Wednesday November 22, 2023 | VICTORIA, BC [Updated 3:48 pm]

Political analysis by Mary P Brooke | Island Social Trends

The federal government’s Fall Economic Statement 2023 generated a lot of political and media response yesterday. [Download the Fall Economic Statement 2023 – PDF]

Taking an upbeat tone, Deputy Prime Minister and Finance Minister Chrystia Freeland yesterday tried to paint a picture of Canada still being a strong country. “For generations, Canada has been a place where if you worked hard—if you went to school, found a good job, and squirreled some money away, there would be a home that you could afford.”

Prime Minister Justin Trudeau posted in social media today: “Yesterday, our government introduced the Fall Economic Statement. In it, we’re increasing our support for affordable housing projects, we’re helping Canadians who are struggling with mortgage payments, we’re taking steps to crack down on short-term rentals, and more.”

While that used to be true: in 1970s and 1980s, for over 40 years the economy has eroded bit by bit for many Canadians — something that may not have been noticed by people with stable jobs and dealt with the inner workings of politics and the economy. People with advantage got ahead, otherwise much of the middle class has been diminished to working class. Attempts to fix this seem to be in the works now (e.g. child care programs, home ownership and rental supports, and low-income support programs), but there will be impacts on individuals and families for generations.

The government’s statement articulated that “inflation is coming down, wages are going up, and private sector economists now expect Canada to avoid the recession that many had predicted” as well as that “over a million more Canadians are employed today compared to before the pandemic”.

Housing challenge:

In a section called Canada’s Housing Action Plan the challenges of needing more supply, more construction workers, more supports for renters and for mortgage holders were outlined:

- 1.1 Building More Homes, Faster

- 1.2 More Construction Workers to Build More Homes

- 1.3 Supporting Renters, Buyers, and Homeowners

- The Canadian Mortgage Charter

That’s a weak response for delivering on a mechanism for filling the immediate housing gap. And for those that are already in homes and worrying about renewing their fixed-rate mortgages next year, the extension to 50-year mortgage terms (or longer) may keep people in their homes but it binds them to debt for much longer.

Stirring the pot to create more housing leaves any real federal financial support until 2025. That means more housing through that process being completed in 2027 and beyond.

Housing is a provincial responsibility, so perhaps the federal government is leaving room for provinces to do their part. Provinces must further deal with municipalities where the usual authority for property zoning and permitting lies.

Provinces and municipalities say they need federal money in order to proceed with many projects, especially those deemed as ‘affordable’ (social) housing; so in many ways things remain at a standstill or in gridlock.

What people have to do:

What is there for people to do in the meantime? Life goes on.

But over the past 30 to 40 years the economic system has worked for those who nestled into the mainstream, and for the rest it’s been a scenario of disarray.

- Renters who now have to move because of skyrocketing rent hikes often end up finding nowhere else to go.

- Homeowners who lose their homes due to mortgage increases would have normally fallen into the rental market, which is now at a near-zero vacancy level.

The housing crisis is pushing folks to find new living arrangements.

- Couples who buy properties together, or groups of adults who choose to grow financially together.

- People tease about young adults having to live with their parents in an established home, but it’s a financial reality when there is not enough affordable supply (or any supply at all).

- Group living arrangement scenarios have already been going on for the Z-Gen young adults who graduated from high school in the 2015 to 2023 period — well beyond their college or university years.

The youngest generations have already been experiencing the lack of opportunity to be financially secure (emerging from families with similar struggles and into a world with roadblocks and inflexibilities to financial momentum).

BC response:

This past weekend at the BC NDP convention BC Housing Minister Ravi Kahlon said that BC is “not waiting” for the federal government on housing. Premier Eby said that governments must step up on housing instead of relying on the private sector.

Today Kahlon responded to an Island Social Trends media question on this, saying that any dollars are welcome, but pointed out that a lot of the funding is not available until 2025 or 2026, and that “people need supply now”.

“We have more things coming, so we’re not done yet. The positive piece of the fiscal update was the additional $15 billion for purpose built rental financing… still some details yet to be heard on what that will look like. But the challenges with the announcement (is that) a lot of the money is 2025 and 2026 and people are struggling now. We saw a line about co-ops in there, unfortunately the money that they signaled was announced many years ago, it still hasn’t gone to co-ops. The billion that they would be additional for building affordable housing is not very much money when you think it’s across the country.

“So that’s about $70 million dollars — a couple of projects across British Columbia,” said Kahlon. The federal Apartment Construction Loan Program estimates that 13,753 more apartment units will be built in BC as a result.

“Although we welcome the dollars, we believe more needs to be done. And there’s some detail we need to hear from the federal government. We need them to be a bigger player in this space. They have been making some moves as of late. I know that they have infrastructure dollars in their budgets and we want to see more dollars flowing to British Columbia, and we want them rolling as quickly as possible.

BC’s suite of housing legislation so far aims to provide housing supply momentum in various ways, including the speculation tax (now expanded to more communities), lifting zoning on all single-family lots to allow multi-family units (including triplexes and fourplexes), and providing off-the-shelf multi-unit building designs, and requiring municipalities to apply Amenity Cost Charges up front so that funding is available for infrastructure to support additional housing.

RELATED ARTICLES BY ISLAND SOCIAL TRENDS:

- Late Monday evening session to deal with housing legislation (November 20, 2023)

- New housing legislation will support population growth in Sooke (November 17, 2023)

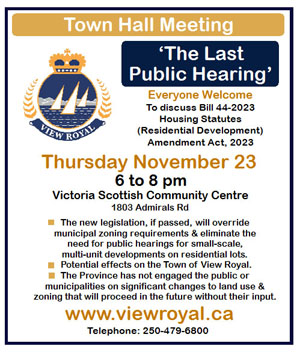

- View Royal & Oak Bay push back on housing legislation (November 17, 2023)

- Housing supply boost with off-the-shelf multiplex designs (November 16, 2023)

- Saanich is up to the task of building more homes quickly, says Mayor (Opinion-Editorial – November 13, 2023)

- Housing legislation takes affordability into account, says Minister Kahlon (November 10, 2023)

- Smart combo: more housing near transit hubs (November 8, 2023)

- Pushback on housing legislation over cost impacts, municipal load, development chill (debate by the Opposition, Nov 9, 2023)

- BC legislation to streamline delivery of homes, services, infrastructure (November 7, 2023)

- Hoped-for housing explosion based on multi-unit zoning (November 2, 2023)

- Clamping down on short-term rentals to free up housing stock (October 16, 2023)

- BC Legislature Fall 2023 session: housing, emergency management, crime, international credentialing, reconciliation (October 1, 2023)

- BC housing initiatives announced twice this week (September 29, 2023)

- POLITICAL NEWS ARCHIVE (Island Social Trends)