Tuesday July 14, 2020 ~ NATIONAL

by Mary Brooke, Editor | West Shore Voice News

Professional emergency preparedness messaging for years has advised to have cash on hand for use in an emergency. Much of that messaging was about disruptions like earthquakes that could damage actual financial transaction infrastructure and the Internet backbone in various ways.

The COVID emergency has differed, in that there was no physical issues with financial technical infrastructure.

“We were surprised at the notable use of cash during the early part of the pandemic,” says Jeri Grant who coordinates the Juan de Fuca Emergency Program (serving areas like East Sooke, Otter Point, and west of Sooke to Port Renfrew). She says this in the context of public health recommendations to use touchless forms of payment as a way to avoid possible surface contact with the COVID-19 virus.

Using a variety of payment methods:

Canadians are now using a variety of payment methods during COVID-19. When the pandemic first hit, it was thought that the use of cash would diminish in favour of using touchless debit and credit cards that could be swiped at checkouts.

A Bank of Canada discussion paper Cash and COVID-19: The impact of the pandemic on the demand for and use of cash (July 2, 2020 ) on the impact of the COVID-19 pandemic on the demands and use of cash reports that cash in circulation in Canada grew sharply in March and April 2020. The increase was large in both absolute dollars and percentages, by historical comparison.

The study found that Canadians have good access to cash — 93% of Canadians reported no difficulty obtaining cash during the pandemic relative to their typical withdrawal behaviour. People were generally able to use cash at points of sale.

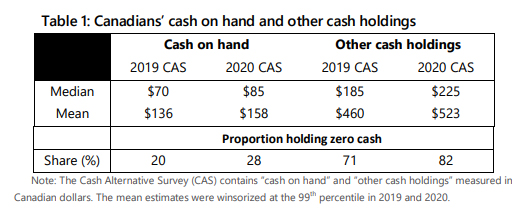

Canadians reportedly increased their cash holdings somewhat during the pandemic — that could have been through a lack of normal disposable spending, getting cash from their bank accounts to have it ready at hand, and receiving one or more government support benefits above and beyond any normal level.

The study found that 36% of Canadians reported using cash for payment in the first week of July. About the same number (38%) used e-transfers. The majority, meanwhile, used debit (52%) or credit cards (62%).

Most respondents (74%) said they have no plans to go cashless in the next five years. This appears to be against the expected trend to a cashless society. More than 50% continue to keep cash on hand (so about 25% say they won’t go cashless but they are).

Comparing debit to credit card usage:

As an additional note, in 2018 was the first time that the number of credit card transactions in Canada exceeded the number of debit purchase transactions (by 5 million). Debit card purchase transactions have dominated, by volume, for decades, it was reported in the 2019 Canadian Payments Forecast.

The shift could be in part due to debit transactions requiring ‘real cash’ in the bank to draw upon, whereas credit card charges do not (perhaps indicating some loss of ground for consumer disposable income) or that people have found ways to group their purchases instead of using debit in a manner similar to cash for small purchases.

Overall, debit card use has been stable in Canada since its inception. Credit card purchase transaction values (which increased rapidly until 2007) have been falling ever since the onset of the Great Depression in 2008, indicating a preference for Canadians to spend within their means and/or lack of availability to consumer credit.

Fraud with non-cash payment:

Meanwhile, fraud is a significant and mounting problem for global economies made worse by non-cash methods of payment, according to new international research. The global economy currently loses US $4.1 trillion annually to fraud. The data suggests that societies must support cash as a way to counterbalance rampant electronic payment fraud.

As reported by the Canadian Association of Secured Transportation (CAST), a new study “Fraud in Cash and Electronic Payments: Taxonomy, Estimation and Projections” (completed for the International Security Ligue) found that fraud with cash is falling 1.7% annually, while fraud with cards has been rising 16.2% every year since 2014. If current trends persist, card fraud per transaction will more than double by 2025.

People in government, business and their own personal lives evidently need to learn better management skills when it comes to inquiries by email or internal transaction systems (or other channels where fraud becomes possible).

Much of the fraud results from opportunities that open up due to people’s trust or lack of recognition of what it takes for fraud to be possible.

The Canadian Bankers Association has information on how employees can be alert to fraud in emails such as CEO scams, supplier phishing, and information theft.

Cash supports consumer options:

“Cash is always important to support consumer options,” said Steven Meitin, President, Canadian Association of Secured Transportation (CAST). “However, this research shows that cash is also important to governments, businesses and central banks to help counter fraud. Criminals see more opportunities as more people rely on technology, which is why different payment forms should remain a primary concern for consumers and governments.”

===== About the writer:

Mary Brooke, editor, West Shore Voice News, has written about business since the mid-1980s. Her first publication in the mid-1980s was a monthly business magazine.

===== Businesses welcome to inquire:

For an article and ad package about your business for presentation within the West Shore Voice News portal, please inquire to advertising@westshorevoicenews.com