Sunday March 22, 2020 ~ NATIONAL

by Mary Brooke ~ West Shore Voice News

In his seventh consecutive daily live message to Canadians from the front steps of his home in Ottawa where has been self-isolating, Prime Minister Justin Trudeau announced today Sunday March 22 that the House of Commons has been recalled to pass economic measures to equipment the federal government for dealing with the COVID-19 pandemic.

The House of Commons needs to pass the economic measures announced last week so that funding can be made available to residents and businesses. In many cases (e.g. Employment Insurance for those who normally aren’t eligible, and businesses that must apply for loans through traditional portals such as the Business Development Bank of Canada). Other mechanisms including a topping up of the already established Child Care Benefit and similarly the low-income GST rebate.

The House will meet on Tuesday March 24 at 12 noon Eastern (9 am Pacific), it was detailed by House Speaker Pablo Rodriguez in a statement after the Prime Minister addressed Canadians.

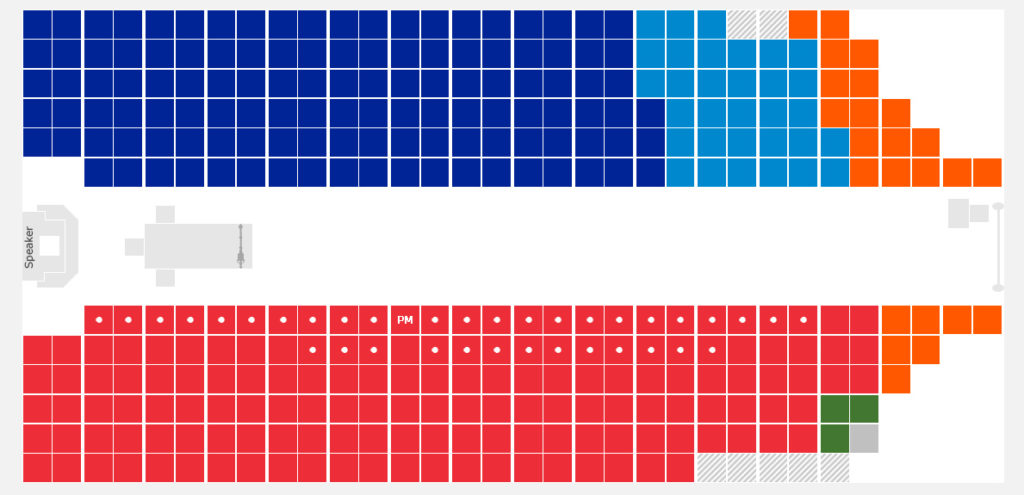

About 30 to 32 Members of Parliament — mostly culled based on being within driving distance to Ottawa, and representing the current proportion of all four parties in the 338 seats in the House (Liberal, Conservative, NDP and Green) — are expected to take part in the special session.

That means generally this approximate distribution: 14 of 157 Liberals, 11 of 121 Conservatives, three of 32 NDP, and one of 3 Greens, plus the Speaker. That’s 30. It’s at times like this where voters are reminded of how important it is to elect MPs to be their representatives in Ottawa.

The Government has been in discussions with opposition House leaders and whips to minimize the number of Members of Parliament recalled, while respecting the current proportion of party representation in the House. This follows public health guidelines about social distancing. A minimum of 20 Members of Parliament must be present in order for the House to exercise its powers, including passing legislation.

Any legislation from the Commons that passes will be sped through passage by the Senate, so that government can start acting on the new legislation by later in the day Wednesday, or Thursday.

Reportedly BC Senator Larry Campbell, a former Vancouver mayor, is driving across Canada for the sitting. NDP Leader Jagmeet Singh who has been self-isolating at home in Burnaby has also said he will attend the session.

Members of Parliament from all parties have expressed commitment to helping individual Canadians, workers, and businesses that are experiencing financial hardship because of the COVID-19 pandemic. That’s just about everybody.

Earlier last week, Singh called on the Liberals to start processing applications for financial aid now, while Trudeau has reiterated the enormity of the task of reworking existing programs (such as EI, Child Benefit, and GST rebate) to handle an additional payments process.

In that, Canada still seems bent on keeping a lid on management of who gets what. By comparison, in the United States a ‘cheque will be mailed’ to every citizen promptly; some who don’t need it will be caught in that net, but the time and resources saved by not having to revise and reinvent things will probably pay dividends for ordinary people.

Many of the Liberal government’s suggestions still seem to be based on the belief that some people may cheat the system, and also that only those already ‘in the system’ (e.g. workers already eligible for EI benefits, and people on disability and social assistance programs) are the ones who need it most. Largely missed in Trudeau’s emergency framework are the smaller of the small businesses and those who are self-employed, and the mostly under-age-30 generation that struggles through in the gig economy.

As a footnote, there is also the danger of missing this sector in BC’s upcoming package to assist British Columbians, which will be addressed in a special emergency sitting of the BC Legislature tomorrow, Monday March 23.

The BC government’s “COVID-19 relief plan for people and businesses” will be announced by Premier John Horgan and Finance Minister Carole James in a media teleconference on Monday March 23 at 12 noon.

However, Premier John Horgan did say in a media teleconference last week that it will take some ‘thinking outside the box’ to address the small businesses that don’t fit into a standard program or system. It remains to be seen whether small business relief will be seen in BC’s rollout.

Recalling the House will give them the opportunity to come together to debate these important measures, but in the interest of speedy action there won’t be a formal question period.

The NDP in particular has come forward with some specific suggestions that recognize the unique needs of everyday Canadians, such as waiving the interest on credit cards for at least two months as the pandemic now unfolds. No word yet on how that would actually happen.

Last week, Prime Minister Justin Trudeau announced over $82 billion in spending to support both Canadian’s and Canadian businesses during the COVID-19 pandemic. Of that, $27 billion is targeted for helping workers and business and $55 billion is for larger corporate enterprises at the financial management level.