Wednesday March 2, 2022 | VICTORIA

by Mary P Brooke, Editor | Island Social Trends

Pre-offer or cooling-off period? What’s the best way to protect homebuyers in BC, as prices rapidly increase and bidding generally favours well-resourced and sophisticated buyers?

Getting first-time homebuyers into the marketplace is a key concern within stabilizing home ownership opportunities for British Columbians.

Earlier this week the BC Real Estate Association (BCREA) proposed a five-day pre-offer period. Buyers would have access to disclosure documents and have time to get an inspection done.

BCREA’s white paper:

Their full A Better Way Home white paper aims to “increase consumer confidence and protections within the residential real estate market, while providing regulatory clarity to the 24,000 Realtors that BCREA represents” by:

- addressing housing supply issues,

- enhancing consumer protection in real estate transactions,

- evolving the real estate sector, and

- contributing to the creation of a world-leading regulatory structure.

Statement from the Minister of Finance regarding the BCREA’s white paper:

Island Social Trends inquired with BC Finance to get their take on the matter. Does the BC Government see any merit in exploring the proposed pre-offer period?

In a statement from Minister of Finance Selina Robinson, the pre-offer period is said to be “unlikely to address concerns about the risk to buyers, can encourage multiple offer situations and have an unknown effect on housing prices”, and suggests that “keeping the market hot” is part of the BCREA objective.

Here’s what the Minister of Finance said more broadly:

- As a commission driven industry, I understand the real estate association having a vested interest in the market being hot, but our work in government is to make sure people are protected.

- People need to have protection as they make one of the biggest financial decisions of their lives.

- In an overheated housing market, we have seen concerns that buyers feel pressure to waive conditions like inspections to get their foot in the door. We want to make sure that buyers have time to get the information they need to make a sound decision that is right for them.

- The specifics of a cooling off period in B.C. will be informed by consultation and analysis by the BC Financial Services Authority.

- I am aware of many points of view on this, including the association’s suggestion of a pre-offer period. Pre-offer periods are unlikely to address concerns about the risk to buyers, can encourage multiple offer situations and have an unknown effect on housing prices.

- We have all also heard the views of mortgage brokers, home inspectors and the experiences of prospective home buyers about taking unfair risks to find a home in a heated market.

- Right now, the province’s real estate regulator is consulting about ways to bring in a cooling off period that could be effective in British Columbia.

Housing supply:

BC launched its 30-point BC housing supply plan in 2018. A 10-year framework is required to make significant changes in the BC housing market including increasing supply, improving affordability, security for renters, and cracking down on tax-related fraud.

Notably, the supply of rental units in Greater Victoria was minimal at best over the past 30 years, as developers leaned heavily into developing housing types for sale at the higher end of the property ownership market.

On March 1, the Ministry of Finance contributed these thoughts in a statement to Island Social Trends, regarding housing supply:

- All governments have a responsibility to work together to increase the supply of much-needed affordable homes for people in B.C. as demand for housing continues to increase.

- Thousands of people are moving to B.C. each year.

- The federal government is targeting immigration levels at 400,000 per year and a significant percentage of those people will be coming to B.C.

- We know we need even more housing, and municipalities have a key role by conducting housing needs studies and approving projects within reasonable timelines.

- Our government is making the largest investment in housing in B.C.’s history – $7 billion over 10 years – and working with partners to deliver 114,000 affordable homes over 10 years.

- More than 32,000 new affordable homes are completed or underway in over 100 communities throughout B.C.

- More than 11,000 homes are open and over 10,000 are under construction.

- As part of Budget 2021, the Province made $2 billion in additional low-cost financing available through BC Housing’s HousingHub to encourage non-profit and private developers to deliver new affordable rental housing and homeownership opportunities for middle-income British Columbians.

- More than 4,400 homes are open or underway through the HousingHub, including 1,000 homes as a result of the additional financing last year.

- We’re also seeing a record number of new homes registered in B.C., which is a leading indicator of housing activity.

- More than 53,000 new homes were registered last year (2021), the highest ever total since BC Housing started collecting this data in 2002.

In the past five years, we’ve registered more rental units than the previous 15 years combined.

Municipal development approvals:

On February 28, BCREA included in their announcement that the BC government should essentially loosen up or adapt the processes by which municipal governments approve housing and other development approvals.

Mechanisms for housing approvals generally include adherence to a municipality’s Official Community Plan as well as requiring alignment with zoning bylaws.

BCREA President Darlene Hyde said on Monday that local governments (which operate within provincial regulations) need to finding ways within their official community plans (OCPs) to address housing supply, including undertaking “housing needs reports and reviewing zoning bylaws”.

On that matter, on March 1 the Ministry of Finance contributed these thoughts in a statement to Island Social Trends, regarding municipal development approvals:

- An efficient and effective development approval process is critical to building the homes people need.

- When we speed up the development process, we get more housing supply, and more British Columbians have access to homes they urgently need.

- Our government is working closely with local governments, developers and housing advocates, through the development approvals process review, to increase the supply of housing and get more of the right homes built for people faster.

- To support more efficient and effective development approval processes, we have:

- revised public hearing requirements for zoning matters that are consistent with Official Community Plans,

- supported local governments with funding to streamline and approve their development processes, and

- given elected officials the ability to delegate decisions on minor development variance permits to staff, to help speed up the process.

- We know there is more work to be done, Minister Eby and Minister Cullen are working together to find solutions to help local governments, developers and housing advocates deliver more affordable housing for everyone in B.C.

Local municipal profile:

Here on the west shore of south Vancouver Island:

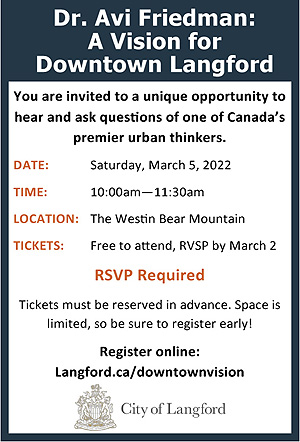

- The City of Langford has clearly led the way in terms of respecting the need for speed in the development permit process. As a business-oriented municipality, there is a recognition that ‘time is money’ (interest charged to developers on their financing with banks is a significant cost factor in housing); when developer applications for permits and rezoning come forward, much of the detail has been sorted out to align within the OCP and zoning parameters.

- In the City of Colwood much of the new development is seen in ‘from the ground up’ in new communities. Once the overall development has seen approvals, the construction moves along relatively unencumbered.

- In the District of Sooke there has been significant housing development, also including government-backed affordable housing projects.

- In the Town of View Royal, there has been leadership in developing a range of approved housing types including secondary suites. Affordable housing projects are given due attention.

===== RELATED:

BCREA proposes pre-offer period to help stabilize home-buying process (February 28, 2022)

Day after Budget 2022: Victoria Chamber hosts Finance Minister Robinson (February 23, 2022)

VREB: Greater Victoria housing market will be slow to change (February 1, 2022)

Oct 2021 real estate: prices up but inventory down (November 12, 2021)

Unusual real estate market during COVID summer (September 1, 2020)