Monday March 25, 2024 | VICTORIA. BC [Updated June 12, 2024]

by Mary P Brooke | Island Social Trends

Last month the BC Government topped up the BC Rent Bank coffers by $11 million. This was in recognition of more renter households requiring support for unexpected or difficult renting situations.

That announcement was made by Spencer Chandra Hebert, BC Government Deputy Speaker. The BC Rent Bank program is also on the radar of Housing Minister Ravi Kahlon.

Lending service:

BC Rent Bank is a lending service. For successful applicants, the full interest-free loan amount must be paid back monthly over a stated period of time. Loan applicants must prove immediate ability to repay.

Who runs it:

The BC Rent Bank service is delivered through a number of local and regional non-profit organizations and agencies. Currently there are 18 such agencies, up from seven when the program first started in 2019.

Government-backed, bank-operated:

The BC Rent Bank program is a project of the Vancity financial institution through their Vancity Community Foundation, primarily using government funds for its lending resource.

The Province has recently invested nearly $11 million in additional funding to BC Rent Bank to continue to help people maintain their homes in times of immediate financial need. “This funding has the potential to support as many as 20,000 renters through unforeseen financial challenges. BC Rent Bank will extend these funds to regional rent banks that work with renters and provide financial assistance and support services to them,” according to the Ministry of Housing in a statement today.

“Rent banks provide interest-free financial assistance and are housing stability and eviction prevention resources that renters can turn to during unexpected interruptions to income that jeopardize their housing. Rent banks also coordinate connections to other services, such as debt consolidation, housing services, government subsidies, benefits and grants to support the needs of the renters. If a renter is unable to pay their loan within the 36-month period, the local rent bank works with the renter to navigate how they can be further supported, as the Province’s goal is to ensure that people remain stably housed. We are always exploring opportunities to ensure programs, such as the BC Rent Bank, benefit more people,” the Ministry says.

The fund is overseen by the BC Rent Bank Board of Directors. The board chair is Clayton Buckingham who is Chief Financial Officer for Vancity and joined the Foundation’s Board of Directors in 2022.

The BC Rent Bank Managing Director is Melissa Giles. “Eviction prevention is the focus of the program. We want to keep people housed,” says Giles about the BC Rent Bank.

Narrow range of applicant opportunities:

The BC Rent Bank program is designed to provide assistance in those netherworld situations of rental instability in scenarios that are otherwise financially stable. It seems not easily suitable for people who have chronically unstable or very low incomes.

Any loaned funds are paid directly from the BC Rent Bank (or one of its operational agencies) to the landlord or utility which might otherwise miss a payment from the loan applicant. This indicates a component of relationship-building with the property-owner and utility sectors as well, to help them see uninterrupted incoming revenues.

Helping but with steps and stigma:

Therefore the program in fact is an interesting mix of a stated open-hearted ‘we want to help’ philosophy combined with a fairly stiff bank-style approval process. And that is overlaid with what many applicants might feel is the stigma of government-program participation (as in the funds going directly to the landlord or utility, which peels back a certain amount of privacy).

The goodwill side of the equation attracts a growing number of applicants in the current renters market conundrum — rapidly increasing rents (even though capped by the province at 3.5% for renters who remain in place), renovictions (owner sells the house in order to renovate and re-rent at a higher level), and inflation-evictions (owner sells the house to recoup investment losses, setting tenant adrift). [Note: The BC Rental Housing Task Force report of 2019 stated in Recommendation #10 that “tying rent increases to the unit, not the tenant” would help avoid some of these scenarios.]

The financial decision-making committee is thorough with applicants, inquiring beyond even what a bank would ask.

There is a stated goal to protect the government’s money and to have a regular return of loaned funds so that a continual number of recipients can be assisted.

“The Province recognizes that inflation and the cost of living are making things tough for a lot of people, particularly renters. That’s why we have been taking urgent action to protect renters and help them to access a home they can afford,” according to a Ministry of Housing spokesperson.

While the government promotes the program as addressing hardship and crisis (see January 31 funding top-up announcement) the operators of the program seem to think of themselves as operating by the principals of a financial institution that issues loans. In some cases this may result in the request for a higher degree of personal information, and doesn’t always result in delivering a feeling of the ‘we want to help you’ framework that the BC Government hopes that it will.

Another potential challenge with the program is that each applicant is assigned a representative. That one representative hears about the applicant’s need and collects what is considered to be necessary information. The case representative makes the pitch to a committee. Unlike with regular financial institutions there is no direct contact between the applicant/client and the lender. This procedure is obviously intended to streamline the decision-making process and provide some arms-length dignity — but can be cumbersome and variable depending on the representative and the composition of the committee.

Well-intentioned but in some ways now mismatched:

The BC Rent Bank has good intentions but in delivering their qualification-based service might yet be functionally mismatched with what the government believes are the goals of the program.

Where the program and process may need to be revised:

- how the program is promoted (so it reaches its full intended audience),

- how the application details are received (perhaps streamlining the initial online application),

- standardizing the process of how the account rep engages with the applicant,

- how the lending decision-making is done (currently dependent on a committee based on a pitch by one representative for the applicant),

- how the funds are disbursed (perhaps should be direct to the applicant, not a third party,in order to increase applicant participation),

- factor-in the likelihood of a 3.5% rent increase for the applicant at least once over the course of the loan repayment period (as part of determining a suitable loan repayment period),

- include a forgivable portion (i.e. grant component) perhaps as the equivalent of the amount of the last payment.

“While rent banks offer interest-free loans, the Province, through BC Housing, also offers rent supplements to families and seniors that provides financial support to help them pay their monthly rent,” the Housing Ministry emphasizes in their March 25 statement. They have not specifically commented on providing a forgivable/grant portion in the BC Rent Bank process, but rather the Ministry emphasizes the many other programs in place to support renters including the BC Housing’s Rental Assistance Program (RAP) and Shelter Aid for Elderly Renters (SAFER) programs have helped over 27,000 low-incomes households with their rent payments in the private market as of December 2023.

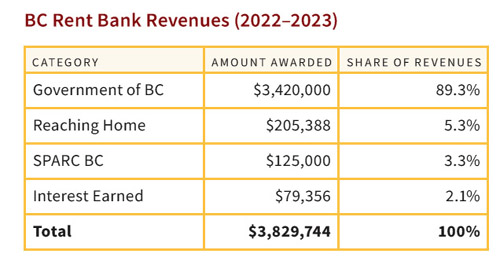

Revenues:

The Government of BC contributes the largest share of revenues to the BC Rent Bank. In 2022-2023 that amount was $3,420,000 (89.3% of total BC Rent Bank revenues for that fiscal years. The federal Reaching Home program contributes $205,388 (5.3%) to BC Rent Bank revenues. The Social Planning and Research Council of BC (SPARC BC) contributed $125,000 (3.3%).

Presently the BC Rent Program agreement with the BC Government prohibits any grant-style forgivable program. Perhaps that is because the province might expect continued strength with interest earnings on the funds. In 2022-2023 the BC Rent Bank program earned $79,356 in interest on the funds they held on account (2.1% of revenues for that fiscal year).

BC Rent Bank leadership weighs in:

BC Rent Bank Managing Director Melissa Giles discussed aspects of the lending program with Island Social Trends on BC Budget Day, February 22.

The loan application process asks a lot of questions that could be experienced as invasive, far more than a bank would ask. The loan has no forgivable portion (there is no grant).

“I know there’s an interest in that,” Giles told Island Social Trends last month.

This is for people who probably are close to middle income but who are caught in a pinch with the current rental crisis where the renter’s next rent might jump as much as 10 to 15 to 25% more than they were paying the month before.

Social justice context:

Melissa Giles has almost 20 years of experience working in the non-profit sector, both domestically and internationally, and is passionate about social justice and housing affordability issues.

In that context she readily appreciated the current challenges brought to her attention by Island Social Trends. Her first response to hearing about an unduly tight repayment schedule was essentially that input from the public is not easily received; perhaps because only applicants would learn the details of the process.

Giles seemed keen (but not entirely surprised) to hear about the strident big-bank-style approach to approvals and in particular to the length of loan repayment period which may not in all cases take into account a sense of relief for the application by giving some time to recoup.

The loan repayment schedule starts in the month after the month in which assistance was received, but if the payback period (e.g. 1 year, 2 years, 3 years) is not spread out enough, the initial few months of payback in particular only add to the sense of hardship for the recipient.

Program adaptation:

“The Rent Bank program was established in 2019 with funding from the provincial government,” Giles sated. The idea of a province-wide rent bank program was Recommendation #4 in the 2019 BC Rental Housing Task Force report.

“Our funding agreement is to offer interest-free loans. So it isn’t like a bank because it is interest-free,” said Giles. “And we have adapted our practices over the last number of years such as increasing the amortization period,” she added.

“We used to have a two-year repayment plan. Now we have up to three years for renters to be able to repay that,” said Giles, being quite on top of her details.

“We recognize that the Rent Bank program is not going to serve the need of every renter that’s in crisis. But it is specifically designed for low to moderate income earners who can’t walk into a financial institution because maybe they don’t have the credit rating that is necessary in order to qualify for a loan,” Giles outlined.

“And we’re trying to help people avoid places like Pay Day loans and Money Mart where they’re going to end up with a high-interest loan to begin with,” she said.

“As for practices, we’re constantly re-evaluating those. We’re looking at them,” said Giles, who said she had recently had a discussion with the ‘office of homelessness’ about some of those practices.

“One of those things about the Rent Bank program is that because we don’t do credit checks or those kinds of things we need to ensure that the person has the capacity to repay that loan. So that’s what some of those practices are about,” said Giles.

“Whether or not we can look at adapting them and changing them in the future that’s something we’re always taking into consideration,” Giles told Island Social Trends.

BC Rent Bank achievements in 2022:

The BC Rent Bank says it “takes great joy in commemorating milestones and achievements”. In their 2022 year-end report:

- $1.51 million in funding given to 2,270 renters in BC to support housing

- 31% increase of rent bank loans compared to 2021–2022

- $3.42 million in year-end funding from the Government of BC

- Renewed funding of over $7 million from the Government of BC starting in 2024

By 10-year cohorts, applicants age 30 to 39 years comprised the highest number of BC Rent Bank applicants. Overall the majority of applicants were age 19 to 59.

There is a notable number of applicants ages 60 to 69, and some in the 70 to 79 age group. That might go down if the BC government makes updates to their Shelter Aid for Elderly Renters (SAFER) program, which Minister Kahlon said again last week are in the works.

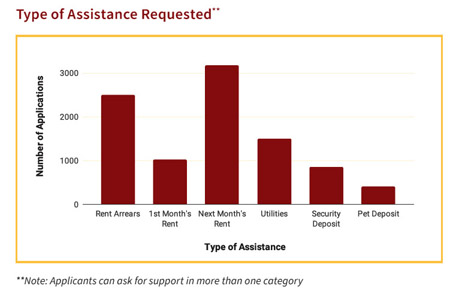

The largest number of applications were for next month’s rent, followed by rent arrears, then utilities. That was followed by first-month’s rent, security deposit and pet deposit. Applicants can ask for support in more than one category.

Cost of living pressures:

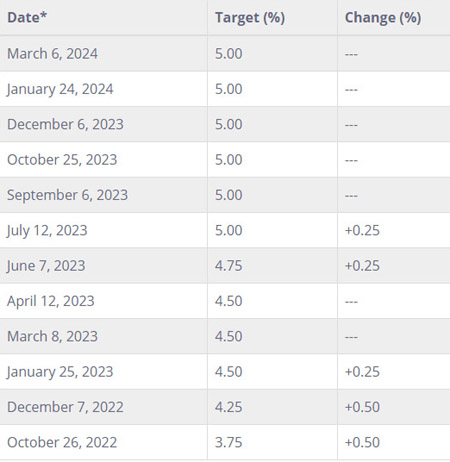

Due to the Bank of Canada’s approach to controlling inflation (with strident interest rate increases in 2022 and 2023, and still maintaining the rate of 5% since summer 2023) there has been a cumulative cost of living increase across the economy that has impacted nearly every person’s range of expenditures for the past two years, not to mention the lingering or still-emerging economic and personal financial impacts of the pandemic.

That is now bringing people to some points of personal financial management crisis in 2024.

“Because we know once they are evicted, we know tenants, landlords and communities pay higher prices for that. So that once is unit is vacant the market value of that is going to increase,” says Giles.

Federal support for rural and remote:

“So our focus is to keep people where they are housed, and that’s what these interest-free loans do offer. We have successfully partnered with a number of different funding bodies, one of them Reaching Home – a national federal strategy (through Infrastructure Canada) around homelessness prevention,” says the BC Rent Bank managing director.

The focus of Reaching Home is in rural and remote areas.

“And in those cases we are able to offer grants to people. Those are not accessible across the province. But right now with the funding that we receive from the province, it’s restricted to interest-free loans,” Giles explained.

Informing government:

“We’re presenting to the (provincial) government at all times what the realities are that renters are facing. This government — even in this budget — is announcing some renter protections that they hope will protect renters,” said Giles on BC Budget day last month.

“We do our best to learn from the renters as they come to the Rent Bank program and translate that into information and help talk to government about the challenges people are facing,” she said.

Vancity taking leadership:

“In 2019, following the BC Rental Housing Task Force report, one of the BC Rent Bank recommendations was that the provincial government get behind supporting community-based rent banks,” says Giles.

“This funding was also always originally intended to support communities that recognize rent banks as an eviction prevention resource. It was there as seed funding in supporting those communities in getting that going. That was a funding agreement established between the provincial government and Vancity Community Foundation.”

“We have 18 different rent banks across British Columbia. We had seven when we started in 2019,” says Giles with pride. The list of communities served by those 18 rent bank partners is extensive.

“So we’ve been able to grow access and ensure that every renter in BC can access the services. We do that through non profit organizations and partners. We wanted a community-based approach. Rather than a centralized approach. Because we knew for example that we could set up a rent bank in the Kootenays or Nanaimo or up in the North, they’re going to know what’s available to renters in (those) areas and connect them out to community resources beyond just what the Rent Bank program can offer.

Appreciating provincial government support:

Giles says the Vancity Community Foundation is “incredibly grateful”.

“When we got that initial investment in 2019 the language was ‘this is a one-time financial support’. So that $11 million comes to us in two different ways: year-end funding and last year’s provincial announcement,” she outlined.

“We’re beyond thrilled that we have the continued financial support because we need that foundational support. A lot of people have been asking us ‘is that enough, is that going to be able to support the province-wide rent bank’,” said Giles.

“We want to use those provincial dollars to work with local private and foundations in the private sectors to be able to offer more supports to renters. It’s a starting point. It really creates a strong foundation and we know there will be a need for more financial support for renters given the current climate,” said the BC Rent Bank’s managing director.

Responsiveness to market forces:

“The reality of the renter market is that it’s changed dramatically in the last three or four years. The original intention of the program and what the current needs are, we’re going to have to constantly evaluate and adapt the program,” says Giles.

“The majority of people are repaying their loans. The reality is we are working with a higher risk population than people who go to a financial institution who know it’s going to be connected to their debt.”

“Our focus is on ‘let’s keep people housed’ and then work with them on that repayment rate,” said Giles. “So we can offer deferrals or reduced payments. We have a very personable approach to it because we want to work with that renter to maintain their housing while repaying their loan. Because money that comes back in from a renter immediately goes back out to another renter.”

A fairly remarkable example of the BC Rent Bank leadership responsive was seen very early in the pandemic — when on April 8, 2020 (the pandemic was declared just weeks earlier) the BC Rent Bank recommended to their rent bank partners to recognize the challenges experienced during the pandemic (including job loss and waiting for federal or provincial benefits) and to adapt repayment arrangements to “reduce financial pressure on clients”. That included:

- deferral of payments

- charge only an administrative fee on new loans (vs beginning repayment)

- extend repayment term to reduce costs

- nominal collection on loan repayments for the first three months

Local MLAs weigh in:

“People from the West Shore and those who want to live in the region often tell me about their struggles as renters. As a young person I know these all too well. It’s been great to hear how initiatives like the BC Rent Banks and improvements to the Residential Tenancy Act have empowered and supported renters in our community, and I know we are going to keep doing the work to make life easier for renters in BC.” ~ Ravi Parmar, MLA (Langford-Juan de Fuca)

“As MLA, I regularly hear from my constituents and community members about the challenges they face in the rental market here. Helping renters is a priority our MLAs share and I’m pleased we’ve taken action like supporting rent banks, bringing in the BC Renter’s Tax Credit, and delivering purpose-built rental housing here and across the province.” ~ Mitzi Dean, MLA (Esquimalt-Metchosin).

===== ABOUT THE WRITER:

Island Social Trends Editor Mary P Brooke covers regional and provincial news through a socioeconomic lens.

Her journalism has been published since 2008 through a series of publications: MapleLine Magazine (2008-2010), Sooke Voice News (2011-2013), West Shore Voice News (2014-2020), and Island Social Trends (since 2020 at IslandSocialTrends.ca and now bi-weekly in print).

Ms Brooke has reported with the BC Legislative Press Gallery since covering the COVID pandemic daily in 2020-2022.

She was nominated in 2023 for a Jack Webster Foundation journalism award that recognizes a professional woman journalist who serves her community through journalism.

===== RELATED:

Seniors rental support update coming soon says housing minister (March 19, 2024)

Province gives $11 million boost to BC Rent Bank (February 2, 2024)

NEWS SECTIONS: HOUSING | POLITICS | VANCOUVER ISLAND