Tuesday March 28, 2023 | LANGFORD, BC [Updated 4 pm]

by Mary P Brooke | Island Social Trends

Download the 5-year City of Langford 2023-2027 Financial Plan

A new City of Langford council heard a new type of approach to outlining the municipal five-year-plan and budget last night.

At their March 27 Committee of the Whole, Mayor Scott Goodmanson and council were introduced to the principles and approaches of the financial planning that staff have been working on.

For over 90 minutes, Director of Finance Michael Dillabaugh presented enough detail to bring council and the public up to speed on how the municipality has adapted to various political and economic conditions over the years. A few key points were hammered home as to the realities of where things go from here.

The evening was chaired by Councillor Lillian Szpak in the capacity of Acting Mayor, as Goodmanson was attending only remotely. The rest of council attended and had a few questions but generally wanted to see the full documents before engaging in deeper questions. | Download the full 5-Year Financial Plan 2023-2027

Right amount of detail:

The presentation included an overview of legislative and budgeting processes, how taxes are calculated, the proposed 2023-27 financial plan, and a detailed review of significant budgetary impacts.

There was enough detail, but not too much, to explain why the City of Langford will need a property tax increase that goes beyond the range of 2.0& to 2.5% that has been held in place (as a form of political capital or ‘amenity’ for many years, to help keep property owners happy).

Respectful analysis:

The analysis was respectful of decisions made by the long-standing previous council that sought to build an economically attractive community — which combined with other political directions achieved its goal of significantly increasing the population and along with that the residential tax base.

Council decisions and city operations of past years that have brought the municipality to where it is now, with its place on the BC map as a fast-growing modern municipality, leaving in the dust most of what Langford used to be.

There has always been an approach to balance revenues with expenses, said Dillabaugh. But the current financial situation is one where — without much reserve funding — could be vulnerable to an unexpected emergency, he said in his presentation last night.

Basic property tax mechanics:

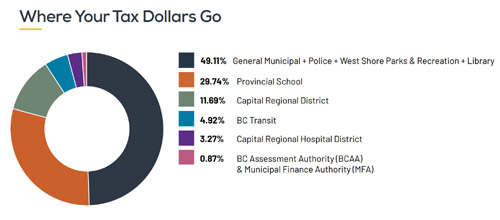

A key point was pretty basic… that the municipality collects property tax but that only about half of it (49.11%) is retained by the municipality. As does every municipality in BC, Langford’s property tax collection also brings in the levies for several other agencies such as the Capital Regional District, hospital board, school board, and BC Transit.

If people are doing a rough ‘back of the napkin’ calculation of how much more they will pay this year for Langford property tax, that increase should be calculated on 49.11% of what they paid last year, explained Dillabaugh several times.

The financial plan proposes a 11.94% property tax increase in 2023, representing costs associated with maintaining City service levels to keep up with population growth, inflation, as well as significant public safety and recreation funding requests and obligations. The proposed tax increase, although high, equates to an average increase of $0.66 cents per day for an average residential property. The following projected tax increases over four-years are 7.75%, 6.24%, 5.86% and 5.42%.

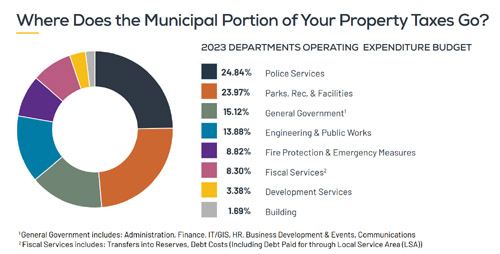

Expenditures by the city cover things like police services and parks and recreation facilities (those are the two largest budget items), as well as general government, engineering and public works, fire protection and emergency measures, fiscal services, development services and building.

Three major options:

The approach to three major investments over the coming years must be dealt with, as proposed by Dillabaugh in his presentation: whether to purchase the YW/YMCA building in Westhills (and meanwhile deal with $950,000 in annual operating costs), proceed with the RCMP detachment building expansion project in the coming years, and how to adequately fund the asset management program (keeping a reserve fund up to a safe level).

The approach of the previous council might be viewed as having been riding the horse of consistent expectation for a bit too long, but cutting some slack for the uncertainty of the pandemic in 2020 and 2021, carrying over into the 2022 budget and financial plan. Things like dealing with the deficit position of the YW/YMCA and needing more staff to accommodate the pressures of serving a larger population now raise their head, not to mention the continual drain on the reserve that the provincial government recommends to have in place.

The presentation also clarified some misunderstandings, and what certain funds can and cannot be used for. That included how Development Cost Charges are collected and spent (as well as borrowed from internally, to help pay for one project while awaiting readiness of another).

Big shifts:

One of the elephants in the room was inflation. It will impact the cost of nearly everything in 2023 and for years beyond.

The other obvious factor is the new council temperament and interest of scope in managing the more diverse and complex urban environment that they have inherited, as was built by the council under one mayor for 30-years prior.

Those two major influences will be a big shift for long-time taxpayers. People who have arrived in Langford in just the last few years might not be as surprised about the cost of living increase that a jump in property tax will produce, but might feel the ‘affordability’ pitch that brought them here has evaporated.

While the suggested tax increase is higher than in past years, overall taxes will remain lower than the average same sized municipalities regionally, and across the province (a $2,100 annual projection, compared to an estimated average of $2,703 when looking at the municipal portion of the tax bill).

Staffing increases:

Council has expressed an interest in maintaining a strong ‘cop to pop’ ratio, ideally one police officer for every 750 residents. Presently the ratio is more like 1:1,100. The hiring of four more RCMP officers for the West Shore detachment is proposed in the 5-year financial plan.

As well, last month the Langford Fire Chief made a presentation with a funding request for hiring nine more career firefighters over three years; that would help maintain firefighter contingents at all three fire halls as the number of volunteer firefighters has dwindled.

Within city hall there is a pitch for six new full-time positions to be created (Arts, Culture & Economic Development Coordinator; Parks Facilities Coordinator; Records Assistant; Senior Accountant; Accounting Technician; and Community Patrol Officer), and the expansion of one part-time position to full-time (Administrative Assistant – Bylaw). As well, for every three RCMP officers added at the detachment, another municipal employee is added.

Capital projects:

In addition to budgetary commitments, the proposed budget includes several Capital Projects. Highlights include:

- Significant downtown parks acquisition projects

- North Langford school turf field and lights (see recent council discussion about turf costs)

- Jordie Lunn Clubhouse

- Purchase of an aerial truck and engine for the Langford Fire Department

- Costs associated with next steps for the proposed expanded West Shore RCMP detachment

- Sidewalk infill projects

Deeper decision-making:

The Director of Finance also highlighted previous policy decisions to keep taxes low by increasing the use of the general amenity funds each year to offset tax increases.

He further explained to Council that the continued use of this approach will have a compounding effect on future budgets and presents significant challenges to its sustainability.

The proposed increase continues this approach by including a $1.7 million dollar contribution from general reserves to keep the rate as low as possible during a financially challenging budget year, however reliance on these funds is projected to be phased out over a five-year period.

As part of the budget deliberation process, Council will decide if they wish to include the purchase of the YW/YMCA building, proceed with the RCMP detachment expansion in the coming years, and adequately fund the asset management program.

One possible financing scenario presented by staff would represent an additional 1% tax increase on top of the proposed 11.94% in 2023, and use of the majority of the $16.4 million dollar Growing Communities Fund Grant (from the Province of BC 2022-2023 surplus, $1 billion was distributed around the province, with a portion to each municipality), as well as an additional 3.5% tax increase in each of the next four-years.

Documents now available:

A copy of the budget presentation and proposed Five-Year Financial Plan are now available online within the City of Langord website at Langford.ca/Budget .

Public input:

The public will have the opportunity to provide input at Committee of the Whole Meetings on Thursday, March 30 (starting at 7 pm) and Monday, April 3 (starting at 12 noon, to 4 pm).

One day-time meeting and one evening meeting were selected for public input to offer equal opportunity to residents not available in the evening when meetings are normally held.

In addition to in-person or virtual participation, residents can submit written comments via email to budget2023@langford.ca or by mail to City Hall.

Budget deliberations:

Council will begin budget deliberations on Tuesday, April 11, 2023 (the meeting starts at 7 pm). For a list of all budget related meetings, and details on how to provide comments on the proposed 2023 budget visit Langford.ca/Budget

Council will consider 1st, 2nd, and 3rd readings of the Bylaws on Monday, May 8, 2023 (meetings start at 7 pm). Council will then consider adoption of the Bylaws on Thursday, May 11 (7 pm).

The Community Charter requires that municipalities adopt a Five-year Financial Plan each year before May 15. The Financial Plan establishes the basis upon which property tax rates are calculated.

==== ABOUT ISLAND SOCIAL TRENDS:

Island Social Trends is a long-standing publication in the west shore of South Vancouver Island (fourth in a series that began with MapleLine Magazine 2008-2010, Sooke Voice News 2011-2013, and West Shore Voice News 2014-2020, which then emerged as Island Social Trends in mid-2020).

Island Social Trends editor is Mary P Brooke, B.Sc., Cert PR. She is a long-time journalist, delivering news through a socioeconomic lens.

IslandSocialTrends.ca covers news of the Greater Victoria area and south Vancouver Island, with insights on BC and national issues.

Ms Brooke has consistently covered progressive politics on Vancouver Island including a focus on food security for the South Vancouver Island region. She has presented detailed coverage of the SD62 School Board and its committees since 2014.