Wednesday September 27, 2023 | VICTORIA, BC

by Mary P Brooke | Island Social Trends

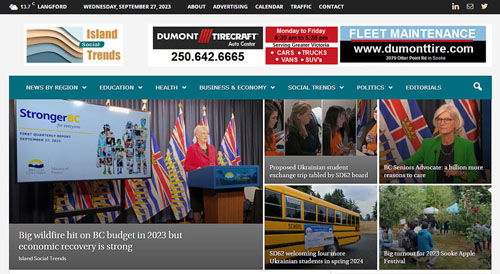

Today BC’s Finance Minister Katrine Conroy rolled out a report on the 2023-2024 BC fiscal plan, with data from the first quarter (Q1) of this fiscal year (i.e. April through June 2023).

Conroy is back on the job after two weeks of dealing with a bout of COVID, delivering her remarks about B.C.’s First Quarterly Report 2023-2024 in top form at the podium in the BC Legislative Press Theatre today in Victoria.

Budget 2024 is coming less than five months from now, scheduled for February 22, 2024. Meanwhile, the key highlights of today’s Q1 report were the impacts of fighting wildfires and other extreme emergencies (and the social and economic supports required in that), and dealing with affordability issues for people during this time of increasing and persistent inflation.

“BC’s First Quarterly Report shows the province’s economy is proving resilient amid challenges, including a devastating wildfire season, high interest rates and costs, and a slowing global economy,” said Conroy today.

Revenues down but expenses up:

Revenue for 2023-24 is forecast to be $1.5 billion lower than projected in Budget 2023. That is said to be primarily due to the drop in natural gas prices and lower 2022 personal income tax revenue.

- There are multiple layers of prudence in the fiscal plan, including contingencies, forecast allowance, a prudent economic outlook for B.C.’s major trading partners, and natural gas royalty prudence.

- The Province forecasts natural gas revenues based on the lowest 20th percentile of private-sector price forecasts, which helps shield the fiscal plan from impacts of fluctuation.

Expenses are forecast to be $996 million higher, largely due to the provincial wildfire response.

Capital spending:

Taxpayer-supported capital spending on health facilities, housing, schools, transportation infrastructure and other projects is forecast to total $12.2 billion in 2023-24, $367 million higher than forecast at budget.

Approved levels of capital funding for schools across BC has been unchanged compared to what has been funded in 2022-2023, which implies that school builds in fast-growing school districts (like Surrey and Sooke) seem to not be getting any unique sort of fast-tracking. Any change in funding directions would have to come from the education ministry, it was stated today. There are eight new K-12 school builds listed in 2023-2024 (none of which are on Vancouver Island), and two post-secondary institutions (both on the BC lower mainland).

There are seven transportation infrastructure projects in this year’s budget, including the Goldstream Safety Improvements in the Malahat section of Highway 1 on Vancouver Island.

The six long-term care and hospital projects this year include the Campbell River Long-Term Care centre.

Helping people is the right approach:

Unsurprisingly, personal income tax was lower than expected (by $522 million) in Q1 (according to figures provided by Revenue Canada). That’s a clear indicator that people are struggling in the current economy.

Minister Conroy repeated a few times that “when the economy slows this is the right approach” (to support people, so they can continue to participate in the economy). “We’re going to continue providing services to people,” the Finance Minister said.

“During hard times and slower economic growth, the old government chose to cut services and increase fees, which was the wrong approach,” Conroy said.

“No matter what, we’re putting people first and making decisions that support the services and infrastructure they depend on to build a good life.”

Big-picture revenues:

She noted that natural gas sales revenues are down 53% year to date (due to volatile global natural gas prices), resulting in $1.18 billion less in royalties in 2023-24. As well, steel-making coal revenues were down by 34%.

Conroy noted that ICBC, BC Hydro and BC Lottery Corporation are “not reporting any changes” in their expected level of revenues in 2023-2024.

Housing sector strong for now:

It was interesting to hear that housing production (mostly by the private sector) is higher than expected, given that Conroy is relying on “anecdotal” input that a skilled trades labour shortage will have a slowing impact on housing projects going forward.

“The province will continue to be affected by global uncertainties, yet B.C.’s economy is proving resilient. B.C. is seeing better-than-expected performance this year in housing starts and the labour market, which have helped lead the province to an improved economic forecast of 1.2% growth in 2023,” it was stated in today’s Finance Ministry news release.

New home construction was up 15.5% year-to-date to August and is expected to continue to trend at an above-average pace. Employment in the province increased by 1.3% year-to-date to August, while B.C. continues to see a lower unemployment rate than the national average.

Just yesterday Housing Minister Ravi Kahlon announced a significant push on municipalities to increase their housing supply. Which seems like a disconnect to the strong housing message in the fiscal update today. [Article about the September 26, 2023 housing announcement — link to come]

But the housing needs in BC will only continue to increase dramatically as the population influx to this province remains strong — 250,000 people in-migrated to BC from across Canada and from international locations in the last two years (natural population replacement is expected to be near-zero in BC by 2030, as births will no longer exceed natural deaths).

School funding approach remains stable:

Diverse economy and strong financial planning:

“With a diverse economy and strong financial planning, B.C. is in a good position to weather global uncertainties as well as keep people safe through this wildfire season and drought,” said Katrine Conroy, Minister of Finance.

“Through challenges like the pandemic, global inflation and high interest rates, we have led the country in making smart investments in people and the services and infrastructure they depend on.”

Higher deficit but also strong economic recovery:

A higher deficit projected for 2023-2024 year end. The updated year-end deficit is projected to be $6.7 billion, which is an increase of $2.5 billion from Budget 2023 (which was announced in February of this year). The change is mainly due to spending to protect people and communities from wildfires as B.C. faces the worst wildfire season in the Province’s history, and volatile global natural gas prices, leading to a drop in natural gas revenues.

B.C.’s faster-than-expected economic recovery from the COVID-19 pandemic helped lay the foundation to weather the challenges ahead. The first-quarter fiscal update shows lower taxpayer-supported debt this year (more tax revenues from corporations and high-income-earning individuals), as a decrease in total provincial debt in 2022-23 put B.C. in a strong position to navigate a cooling economy.

“Supporting people and communities has made our economy stronger and better able to withstand challenges, and we will continue to have people’s back now and for the long term,” Conroy said.

British Columbia has among the best credit ratings of all provinces and one of the lowest debt-to-GDP ratios in the country, which translates into low debt servicing costs for B.C.

Projected capital spending increased by $413 million, mostly to support improvements to health-care facilities and housing projects. The update also includes several projects approved for construction since Budget 2023, including Phase 2 of the Burnaby Hospital redevelopment.

Debt:

B.C.’s forecasted total debt level in 2023-24 decreased $4.9 billion from Budget 2023, primarily due to lower debt in 2022-23, which was supported by a $704 million surplus.

Debt-affordability metrics for the Province remain among the best in Canada, including the forecast for debt-to-GDP at 17.6%.

Longer-term outlook:

The longer-term outlook in the financial plan forecasts that global economic headwinds will affect B.C. and the rest of Canada in 2024, with slower economic growth and higher unemployment. Levels of prudence are built into the fiscal plan, including $5.5 billion in contingencies and a $700-million forecast allowance this year to respond to unanticipated changes or expenses.