Sunday February 23, 2025 | LANGFORD, BC [Posted at 8:20 pm]

by Mary P Brooke | Island Social Trends

Digging deeper into the numbers and implications of Budget 2025 was the stuff of the City of Langford’s Committee of the Whole meeting on Thursday February 20.

With mayor and all six councillors there, decisions began to formulate. They reviewed key items from the operating budget and approved several resolutions that reduced the proposed tax increase from 14.51% down to 11.96% for 2025.

The full council that attended Thursday night’s Committee of the Whole deliberations was there in person: Mayor Scott Goodmanson and Councillors Kimberley Guiry, Colby Harder, Mark Morley, Lillian Szpak, Mary Wagner and Keith Yacucha.

Members of the public who attended were there either in person or online (via Zoom or phone).

There will be more discussion at Committee of the Whole on March 4. A final budget motion is expected for the May 5 council meeting (after two other meetings on March 17 and April 22).

Five-year financial plan:

At their February 20 evening meeting, City of Langford Council deliberated the draft Five-Year Financial Plan for the period of 2025 to 2029, of which Budget 2025 is a part.

The City of Langford’s annual budget is designed to maintain service levels, accommodate population growth, address inflation, and meet funding requests and obligations related to public safety and recreation, aligned with Council’s Strategic Plan priorities.

This year’s overall budget deliberation tone was one of recognizing what are expected to be difficult economic times under the threat of US tariffs (and counter-tariffs by BC and federally), and impacts on sectors that have a further impact on the well-being of the south Vancouver Island economy (e.g. forestry, travel and tourism).

“This is a little bit of an uncertain time,” said Councillor Keith Yachucha. By clawing back a little bit now he acknowledges it will ask more from ourselves and our children in future.

CPI and population:

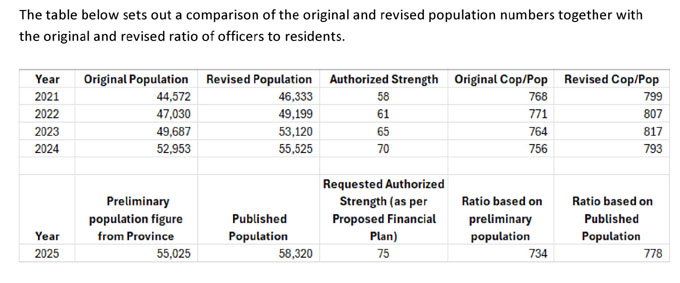

Langford’s municipal budget is directed impacted by the Consumer Price Index (to which staff salaries are indexed) and the city’s population (more people means providing more services and doing more maintenance).

The current Langford population is now officially pegged at 58,320. The city’s population is projected to reach 100,000 by the year 2050.

Tax increases:

Langford’s municipal property taxes are once again projected to remain among the lowest within the Capital Regional District.

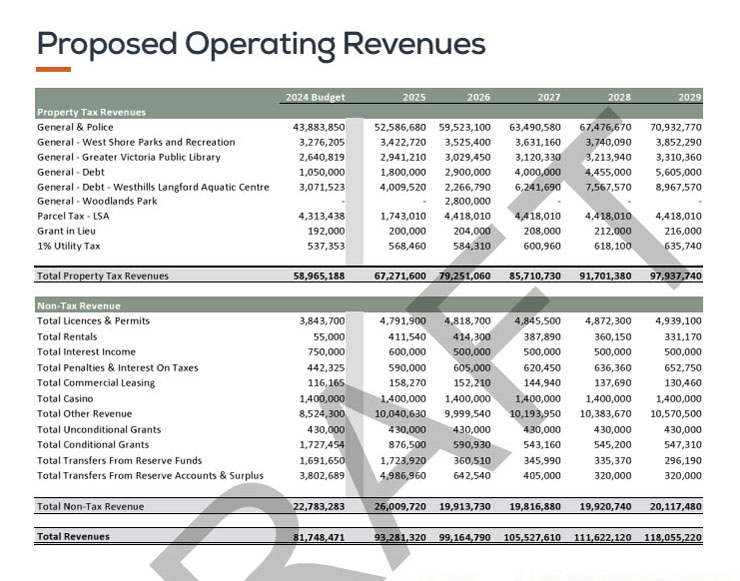

The draft five-year plan included a proposed 14.51% tax increase for 2025, with projected annual increases of 11.56%, 6.27%, 5.18%, and 5.11% over the subsequent four years.

The proposed 14.51% increase in 2025 would result in an approximate $30 per month increase in municipal property taxes for a representative house.

Getting the tax increase down to 11.96% will be politically helpful to council as well as be more favourable to the financial scenarios of property taxpayers.

The Langford budget is still catching up in many ways from three years (2020, 2021 and 2022) where the council of the day kept property taxes artificially low during the pandemic by taking money out of the general amenity reserve. The current council (elected in October 2022) decided to not continue that practice.

Any reduction of tax in a given year will increase the tax percentage increase in the following year, explained Langford Director of Finance Mike Dillabaugh.

Reducing more items:

With a reduction in the proposed tax increase, there is always the need to look at what is not being funded or what is being funded differently over a five-year period.

The Committee of the Whole also requested that staff review additional key budget items for potential reductions and present a report at an upcoming Committee of the Whole Meeting, scheduled for Tuesday March 4 at 7 pm.

Capital fund:

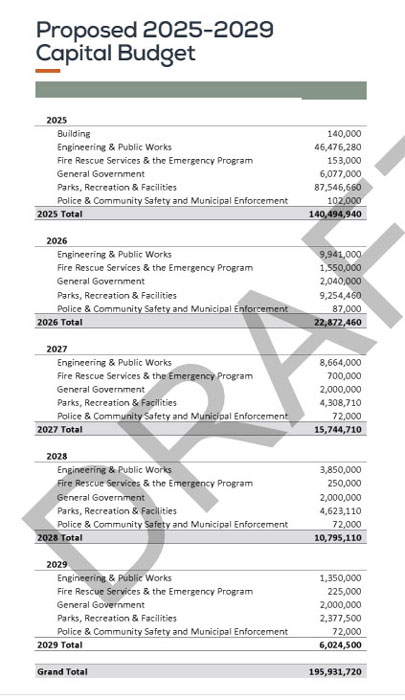

The proposed five-year plan uses a significant amount of the reserve balance, it was pointed out by City of Langford’s Director of Finance. He recommended reviewing the capital items.

The capital works reserve is funded almost entirely by the City’s share of revenues from the Elements Casino in View Royal. With tough times ahead, that revenue source might decline.

Another source of funds for capital projects is the Gas Tax Fund (received through the provincial government). The amount may not be be consistent in the years ahead.

Key Budget Items in the Draft Five-Year Financial Plan Included:

- RCMP Contract (contract increases and five additional members): 4.00%. The cost of each officer is about $225,000 (salary plus benefits plus associated costs). This is above CPI (which is 2.5%) because of the extra costs.

- E-Comm Police Dispatch: 2.36%. This is a shift from something that was previously covered by the provincial government.

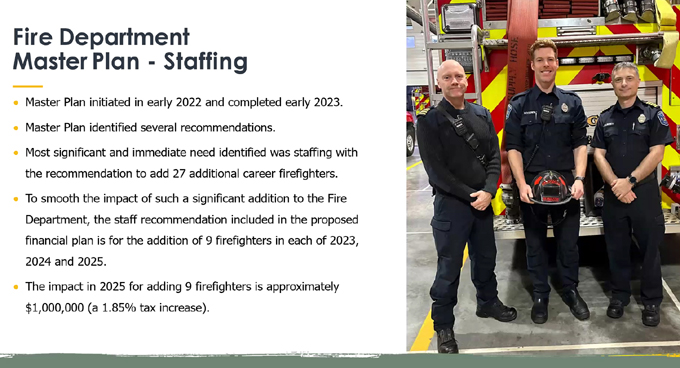

- Fire Department Staffing (per Master Plan): 1.85%

- Debt Servicing Costs (Westhills Langford Aquatic Centre): 1.75%

- Maintenance Contracts (roads and parks maintenance): 1.47%

- Debt payment (internal borrowing): 1.39% to 0.46%. Committee of the Whole recommended that this item be reduced by $500,000, as a way to provide a small buffer in tough economic times.

- General Staffing: 1.30% (Committee of the Whole requested further information be provided on March 4th).

- CPI on Wages: 1.12%. Staffing costs are increased if the CPI goes up; as City of Langford staff are not unionized, this is their way of keeping up with inflation.

- Langford Aquatic Centre Rent (three months): 0.86% to 0%. Committee of the Whole requested that staff explore whether this item be funded from a source other than taxation; one source might be the council contingency fund.

- Repairs and Maintenance: 0.69%

- Greater Victoria Public Library: 0.56%

- Additional Savings for Required Future Technology Upgrades: 0.56%. Committee of the Whole requested that staff explore whether this item be funded from a source other than taxation.

- Capital Funded by Property Taxes: 0.45% to 0%. Committee of the Whole requested that staff explore whether this item can be funded from a source other than taxation and that these projects be debated as part of the capital budget.

- Woodlands Park Tenant Supports: 0.37%, Langford will purchase the mobile homes in that park, with the aim of opening a new city-core park in 2030.

- IT Programs and Licencing: 0.37%. In a few years there will be a ‘hard deadline’ to replace some accounting software, for which hardware and installation costs are also required.

- Miscellaneous (net effect of increases and decreases of revenues and expenses): 0.33%

- Royal Roads Innovation Studio: 0.28% to 0.14%. Committee of the Whole recommended that this item be reduced in the short term as the new downtown campus is not yet open.

- West Shore Parks and Recreation: 0.27%. The City of Langford pays about 50% of the operations of WSPR; the facility is owned by five west shore municipalities – Langford, Colwood, View Royal, Metchosin and Highlands.

- Insurance and Utilities: 0.25%

- E-bike Rebate Program: 0.14% to 0%. Committee of the Whole recommended this program be deferred to 2026 and 2027, in part because city housing density has not increased enough to naturally push more use of bicycles.

- Legal Budget Reduction: -0.30%

- Non-market Change: -5.56%. This is due to new growth which impacts a wide range of things like new roads, more traffic lights, new sidewalks, and needing more police officers and firefighters.

Travel budget:

In addition to the above items, the Committee of the Whole recommended a 25% reduction in the Council training and travel budget, which equates to $17,500.

The item became a matter focus in response to some public input, including at the February 20 meeting.

A reduction in the travel budget would be a token gesture — more of a nod to public complaint than any real agreement by council with those complaints. The reduction (if any) is a Council decision, yet to come.

This discussion covered a wide range of views, with Councillor Lillian Szpak and Councillor Mary Wagner explaining the many advantages of networking at conferences like the Union of BC Municipalities (UBCM), including face-to-face meetings with BC cabinet ministers and their senior staff.

Wagner pointed out that at some policy conferences a municipality can only vote if a representative is there in person. At the Federation of Canadian Municipalities (FCM) conferences there is an opportunity to learn from what other cities are doing.

Szpak was quite vocal on this issue, saying that part of doing her job well as an elected representative is to have access to the work and activities in person at conferences, conventions and meetings.

Perhaps if the public had a better understanding of what goes on at these meetings, there would be less pushback or nit-picking on one particular item like travel. In reality, there is probably more debatable expenditure in other areas of the budget that the public rarely wraps their head around, so they pick on something simple like travel.

Capital Projects:

The proposed budget also includes multiple capital projects that will enhance infrastructure and public amenities throughout the community.

Capital project highlights include:

- Latoria Road Corridor Upgrades

- Sidewalk Infill

- Westhills Langford Aquatic Centre

- Woodlands Park

For a full listing of proposed capital projects please refer to the proposed City of Langford Financial Plan 2025.

These capital projects will be debated at the Committee of the Whole Meeting on March 4 at 7 p.m.

Pre-deliberation survey:

This year, the public was invited to contribute to the budget process by providing input through a survey hosted on LetsChatLangford.ca, written submissions via a dedicated email, and participation during Committee of the Whole meetings.

The survey was done ahead of the first deliberation session. About 240 new registrants at LetsChatLangford.ca after announcing the budget survey was noted by staff. In total, 631 people undertook the online survey (out of a total 2,068 registrants in that portal).

Comments received the City were forwarded to Council and may be discussed during upcoming meetings.

Truncated survey:

The survey, launched on January 21, 2025, aimed to increase transparency and public participation in budgeting, aligning with the Council’s Strategic Plan initiatives to enhance budget related decision making.

To avoid being burdensome the questionnaire was quite short and essentially pre-shortlisted as to key budget items; that ended up being concerning to some residents.

The online survey closed on February 9, 2025, with a total of 631 responses received. A survey summary report was included in the February 20th agenda package and is posted on Langford.ca/Budget, and on LetsChatLangford.ca/Budget.

More public input:

As Council continues to deliberate the 2025-2029 Financial Plan, the City looks forward to receiving further input from the community during public participation over the next few meetings:

- Committee of the Whole Meeting, Tuesday, March 4 (starts 7 pm)

- Regular Council Meeting, Monday, March 17, (starts 7 pm)

- Regular Council Meeting, Tuesday April 22, (starts 7 pm)

- Regular Council Meeting, Monday May 5, (starts 7 pm)

Municipal budgets:

Municipalities must adopt a five-year financial plan annually before May 15, as required by the Community Charter, which forms the basis for calculating property tax rates.

Langford tried to get an early start on the budget process this year.

Downloading:

Ten south Vancouver Island municipalities will have to absorb the cost of 911 services (provided by E-Comm) as the provincial government is no longer covering this cost.

A motion will be going to UBCM to insist that the provincial government assist the affected municipalities with getting 911 fees charged on cell phone bills.

Other cases of ‘downloading’ onto municipalities is in areas of health and education which are provincial responsibilities.

===== RELATED:

- Ten south Vancouver Island municipalities coming to terms with 911 tax increase (February 7, 2025)

- Langford gets early start on Budget 2025 (January 20, 2025)

- Shift to Next-Gen 911 driven by use of mobile phones (March 1, 2023)

NEWS SECTIONS: LANGFORD