in 2017.

Locally, at least one developer in the Greater Victoria area this year dropped GST on the purchase price of condos, which certainly helped those who could afford to purchase a condo. But this targeting of purpose-built rental goes much further as it’s clear that many Canadians will never be able to afford a home and should instead be able to find an affordable rental unit.

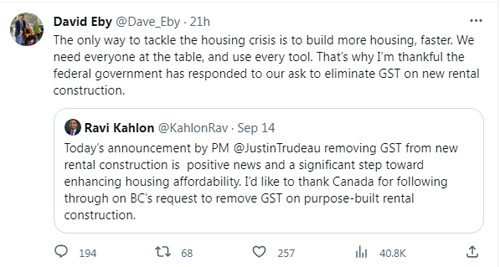

BC Housing Minister Ravi Kahlon — who met with Deputy Prime Minister and Finance Minister Chrystia Freeland here in Victoria this summer, was pleased at the news about the federal government removing GST on new rental construction:

“Today’s announcement from the federal government removing GST from new rental construction is very positive news, and a significant step toward enhancing housing affordability. I’d like to thank Canada for following through on BC’s request to remove GST on purpose-built rental construction,” said Kahlon in a news release.

“We are pleased to see that our call for action has been heard,” said Kahlon, adding that he wrote to, and met with, the former federal minister to call for this move in June. “My predecessors as housing ministers for our government have consistently urged the same. These measures are crucial to addressing the rising challenges posed by historic interest rates and rising construction costs, which threaten our ability to meet the increasing housing needs of our rapidly growing population.”

“Our government is committed to doing everything possible to deliver safe, affordable and quality homes for people. We need the federal government to help us do more,” said Minister Kahlon yesterday.

Premier Eby reposted Minister Kahlon’s post/tweet yesterday, with this comment: “The only way to tackle the housing crisis is to build more housing, faster. We need everyone at the table, and use every tool. That’s why I’m thankful the federal government has responded to our ask to eliminate GST on new rental construction.”

Minister of Water, Land and Resource Stewardship, Nathan Cullen, posted on X (Twitter): “Parliament works for Canadians when good ideas come from different parties and make it to national policy that helps people. Thanks to the #NDP and @theJagmeetSingh for pushing this great idea to get more rental homes built.”