Saturday September 11, 2021 [Updated 9:20 pm September 11, 2021]

by Mary P Brooke, Editor | Island Social Trends

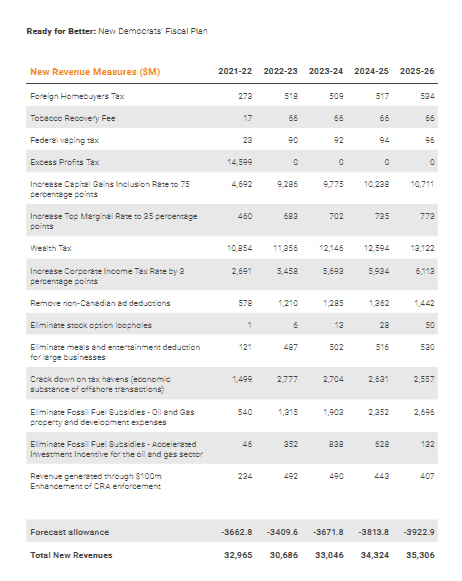

The NDP idea is to generate additional federal revenues so that policy directions in helping Canadians with better health care, child care, tuition supports, and coverage for dental and pharmaceutical expenses can be better achieved.

Today NDP Leader Jagmeet Singh told media that costing and the financial side of NDP policy in this election is “his favourite topic”. He pointed out that the NDP are offering the “highest amounts of transfers for health care” and wants to ensure that government “is not putting any extra burden” on individual Canadians and small business.

“The increase in revenue would be used to invest in helping things that people need” and also to put Canada “in a better position

“We’re going to invest in you, and not put the burden on you, and make sure the ultra wealthy pay their fair share,” Singh said to Canadians via media today. He points out there was a time in Canada when not so much of the financial burden was shouldered by the middle class.

Retail & business impacts:

Here are a few things that individual Canadians and small to mid-size businesses may notice if the NDP’s costed budget were to come to pass, as learned from the NDP’s release of their costed budget during this 44th federal election campaign.

=== Tobacco Recovery Fee (up $47 million per year from the present level, and holding there going forward): This is a cost recovery fee that would be paid by tobacco companies to government to help cover the costs of smoking on the health care system. This probably would push up the price of tobacco products at the retail cash register, given that corporations tend to pass on cost increases to customers. A similar fee has been implemented on the cannabis industry already by the federal government, which is set to recover $112 million annually by 2022.

=== Federal Vaping Tax (jumping by $67 million in the first year, to be collecting $90 in 2022, then increasing by $2 million per year for the next few years): This would have a retail price impact, in a clear response to health policy concerns about the health impacts of vaping.

=== Meals & Entertainment Deduction for large businesses (jumping by $366 million in 2022, then increasing by $15 million in 2023, then by $14 million in each of 2024 & 2025): This is not about deducting part of the cost of a lunch meeting for small or medium-size business but more along the lines of targeting the deduction of things like buying VIP boxes at sports venues. This takes a policy swipe at big-corporate culture and how finances work for large companies and their patrons.

=== Remove non-Canadian ad deductions (a jump of $632 million in 2022, followed by a steady increase over the following years, i.e. another $75 million in 2023, another $77 million in 2024, and another $80 million in 2025): At the moment, if a Canadian business or government buys ads in foreign-owned media/tech platforms (e.g. Facebook, Google, US online newspapers, etc.) some of that cost can be deducted. The federal government concept of why that would be done has never been clarified, as it clearly misses a huge revenue source for the federal government. The NDP would change that, bringing in more revenues from the purchases of advertising in foreign-owned media. This would also have the important impact of helping to even the playing field for small and mid-size media outlets in Canada.

Critique from the competition:

The Liberals issued a news release today pointing out that the NDP released their costing after people have already started voting in the advance polls.

It should be noted, however, that the Parliamentary Budget Office was grinding through a long list of costing projects, and the NDP (as were others) waiting on delivery of the results.

===== RELATED:

Alistair MacGregor advance-votes ahead of six more debates (September 10, 2021)

Poor debate format a disservice to viewers & voters (September 9, 2021)

Candidate-voter interface during the 2021 pandemic federal election (September 9, 2021)