Tuesday March 5, 2024 | VICTORIA, BC [Updated March 6, 2024 – Rate was held at 5% today]

Editorial analysis by Mary P Brooke | Island Social Trends

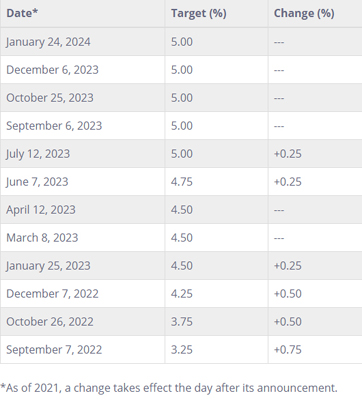

After two years of grinding policy interest rate increases by the Bank of Canada (from 0.25% in March 2022 to 5.0% by July 12, 2023), the last few months have by comparison seemed calm and possibly even reassuring.

There have been no increases of the interest rate beyond 5% since summer 2023.

The central bank — in response to their actions to contain inflation at their ‘target’ of between two to three percent — is seeing proof of their decision-making impact in the form of sagging consumer spending and a job market that has cooled though remains stable.

Household exhaustion:

Just below the surface of that is exhaustion within households, small businesses and communities. Even provincial governments have been scrambling to support their citizens, and those resources are in many ways (budget and politically) stretched to a limit too.

Household debt is higher than ever as people reach for options to keep their lives afloat. Everyone is experiencing pressures on mortgages or rent, at the grocery store, and on a range of other cost pressures related to the impact of higher interest on financing, insurance, manufacturing and transportation overhead.

Last fall, Bank of Canada Governor Tiff Macklem admitted that the Bank was surprised at how food price inflation had been coming down with a lag.

Next rate announcement:

The next interest rate announcement by the Bank of Canada will take place tomorrow Wednesday March 6, 2024 at 6:45 am (Pacific).

Getting to know the Bank:

Prior to the 2022-2023 phase of rate increases, the Bank of Canada seemed like a remote force out of Toronto’s Bay Street financial sector.

Now the Bank of Canada is much more of a known entity, and even the Governor of the Bank of Canada, Tiff Macklem is in some sectors now a household name. The Deputy Governor is Carolyn Rogers.

In December it was announced by the Bank that every rate announcement in 2024 would be accompanied by a live media session.

As well, the Bank seems to be giving more one-on-one media interviews with media including beyond the mainstream financial press, as a way to reach a broader Canadian audience.

Breaking rank:

Last summer BC Premier David Eby — followed by Doug Ford in Ontario and at least one other premier — broke rank with the untouchable Bank of Canada to voice their concerns about impacts on everyday Canadians. “I don’t believe in solutions that come at the expense of the poorest people,” said Eby during the Premiers conference in Winnipeg in July 2023.

Until this recent cycle of inflation-level management by the Bank, it was very unusual to hear any political comment about what the Bank was doing.

Even Prime Minister Justin Trudeau recently weighed in to suggest that perhaps the pressures have reached a peak. And just yesterday during a media session, Premier Eby sounded quite unsure that the central bank would make any improvement to things to really help people.

Rate perhaps downward this year:

Overall, economists and economic pundits are predicting the beginning of a relaxing of the central bank rate starting this spring, summer or fall. That’s a broad time frame. It’s obviously still entirely in the hands of Governor Macklem and his team.

The raw truth is that the everyday lives and economic longer-term well-being of most Canadians are at the mercy of think-tank corporate executives at the Bank of Canada. This is the biggest realization of the post-pandemic economy. It’s a realization that — now out of the box — can’t be returned to the shadows.

===== RELATED:

- Bank of Canada holds interest rate steady at 5 percent (January 24, 2024)

- Bank of Canada aims to rebuild public trust with better communications (December 15, 2023)

- Bank of Canada holds interest rate at 5% (December 6, 2023)

- Bank of Canada: Food price inflation coming down with a lag (October 25, 2023)

- Bank of Canada holds interest rate steady (September 6, 2023)

- Premier Eby on July 12 Bank of Canada rate increase (July 12, 2023)

- Bank of Canada Deputy Governor draws a crowd in Victoria (June 8, 2023)

===== ABOUT THE WRITER:

Island Social Trends Editor Mary P Brooke has been following socioeconomic trends in the news since 2008.

As a news entrepreneur, Ms Brooke’s series of publications has been: MapleLine Magazine (2008-2010), Sooke Voice News (2011-2013), West Shore Voice News (2014-2020), and Island Social Trends (2020 to present).