Monday November 22, 2021 | VICTORIA, BC

by Mary P Brooke, Editor | Island Social Trends

Borrowing is not expensive, and most of the economy is bouncing back. That’s the over-arching takeaway from the BC Government second quarterly report as announced today.

Finance Minister Selina Robinson addressed media at 9:30 am this morning, November 22.

Today’s prominent buzz phrase was “remaining nimble”, for which monies are being kept available, as the bills for handling the flooding impact recovery and the continuing pandemic have yet to roll in. “We are working hard to assess the damage,” said Robinson.

There is a lot of liquidity in the system, according to government. And tax revenues have been strong, including from personal and corporate tax, as well as through the real estate sector (property transfer taxes) and consumer spending (retail sales tax). Government takes credit for strong retail by having supported businesses during the pandemic recovery.

There is “some progress in housing supply”, said Robinson, adding that the supply of purpose-built rental is improving (not all of it built yet).

Rebuilding infrastructure and helping communities — in the wake of the flooding due to the wind and rainstorm of November 15, will be done under the Emergency Program Act.

The government’s summary:

- Broad-based supports to help people and businesses have helped BC bounce back.

- The province is forecasting a deficit improvement from $4.8 billion to $1.7 billion.

- Pandemic and Recovery contingencies continues to provide support for our ongoing health response and to provide targeted economic recovery supports.

- We expect the recovery to continue to be uneven across sectors, while there remains much uncertainty from the pandemic.

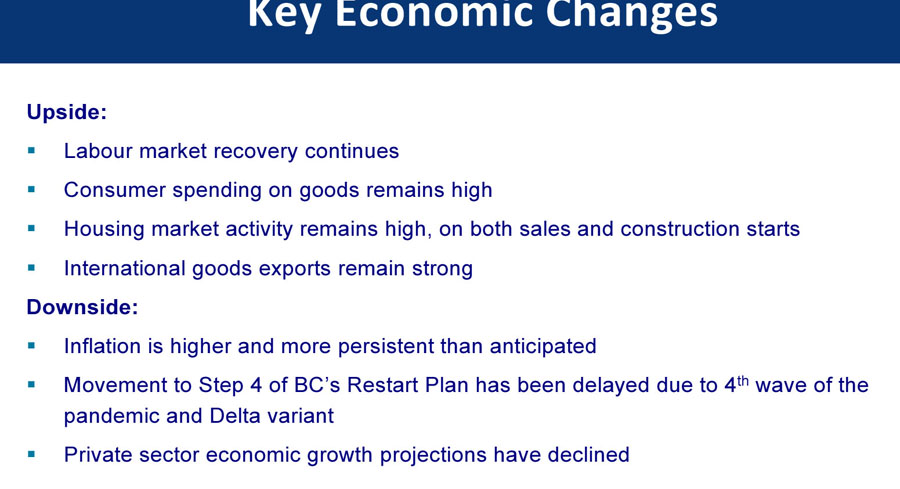

Key Economic Changes:

On the upside, the government shows that labour market recovery continues and that consumer spending on goods remains high. Housing market activity remains high, on both sales and construction starts. International goods exports remain strong.

On what they call the downside, inflation is at the top of the list: “Inflation is higher and more persistent than anticipated.”

Almost no one thinks in terms of the COVID economic Steps anymore, as individuals, families, businesses and society have just started getting on with life during the ongoing pandemic. So it’s interesting that the Ministry of Finance document puts it this way: “movement to Step 4 of BC’s Restart Plan has been delayed due to 4th wave of the pandemic and Delta variant”.

It’s also noted as a downside that “private sector economic growth projections have declined”. This should come as no surprise, as businesses are still assessing and adapting carefully to COVID economic recovery, and may not have funding at the time they need it, for pivotal changes (despite a strong and fairly successful program of business grants and economic supports).

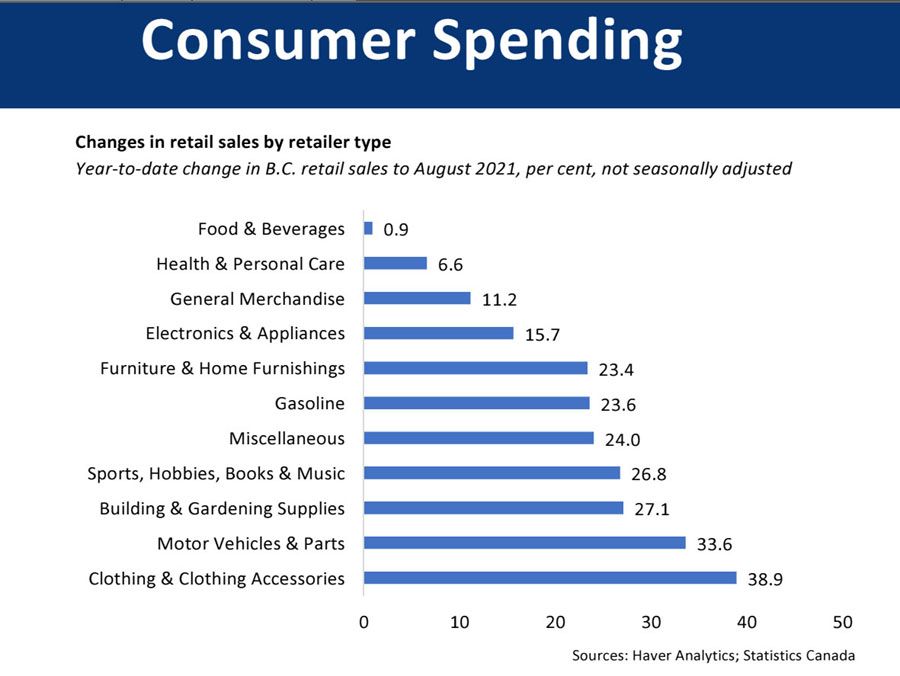

Consumer spending:

Year-to-date changes in consumer spending show a strong bounceback in clothing/accessories, motor vehicles/parts, building and gardening supplies, and sports, hobbies, books and music. Those are areas of the economy that have faltered during the pandemic. There is not much increase shown in expenditures on food, personal care or general merchandise, as those areas had already bounced back by late-spring and early summer.

Points of interest:

Most of the strong revenue increases are from the hot housing market (property transfer tax was even higher than property taxes from existing homeowners). Robinson said legislation is coming forward to institute a “cooling off period” in the real estate market, but it’s unlikely the cost of a home (house, townhouse, or condo) is ever going to decrease, especially in the Greater Vancouver and Greater Victoria areas. In October 2021 the average house sale price in Greater Victoria was $1,327,228 (and $1,137,007 in Langford where homes still have lower price tags than in Saanich and Oak Bay).

An interesting result of providing broader social supports during the pandemic, is that there’s been a reduction in expenditures for managing the case load for income and disability assistance.

BC will make sure there’s enough money for “critical supplies and PPE” during the ongoing COVID pandemic, including $875 million in the budget for “additional health measures”, Minister Robinson said today.

There is uncertainty in the “high contact industries” economic sector, due to the continuing pandemic. That would include aspects of the tourism industry (including restaurants and accommodation).

Flood recovery assistance “is going to be very costly, for sure,” said Minister Robinson in her media session today. Last week Public Safety Minister Mike Farnworth said the province is financially in good shape to handle whatever recovery expenditures are required, particularly noting the Disaster Financial Assistance that was announced November 18.