Monday August 31, 2020 ~ VICTORIA, BC

by Mary P Brooke, Editor | Island Social Trends

The economic impacts of COVID-19 in BC hit toward the end of the 2019-2020 fiscal year. It was in March of this year that the virus sent families and businesses into retreat.

Due to the COVID-19 pandemic (as declared by the World Health Organization on March 12), a public health emergency was declared by BC’s Provincial Health Officer on March 17, and BC went into a State of Emergency on March 18 (which continues still).

So the impacts of pandemic-related economic shutdown and disruption are only preliminary in the 2019-2020 fiscal profile report that Finance Minister Carole James delivered today in a media session livestreamed from Victoria.

“We all know that the world is a very different place than when Budget 2020 was introduced,” she opened with today.

Minister James drove home the government philosophy that “investing in people is just as critical today, if not more, than it was in 2019”. Few can argue with that now, seeing how supports for individuals, families and workers have kept most British Columbians above water in uncertain times.

COVID in March coloured 2019-2020 outcomes:

Despite strong fiscal results in the first three quarters of 2019-2020, unforeseen changes in the fourth quarter due to COVID-19 — including declines in tax revenues, ICBC losses and early measures to tackle the pandemic (such as additional costs for emergency preparedness and the health care system) — produced different outcomes from what was projected in the Province’s projections for 2019-2020 financial results.

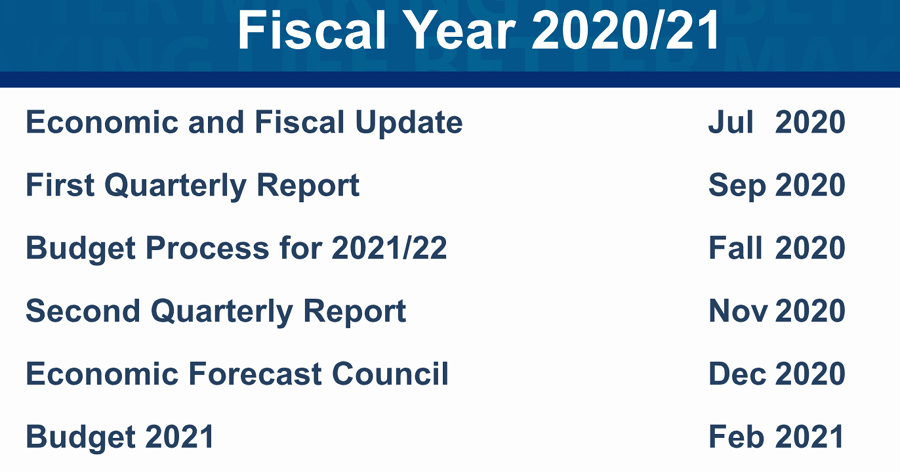

The current 2020-2021 fiscal year will ultimately show the most evidence of the economy bearing the brunt of COVID-19 economic adjustments, covering the period of April 1, 2020 to March 31, 2021. Budget 2021 comes in February of 2021.

Meanwhile, a 1st Quarter report (April to June 2020) will come soon, in September. “We’ll be able to get a good read of that (i.e. impact of COVID in April to June),” said Minister James today. And even more so in a 2nd Quarter report (covering July to September 2020) which is scheduled for November.

“While the first three quarters of 2019-20 reflected a modest surplus and steady economic growth, COVID-19 led to lower tax revenues and losses at ICBC in the fourth quarter,” said Minister James today.

COVID-related costs:

Immediate costs related to the pandemic in March 2020 alone included $11 million for core government costs and $35 million needed by the health care sector.

Both reports (in September and November) will show further impacts due to COVID-19 during May through September.

With people self-isolating and working from home, the 2nd and 3rd Quarter reports will certainly include things like decreased tax revenues from business (EHT waived), lower property sales (notably $171 million lost in the first quarter) and lower retail sales (PST collections are down), together with the overhead people-support costs to government as related to high unemployment (already including an estimated loss of $397 million in personal income tax revenue).

During the pandemic lottery sales have also been lower (those funds are used to support a wide range of government expenditures including through grants to municipalities).

“Despite the impacts of COVID-19, I am encouraged that B.C. continues to show positive signs, including improving employment numbers, robust capital spending and the best debt affordability in Canada,” said James.

COVID produced a 2019-2020 deficit:

The 2019-2020 fiscal year ended with a deficit of $321 million, which is $595 million lower than the surplus projected in Budget 2019, mainly due to:

- costs related to B.C.’s initial COVID-19 response ($11 million core government costs), and public health measures ($35 million);

- lower taxation revenue due to COVID-19; and

- a $298-million ICBC investment loss due to market conditions from COVID-19.

“The final quarter of the fiscal year brought many challenges,” James said. “B.C. isn’t alone in facing these challenges, but we are in a strong position to weather them,” she said.

Planning for Budget 2021 already underway:

Minister James explained that the investments that BC made in 2019-20 — such as eliminating MSP premiums and investing in child care and housing — will make life more affordable and support people through COVID-19 as the Province develops a strong economic recovery plan.”

A resilient and ready workforce will be essentially for a healthy economic recovery once we are past the pandemic (which is now thought to be at least 2022, based on presumed progress with vaccine availability).

Development for Budget 2021 (coming in February) is already underway. Feeding into that will be those 2nd and 3rd Quarter reports.

She projects a deficit of $12.5 billion for 2020-2021 due to the impacts of COVID-19.

Recovery plan numbers coming soon:

The government will release details soon for its $1.5-billion economic recovery plan to help employers and employees rebuild during the pandemic.

The funding is part of the B.C. government’s $5-billion pandemic plan introduced this past spring which at the time included new tax deferral incentives for businesses and the $1,000 tax-free BC Emergency Benefit for Workers for people whose ability to work was suddenly and detrimentally impacted by the pandemic.

Vaccine progress update (federal):

Today in Ottawa federal Finance Minister Chrystia Freelance, Minister of Public Services and Procurement Anita Anand, and Health Minister Patti Hajdu said Canada has invested in various aspects of vaccine readiness.

That includes with now four potential vaccine developers (for up to 190 million vaccine doses) as well as with suppliers of the vials needed for manufacturing, packaging and distribution (and support supplies such as syringes, needles and alcohol swabs).

The federal government is doing COVID business in BC… today announcing the purchase of three ‘fill and finish’ systems in contracts with a company in Burnaby, to support the last portion of the vaccine production line where vials are filled and finished without human intervention, for a fast rollout of vaccines.

“When a vaccine is ready, Canada will be ready,” said Freeland today.

Investments in 2019-2020 put BC in good stead:

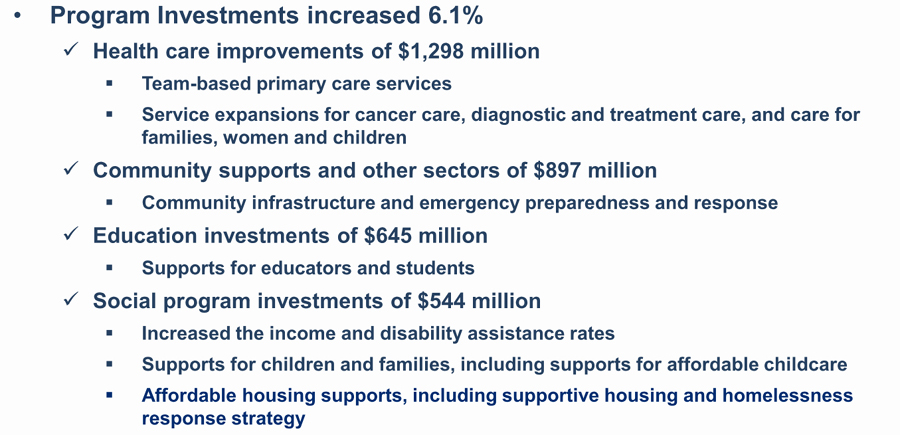

Public Accounts 2019-20 confirm the Province’s commitment to put people first through $3.4 billion in increased investments in health, community supports, education and social services, and a historic $4.8 billion in capital spending for hospitals, schools and highways.

Public Accounts 2019-20 show B.C. is in good financial standing with affordable debt levels at the end of the fiscal year and continues to lead the country as the only “AAA” accredited province. Provincial gross domestic product (GDP) for 2019 grew by 2.8%, above the national average of 1.7%.

===== Links:

To access Public Accounts online, visit:

https://www2.gov.bc.ca/gov/content/governments/finances/public-accounts

The technical PowerPoint presentation is available online:

https://news.gov.bc.ca/files/PPT_Technical_Public_Accounts_2019_20.pdf

For information about BC’s Restart Plan, visit: http://gov.bc.ca/restartbc

To learn more about the supports and services available for people, businesses and communities through the pandemic, visit: gov.bc.ca/covid19

===== BACKGROUND:

Public Accounts 2019-20 highlights (as provided by the Ministry of Finance):

More investments in capital infrastructure, like schools and hospitals, continue to build a strong economy with opportunities for British Columbians and will support a strong economic recovery through COVID-19.

Economic highlights:

- Provincial GDP for 2019 grew by 2.8%, the third-highest in Canada and higher than the Canadian average of 1.7%.

- Taxpayer-supported debt to GDP is 15.1%, the second-lowest in the country and only 0.1% higher than forecast in Budget 2019.

- B.C. continues to be the only province in Canada to hold a “AAA” credit rating.

- On an annual basis, B.C. had the lowest unemployment rate in Canada in 2019, with an average of 4.7%.

COVID-19 impacts:

- COVID-19 led to an estimated loss of $397 million in personal income tax revenue and $171 million in property tax revenue.

- Lower market investment values created an ICBC impairment loss of $298 million.

- $11 million in core government and $35 million in health authority costs are attributed to the final quarter of the fiscal year 2019-20.

- The Province received $68 million through the federal Canada Health Transfer before the fiscal year-end.

Operating results:

- The first three quarters of the 2019-20 fiscal year reflect a modest surplus and steady economic growth.

- The unanticipated impacts of COVID-19 resulted in a year-end deficit of $321 million, $595 million lower than the surplus forecast in Budget 2019.

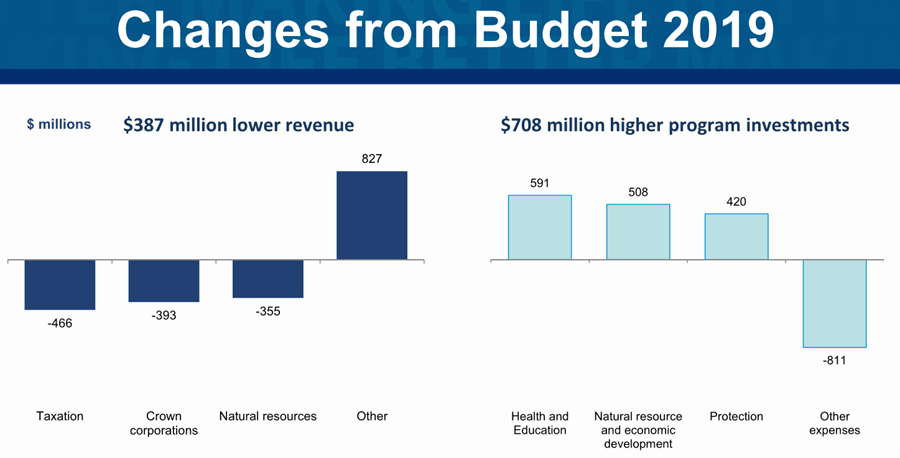

- Revenue increased by $1.5 billion over the previous fiscal year and was $387 million lower than expected in Budget 2019.

- Expenses increased by $3.4 billion over the previous fiscal year for program investments and were higher than budgeted by $708 million.

Capital spending:

- Public Accounts 2019-20 include a total of $4.8 billion in taxpayer-supported capital spending on hospitals, schools, post-secondary institutions (such as student housing), transit and roads.

- Total capital spending was $1.5 billion below Budget 2019’s projection due to project-scheduling changes.

Debt levels:

- Governments, like the private sector, borrow to finance building long-lasting capital infrastructure, such as schools, hospitals and highways.

- Taxpayer-supported debt levels increased by $3.5 billion in 2019-20, mostly due to capital project spending, including schools and highways.

- Self-supported provincial debt increased by $2.7 million for investments in capital infrastructure power projects.

- The total debt for 2019-20 was $387 million lower than projected in Budget 2019.

- Despite the need for increased borrowing and higher debt levels, B.C. continues to have among the best debt metrics and credit ratings compared to other Canadian provinces and will benefit from low interest rates.

Fiscal challenges:

- Public Accounts 2019-20 show the changes government is making to reform ICBC are stabilizing the Province’s public auto insurer.

- The total net loss of ICBC in 2019-20 was $376 million, $777 million less than the previous year’s net loss of over $1.1 billion.

- Speculation and vacancy tax revenues were lower than anticipated in 2019-20, a sign that the tax is working to prevent much-needed rental units from sitting vacant, leading to a 19% increase in available long-term rental units.