Saturday September 26, 2020 | VICTORIA, BC

Editorial analysis | by Mary P Brooke, B.Sc. | Island Social Trends

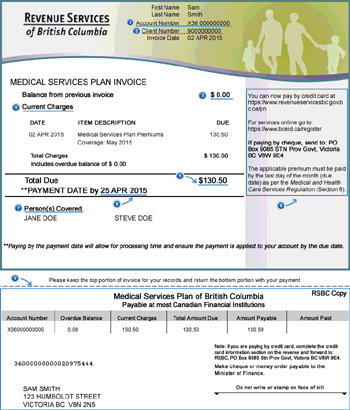

One of the things at stake in the current BC provincial election is whether or not Medical Service Plan (MSP) premiums are paid by individuals and families, or through larger employers.

The system currently in place as brought in by the NDP BC Government during their 2017-2020 term in office means that individuals have been spared the expenditure with after-tax dollars of about $1,800 per year.

The shift under the NDP vision is part of income equity, so that individuals and families have a bit more money in their household financing by which to make other live-improving decisions. So many things can be done with $1,800 in a year, such as training, better preventative health choices, more opportunity for fitness, paying down household and automobile debt, more recreational activities for children, and so on.

“As long as I am Premier, MSP fees will never come back,” said NDP Leader John Horgan on his Twitter feed today on this, Day 6, of the 42nd general election in BC.

“The BC Liberals doubled MSP premiums, making families pay huge bills just to get basic care. We got rid of it and saved families up to $1,800 every year.”

Horgan said in his election launch announcement on September 21 that he wants harmony and prosperity for everyone in BC.

Wilkinson against the EHT:

Based on how BC Liberal Leader Andrew Wilkinson has been consistently against the Employers’ Health Tax (EHT) — which was created in 2018 to fund the BC NDP’s elimination of Medical Services Plan (MSP) premiums — should have voters on alert.

If the BC Liberals were to win a majority in next month’s general election and go ahead with eliminating the EHT, that would likely lead to cuts in health care and the restoration of MSP premiums from individuals, say the NDP.

Not only were the premiums an expense in the household budget, the bloated administration and debt-collector system that cost the government money and harassed individuals who were struggling to make ends meet was entirely undignified in at least two ways.

It was a low-blow use of government muscle (also, by the way, farmed out to a US collection agency under the BC Liberal government which saw government dollars leaving the province and the country). And it was a blight on the dignity of hard-working British Columbians to be subjected to collections of a style similar to that car-loan collectors.

Said it on radio:

The NDP points out, that in Opposition, the BC Liberals have the intention to get rid of the EHT:

“I’d like to, first of all, get rid of the unnecessary NDP taxes that have been piled on this year. That starts with this Employer Health Tax, which is going to drive up the costs of doing business in BC and drive employment out of BC.” – Andrew Wilkinson, CKNW, May 17, 2018.

About the EHT:

The EHT is a payroll tax paid by the largest 15% of BC businesses. Businesses with payrolls under $500,000 a year pay no EHT.

The EHT applies to employers who pay B.C. remuneration in excess of $500,000 during a calendar year. Here’s how it is calculated.

- If the B.C. remuneration is $500,000 (exemption amount) or less during a calendar year, no EHT is payable by the employer for that calendar year.

- If the B.C. remuneration is greater than $500,000 and not more than $1.5 million (notch rate amount) during a calendar year, the employer must pay EHT equal to 2.925% of the amount by which the B.C. remuneration exceeds $500,000.

- If the B.C. remuneration is greater than $1.5 million during a calendar year, the employer must pay EHT equal to 1.95% of the total B.C. remuneration paid by the employer during the calendar year. This also applies to school boards in BC.

What is the tax revenue used for?

About 96% of the EHT revenue comes from the largest five percent of employers in BC. EHT brings in $1.8 billion every year to fund healthcare and other services.

“If Andrew Wilkinson eliminates the EHT, a BC Liberal government would have two ways to pay for it: cuts to healthcare, or raising fees – like bringing back MSP,” it was claimed in BC news release today.

The requirement to pay EHT was deferred by the NDP Government during the COVID-19 pandemic, as a way to help businesses cope with increased expenditures and in many cases reduced revenues.

Paying for health care:

Most provinces in Canada do not collect health plan premiums through direct-billing to their citizens. BC was one of the last to do that.

People are still paying for health care, through other taxes they pay on various things and indirectly through other fees they pay for various services (i.e. as businesses pass on the cost of EHT to their customers or users).

Another option:

Another way to organize health care premiums would be through individual income tax returns, based on a sliding percentage scale depending on income level. There could be a lower threshold below which a person with low-income does not pay a health tax (but their participation in the economy would still assure their contribution).

This method would avoid the penalization and harassment, and after-tax dollar payment of medical premiums as was the case under the BC Liberals until the Horgan government phased it out during 2017-2019. It would also show individual taxpayers that they are contributing to the cost of their health care, equally so, based on level of income (with no higher threshold). the old system saw extremely wealthy people paying the same amount as a middle income household, which was clearly lopsided and unfair and served to ‘suppress the poor’ in a way that only the Horgan government was able to beat.

This method could also be included with some sort of EHT that is not as apparently unattractive to big-business investors (who may otherwise shy away from investing in large companies in BC).

This method would also not formalize businesses as the target from which to cull large chunks of the provincial health budget. And in fact, it’s not just businesses paying the EHT, but also school districts which receive most of their revenues from the BC government to begin with (through the per-pupil funding formula) which sort of sees government funds going in a loop.