Tuesday, July 2, 2019 ~ VICTORIA

~ West Shore Voice News

Almost half of BC families will receive more for their climate action tax credit this week, putting money back in their pockets and helping make life more affordable, says the BC Ministry of Finance in a release today.

On Friday, July 5, 2019, eligible families will see the first of four installments of the newly expanded credit. Families of four will receive up to $400 over the next year, and up to $500 starting in July 2021 when the credit will be nearly 70% higher than it was in 2017.

The climate action tax credit offsets BC’s carbon tax and helps low- and middle-income families as the Province transitions to a cleaner, greener economy. This is the second increase to the climate action tax credit since it was last expanded in September 2017.

The government says that expanding the credit is an important part of their commitment to make life more affordable for everyone in BC, while continuing to meet climate change goals under the Province’s CleanBC plan to reduce carbon pollution, drive sustainable growth and protect BC’s clean air, land and water.

- Budget Update 2017 took steps to reduce BC’s carbon emissions, including increasing the carbon tax on April 1, 2018, by $5 per tonne of CO2 equivalent emissions, while increasing the climate action tax credit to support low- and middle-income families.

- Budget 2019 invested $223 million to increase the climate action tax credit over three years:

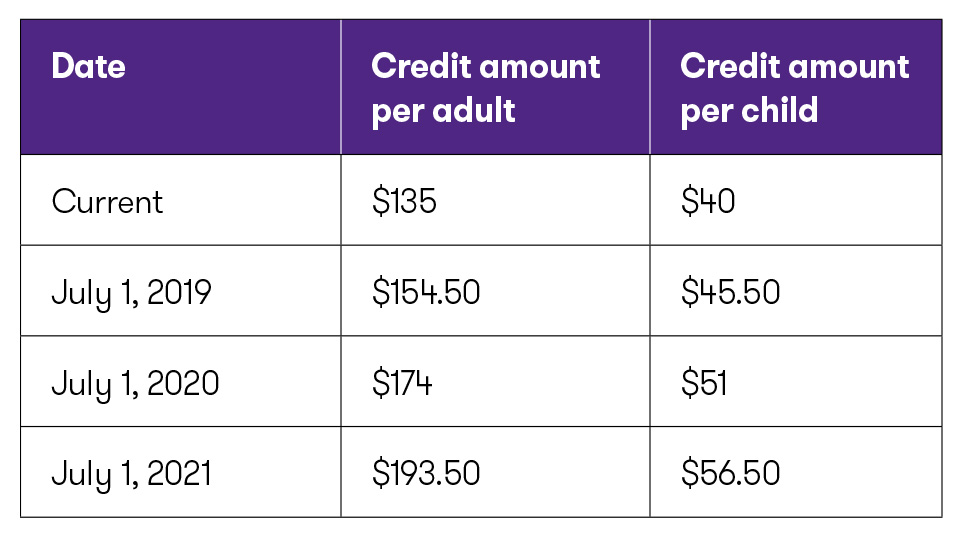

- Effective July 2019, the maximum annual climate action tax credit will be increased to $154.50 per adult and to $45.50 per child.

- Effective July 2020, the maximum annual climate action tax credit will be increased to $174 per adult and to $51 per child.

- Effective July 2021, the maximum annual climate action tax credit will be increased to $193.50 per adult and to $56.50 per child.

- Single-parent families will continue to receive the adult amount for the first child in the family.

More information about the Province’s CleanBC plan is posted here: https://cleanbc.gov.bc.ca

BC claims it has seen success with its Climate Action Tax initiatives over the past 10 years or so. Other provinces across Canada — especially those with a Conservative leadership — are battling the federal concept of a tax associated with climate change, saying it is ‘just another tax’ and doesn’t help improve the environment.