Wednesday October 23, 2024 | VICTORIA, BC [Updated October 24, 2024]

Socioeconomic analysis by Mary P Brooke | Island Social Trends

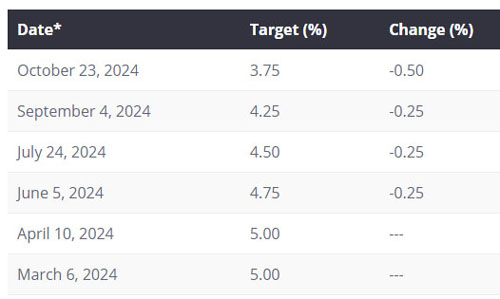

Today the Bank of Canada has dropped its policy interest rate by 50 basis points to 3.75%.

[See Bank of Canada monetary policy report October 23, 2024]

That’s the fourth consecutive rate drop this year (starting in June 2024, with drops also in July, September and now October).

This may be relief for some households and small businesses, but for many it feels like a little bit of relief that comes much too late.

Many households and small businesses had no choice but to rely on lines of credit and/or credit cards in order to make it through their financial commitments over the past few years. Accumulated debt will still take time to pay off.

As a comparison, households and small businesses that were hard-hit by the 2008 recession required years to pay off accumulated debt. There were only a few years in between, until then the pandemic financial challenges hit, followed by the grinding upward rate increases by the central bank.

This sort of monetary policy to clamp down on inflation with cranking up interest rates may have worked decades ago when the Canadian economy operated by a rigid model that responded to blunt levers. But the complexity of the economy since at least the late 1990s has seen households in particular relying on debt in order to keep up with even a basic standard of living.

Household debt is about as high as it’s ever been in Canada. When people earn money, much of it goes to debt payments.

There seems no easy fix to any of this. While the Bank of Canada can feel some relief that they’ve achieved their ‘back to target inflation’ goal, many households and small businesses across Canada know there are many years ahead to stabilize.

Where politics might help:

If politicians wonder why populations vote with frustration, this is part of it. There seems to have been no policy attempt by government to shift the way the cost of living in Canada is managed.

That’s not about directing the Bank of Canada to do anything, it’s about policy-makers in government looking for new models for things like:

- the cost of housing,

- the way the grocery sector operates,

- how basic services like wireless/tel are monopolized, and

- so much more including a new sort of social safety net for people who fall between the many cracks.

Parliamentary Standing Committee:

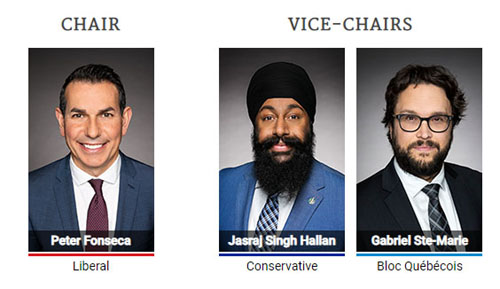

On Tuesday October 29, both Governor Macklem and Deputy Governor Rogers will appear before the House of Commons Standing Committee on Finance in Ottawa at 3:30 pm Eastern (12:30 pm Pacific).

The Governor’s opening statement will be published on the Bank’s website at that time.

This televised appearance is part of Pre-Budget Consultations in Advance of the 2025 Budget.

Next rate announcement:

The next scheduled interest rate announcement is coming up on December 11, 2024.

Today Bank of Canada Governor Tiff Macklem said the rate is likely to fall again in December but — as he always has said in the past few years — each rate announcement decision will be taken one at a time.

See the Bank of Canada scheduled rate announcement dates for 2025.

===== RELATED:

- Bank of Canada lowers interest rate to 4.25% (September 4, 2024)

- Bank of Canada announces 8 interest rate dates for 2025 (August 6, 2024)

- Bank of Canada drops interest rate for 2nd time in 2024 (July 24, 2024)

- First Bank of Canada rate drop in four years (June 5, 2024)

- NEWS SECTIONS: BUSINESS & ECONOMY | POLITICS