Thursday April 30, 2020 ~ BC

by Mary Brooke ~ West Shore Voice News

Coast Capital Savings is experiencing the impacts of two significant changes this year.

Having moved from being provincially regulated to being federally regulated (and now governed by the Bank Act) is one thing. And then on top of that dealing with, like everyone else, the impacts of the COVID-19 pandemic.

2020 Board of Directors election:

Where Coast Capital Savings members will see a difference brought about by the financial institution now being federally regulated, is in how things have turned out with their current board of directors election.

This year three individuals are standing for election to the Board of Directors. “This means that we are in the situation where the number of candidates—all recommended by the Nominations Committee—equals the number of vacant positions at the Board,” says Erin McKinley, Media Relations, Coast Capital Savings.

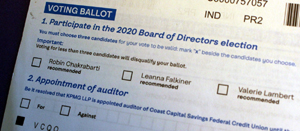

This year the ballot has the names of three candidates, with a notation that “voting for less than three candidates will disqualify your ballot”. Which effectively serves to force election of those three candidates, i.e. a ‘done deal’. So why not say the three candidates — Robin Chakrabarti, Leanna Falkiner, and Valerie Lambert — be declared by acclamation?

“When such a situation occurred in the past when we were provincially regulated, the candidates would have been declared elected by acclamation. However, as of November 2018, when we became federally governed under the Bank Act this changed. We are now required in all circumstances to conduct an election by ballot regardless of the number of candidates and vacancies,” says McKinley.

Coast Capital Savings used to be provincially regulated but as of November 2018 is federally regulated.

“Additionally, Coast Capital’s Credit Union Rules require that a ballot cast in any election of Directors must contain the same number of votes as the number of vacancies to be filled in that election of Directors for a vote to be valid. That is why this year’s ballot asks our members to vote for exactly three candidates,” she explained.

It seems like an exercise in compliance by members. But McKinley says: “We appreciate the awkward dynamics of this year’s election, and are asking members for their understanding by showing their support for those who have come forward to place their names on the ballot as they are highly qualified and capable individuals who we believe will add value to our organization.”

Voting for members (by mail or online) is open from 8 am on April 14 to 5 pm on May 5, 2020 (Pacific Time).

Responding to the impacts of COVID-19:

During the pandemic, financial institutions across the country — whether banks, credit unions or credit card companies — have been responded to the financial distress of their customers in different ways.

Fees and charges:

Coast Capital Savings has not dropped the fee of $1.50 per e-transfer transaction as many financial institutions have (in whole or in part), saying that’s essentially because they already provide very low-cost banking packages to their member-customers.

“While every financial institution and account is different, many financial institutions charge a monthly account fee that covers the features and services of that particular account, including a certain number of transactions per month. A number of etransfers may be included as a part of the monthly account package,” says McKinley.

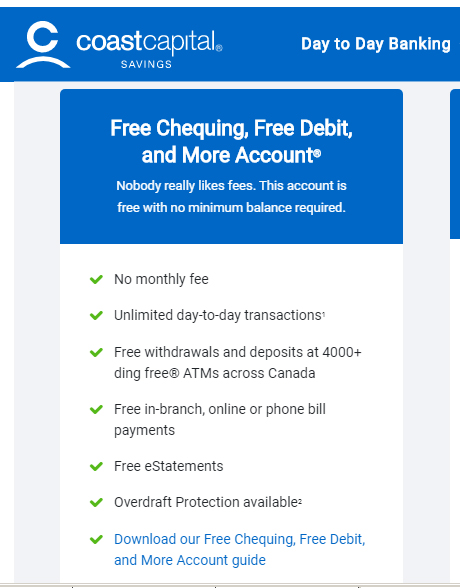

Although Coast Capital charges for etransfers still during the pandemic: “Unlike the majority of financial institutions, we offer low- or no-fee full service banking to our members,” she says. Examples of that are the Free Chequing, Free Debit and More Account options which require no minimum monthly balance yet offer unlimited transactions including free member-to-member transfers, among other features.

“We are committed to helping our members achieve financial well-being and will remain transparent in the fees that we charge,” says the Coast Capital Savings rep.

To support our personal and business members through the financial hardship of the current economic circumstances, Coast Capital Savings is offering financial relief on a case-by-case basis. “We are focusing our efforts on our Member Financial Relief Program, to help ease the financial burden that many are experiencing. In addition, we have launched our Coast Capital Community Relief Fund. We are also supporting and administering the various government programs, including those for businesses that have been announced to help Canadians weather the storm.”

Donation to Community:

Coast Capital Savings has made a donation to Food Banks BC which has dispersed the funds to food banks in the areas that are served by the financial institution. “We are very proud of the measures that we are taking to help both our members and the wider communities where we operate,” says McKinley.

Branch closures for physical distancing:

As have many other financial institutions, Coast Capital Savings has reduced hours (such as just 12 noon to 3 pm at the Bay Centre branch in downtown Victoria) to allow for physical distancing in the branches that are open, and have fully closed many other branches (including five in the Greater Victoria area) for self-isolation of employees at home.

They are reserving the first hour at all open branches for seniors and members with compromised immune systems.

Branches that are presently closed in the Greater Victoria area are Admirals, Colwood, James Bay, Oak Bay and Shelbourne.

“Coast Capital is tremendously grateful and proud of our teams who, since the beginning of this outbreak, have been working tirelessly to help members in these unprecedented times,” says VP, Communications and Public Affairs, Roanne Weyermars. “Rest assured that as things continue to evolve, every decision we make will be fueled by our deep care for our people, our members and our communities,” says Weyermars