Wednesday July 28, 2021 | VICTORIA, BC [Updated July 29, 2021]

by Mary P Brooke, Editor | Island Social Trends

The resilience of British Columbians has helped keep the province’s finances “on more stable ground” during the COVID-19 pandemic, which today Finance Minister Selina Robinson described as “one of the most challenging times in the province’s history”.

Responses from government to individuals and businesses included income support, business grants, tax breaks and crucial services during the pandemic.

While this might have seemed at first like a lot of handouts and a spillover of funds into everything everywhere, that strategy actually helped sustain people and business in ways that prevented panic and disarray (people could pay rent, buy food and pay bills, businesses could pay employees and generally keep the lights on).

Most of BC’s economic sectors remained open through the pandemic. The hardest hit — notably tourism — are now receiving a range of supports (such as an additional amount in the Small and Medium-Sized Business Recovery Grant, more than businesses in other sectors can receive).

Despite the spending to help keep the economy afloat during the first three waves of the pandemic, BC ended up with a smaller-than-expected deficit due to the powerful resilience of three major instruments: the turnaround of ICBC from the so-called “dumpster fire” into a stable source of revenue, the forever-growing urban real estate market (primarily BC Lower Mainland and Greater Victoria areas) and significant (though probably one-time) financial supports from the federal government.

- The forestry sector did better than expected during the pandemic (due to higher lumber prices), Robinson explained.

- Minister Robinson was quite pleased that ICBC was turned around, saying “it was no easy task”. This year $950 million was returned to drivers.

- She also noted that post-secondary will be “back in full force” this fall. The Return to Campus program is underway.

Deficit and capital spending:

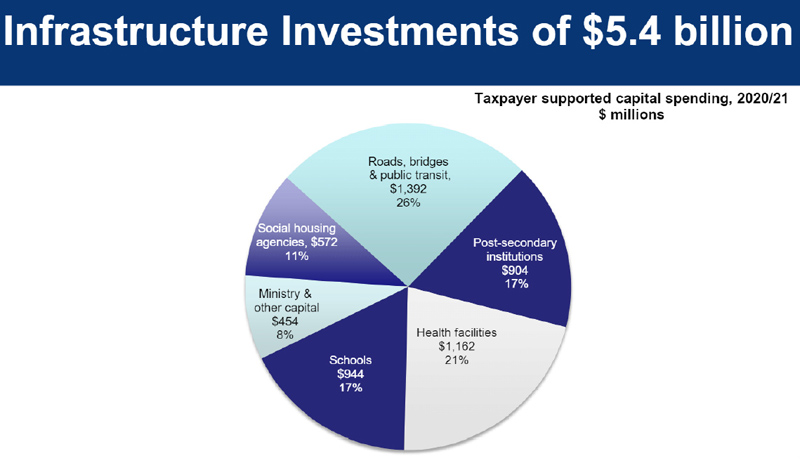

Today, the Ministry of Finance shows a lower-than-projected deficit of $5.5 billion for the 2020-21 fiscal year, as well as a continued strong credit rating. The amount spent on capital infrastructure is also about that same amount ($5.4 billion):

- Roads, bridges, public transit (26%): $1.392 billion

- Health facilities (21%): $1.162 billion

- Schools K-12 (17%): $944 million

- Post-secondary institutions (17%): $904 million

- Social housing agencies (11%): $572 million

- Ministry & other capital (8%): $454 million

People first, and guidelines were followed:

The NDP government’s philosophy and inclination is to put people first. They commend British Columbians themselves for doing “the right thing” by getting vaccinated and practising safe distancing throughout the pandemic, said Robinson today.

“People’s diligence around the provincial health officer’s guidance has meant getting vaccinated and practising safe distancing throughout the pandemic,” said Selina Robinson, Minister of Finance. “People’s diligence around the provincial health officer’s guidance has meant we were able to keep much of our economy open. Strong recovery in many sectors has allowed us to shift from the broad-based support provided during the uncertainties of last year to a more targeted approach for those suffering the greatest effects as the pandemic progressed.”

Year-end deficit lower than expected:

The year-end deficit is $2.7 billion lower than projected in Budget 2021. This is attributed to some sectors of the economy faring better than worst-case scenarios, which resulted in lower-than-expected spending and higher-than-expected revenues.

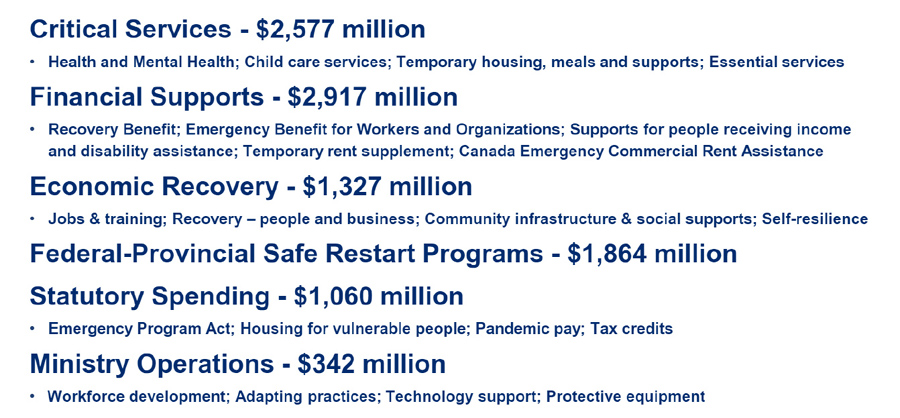

Spending on COVID-19 support and recovery programs reached $10.1 billion by the end of March 2021.

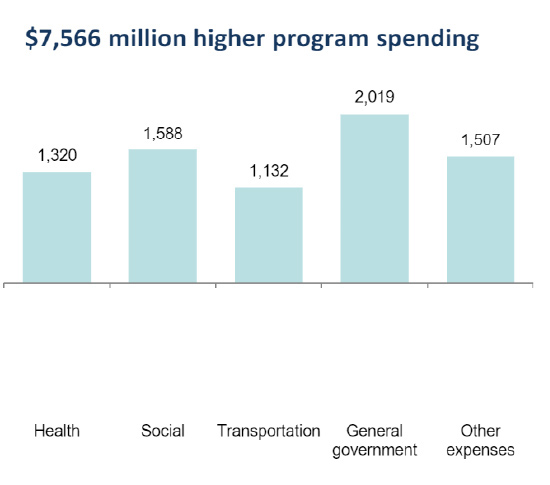

Overall, the Province’s expenses increased by $8.6 billion over fiscal 2019-20, with increased investments in health, community supports, K- 12 education and social services. Revenue increased by $3.5 billion over revenues in 2019-20. Much of the higher revenues can be attributed to some sectors proving resilient during the pandemic, federal contributions for COVID-19 support and more savings and higher earnings at ICBC.

While a provincial deficit is expected for the next several years due to the severity of the pandemic’s impacts and the need to support people and businesses to seize the opportunities that recovery will offer, the ministry is forecasting declining deficits over the next three years.

Public Accounts 2020-21 show BC is in good financial standing, says Minister Robinson, with what are called “affordable debt levels” at the end of the fiscal year. While only Moody’s has maintained the AAA credit rating for BC after the pandemic, Robinson says that British Columbia continues to lead the country in credit ratings from the major international ratings agencies (which are a proprietary assessment by those private agencies).

Public Accounts on the previous fiscal year are a vital part of ensuring transparency and accountability within government’s finances. The next report on provincial finances will be the first quarterly report in September.

Fiscal highlights:

- Following growth of 2.8% in 2019, B.C.’s economy declined by an estimated 3.8% in 2020. Despite this, B.C.’s gross domestic product (GDP) was better than the national average decline of 5.3%.

- B.C. ended the year with a $5.5 billion deficit – $2.7 billion less than projected when Budget 2021 was presented in April.

- Employment decreased by 6.6% in 2020, raising B.C.’s unemployment rate last year to 8.9%, lower than the national rate of 9.5%.

- Taxpayer-supported debt to GDP is 20.2%, the second lowest in the country, even after significant investments in pandemic supports and capital infrastructure.

- B.C. continues to have among the best debt metrics and the best credit ratings in the country, keeping the Province’s borrowing costs for capital projects and other critical measures more affordable.

- The Public Accounts show the changes government is making to reform ICBC are stabilizing the public auto insurer. The total net income of ICBC in 2020-21 was $1.5 billion, a $1.9-billion improvement over the previous year’s net loss of $376 million.

COVID-19 pandemic spending:

- The pandemic response and recovery programs totalled $10.1 billion during the year. This included: $2.57 billion on health, mental health, child care, temporary housing and essential services;

- $2.9 billion on financial supports for people, such as the BC Recovery Benefit and the BC Emergency Benefit for Workers, temporary rent supplements, supports for people requiring income and disability assistance and the Canada Emergency Commercial Rent Assistance program;

- $1.3 billion for economic recovery measures, such as job creation and training, community infrastructure projects and social supports;

- $1.86 billion for federal-provincial safe restart programs;

- $1 billion for statutory spending on measures related to the Emergency Program Act, housing for vulnerable people, pandemic pay and tax credits; and

- $342 million through reprofiled government programs to address workforce development and adaptation, technology support and protective equipment.

Operating results:

- While provincial expenses significantly increased and provincial taxation revenue dropped as government delivered pandemic response and recovery programs, provincial revenues were higher than expected due to federal government one-time pandemic contributions. This helped to offset impacts on provincial finances.

- The operating result for the fiscal year ending March 31, 2021, is a deficit of almost $5.5 billion, an improvement of $2.7 billion from the 2020-21 numbers presented with Budget 2021.

Capital spending:

- Public Accounts for 2020-21 includes $5.4 billion in taxpayer-supported infrastructure spending on hospitals, schools, post-secondary facilities, clean-infrastructure projects, transit and roads. This includes: $1.848 billion to build, upgrade and modernize K-12 and post-secondary schools;

- $1.392 billion in B.C.’s transportation network (which includes BC Ferries); and

- $1.162 billion on key health facilities (most in this capital year were in BC mainland areas).

- Total capital spending was $1.7 billion below the Budget 2020 projection due to project scheduling changes.

Debt levels:

- As of March 31, 2021, the total provincial debt was $87.1 billion, an increase of $14.9 billion in 2020-21.

- About 31% of the total debt is self-supported through commercial Crown corporation activities.

- The taxpayer-supported debt-to-GDP ratio, a measure often used by investors and credit rating agencies to analyze governments’ ability to manage debt loads, stood at 20.2%.

- The Province of B.C. has the second-lowest taxpayer-supported debt to GDP in Canada, after Saskatchewan.

- B.C. spent 3.1 cents of every revenue dollar toward taxpayer-supported debt last year, the lowest in Canada.

- B.C. continues to have among the best debt metrics and the best credit ratings in the country. This is keeping the Province’s borrowing costs for capital projects and other critical measures more affordable.

===== LINKS (from BC Government):

To access Public Accounts online, visit: https://www2.gov.bc.ca/gov/content/governments/finances/public-accounts

The technical PowerPoint presentation is available online: https://news.gov.bc.ca/files/PA21.pdf