Friday July 22, 2022 | VICTORIA, BC

by Mary P Brooke | Island Social Trends

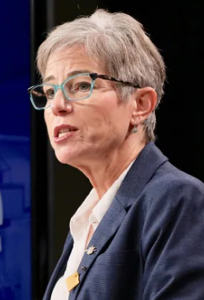

A new homebuyer protection period will protect people in BC looking to buy a home from being pressured into high-risk sales. That’s what BC Finance Minister Selina Robinson announced on July 21, 2022.

The period is the first of its kind in Canada and marks the first key action the Province is taking based on the BC Financial Services Authority’s (BCFSA) report on ways to offer homebuyers better consumer protection in the real estate market.

BCFSA is responsible for the supervision and regulation of the financial service sector, including real estate professionals, mortgage brokers, insurance, pensions, trusts, credit unions and the Credit Union Deposit Insurance Corporation.

This makes BC the first province to implement a homebuyer protection period for resale property and newly constructed homes. Cooling-off periods for pre-construction sales of multi-unit development properties, like condominiums, are already in place under the Real Estate Development and Marketing Act.

Three-day period:

The BC government says that the mandatory three-day period will give homebuyers an opportunity to take important steps, such as securing financing or arranging home inspections, as they prepare to make one of their biggest financial decisions.

Normally, however, most people make those arrangements and decisions ahead of putting an offer on a home. In that context, the BC real estate community is not keen about the new regulation.

Time for house inspection:

“Too many people have been faced with giving up an inspection in order to buy a home,” said Selina Robinson, Minister of Finance. “This is a major step toward providing homebuyers with the peace of mind they deserve while protecting the interests of people selling their homes – for today’s market and in the future.”

Perhaps part of the solution is to increase the number of housing inspectors in BC’s major urban centers, and to also encourage more professional separation between the inspection industry and the real estate side.

“Home inspections help to eliminate some of the potential costly risks involved in purchasing while helping to make an informed decision,” says Jonathan Sheppard, president, Home Inspectors Association BC. He says that Home Inspectors Association BC members “are proud that the BC government has recognized these risks and again leads the country in consumer protection.”

Market dynamics & purchase preparation:

Because the real estate market in BC has very much become a speculative investment mechanism for the investment class, it’s an almost recession-proof way to maintain and build wealth. People who try to jump in at the low end (i.e. first time buyers, and/or first-time speculators) are the ones who often get burned.

Preparation for a home purchase starts long before the actual purchase, including accumulation of the downpayment, finding and building solid working relationships with bankers and mortgage specialists, and building a strong enough income profile to support mortgage payments even when interest rates rise. Getting to know the housing inspection market ahead of time helps, as does analyzing the local pool of Realtors for best talent and reliable service, as well as getting an idea of how your region’s real estate board functions (including their presentation of statistics).

Starts January 2023:

The homebuyer protection period will come into effect on January 1, 2023. It includes a recission (cancellation) fee of 0.25% of the purchase price, or $250 for every $100,000, for those who choose to back out of a deal. For example, if the purchaser exercises the right of rescission on a $1-million home, they would be required to pay $2,500 to the seller.

Due diligence when no conditions:

Buyers still may make offers conditional on home inspections or financing at any time. The protection period will offer homebuyers the opportunity for due diligence at times when conditions are not in place.

Background:

The homebuyer protection period is informed by the results of consultations that the BC Financial Services Authority (BCFSA) completed this year with a wide range of real estate industry stakeholders, including home inspectors, appraisers, realtors and academics, as well as representatives from the legal and financial services sectors.

The Province will continue studying the BCFSA’s advice and its potential effects to further strengthen public confidence in the real estate market.

This announcement is in-keeping with the NDP government’s ‘people first’ approach to governance. In this case, recognizing that a home purchase is — for most people — the largest investment decision of their lives.

The report called Enhancing Consumer Protection in B.C.’s Real Estate Market is available online.