Thursday December 5, 2024 | VICTORIA, BC [Updated December 8, 2024]

by Mary P Brooke | Island Social Trends

Coming up on Wednesday December 11 is the last Bank of Canada rate announcement of 2024.

Will continued challenging times spur the bank to lower the rate (to help small business & mortgage holders), or will they hold with a cautious approach at 3.75%?

Pundits predicting lower rate:

A few weeks ago most economic observers were cautiously if not enthusiastically predicting another rate decrease (following four rate drops during summer and fall of this year).

But economic conditions are relatively stagnant and productivity continues to fall short of what the economy needs. Small and medium size businesses are expressing concern.

The GST tax holiday for two months (December 14, 2024 to February 15, 2025) will bring a modest short-term consumer and business revenue boost at best.

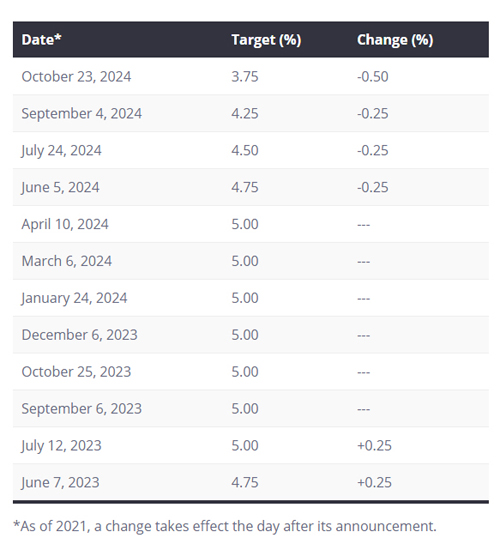

Rates in 2024:

After the central bank rate holding at 5% from July 12, 2023 to June 5, 2024, here is what happened with the Bank of Canada rate in 2024:

- On June 5 the rate was lowered by 25 basis points from 5% to 4.75%.

- Then on July 24 the rate was dropped a further 25 basis points to 4.5%.

- On September 4 the rate was dropped another 25 basis points to 4.25%.

- On October 23 the rate was dropped 50 basis points to 3.75%.

Still challenged:

Other than households and businesses carrying variable interest rate financial services (loans and lines of credit), most people have not directly benefited from the four rate drops already seen this year.

Credit card companies don’t automatically respond with interest rate reductions. People with fixed rate mortgages are not impacted until it comes time for renewal.

And the price of nearly everything has been pushed up by inflation for over two years, causing a real decline in household disposable income.

As the economy is still challenged, the Bank of Canada may hold the rate at its current 3.75% until their next review in January 2025. Some might think that lowering the rate would help spur activity but there is very little ‘juice’ left in the economy for anything but cautious financial decisions.

The Bank of Canada repeatedly states their aim to try (by using their blunt tool of setting the central bank interest rate) to keep the rate of inflation within their target inflation range of 2% to 3%.

“Inflation is now around 2% and is expected to remain near the middle of the Bank of Canada’s control range of 1% to 3% over the projection,” the Bank of Canada stated in October 2024.

Looking ahead to 2025:

Earlier this year the Bank of Canada published its 2025 schedule for policy interest rate announcements and other major publications.

- Wednesday, January 29

- Wednesday, March 12

- Wednesday, April 16

- Wednesday, June 4

- Wednesday, July 30

- Wednesday, September 17

- Wednesday, October 29

- Wednesday, December 10

Time on the clock:

All interest rate announcements are scheduled to take place at 9:45 am Eastern time (6:45 am Pacific), and the Monetary Policy Report will be published concurrently with the January, April, July and October rate announcements.

===== RELATED:

- GST winter tax holiday misses political mark, frustrates businesses, and fails many families (November 23, 2024)

- Bank of Canada half-point interest rate drop (October 23, 2024)

- Bank of Canada lowers interest rate to 4.25% (September 4, 2024)

- Bank of Canada drops interest rate for 2nd time in 2024 (July 24, 2024)

- Eby continues to target Bank of Canada about interest rates (July 17, 2024)

- First Bank of Canada rate drop in four years (June 5, 2024)

- NEWS SECTIONS: BUSINESS & ECONOMY | POLITICS