Monday September 28, 2020 | VICTORIA, BC

by Mary P Brooke | Island Social Trends

Today in his media availability, NDP Leader John Horgan twice replied that any possible changes to the Provincial Sales Tax (PST) in BC might be proposed in his party’s campaign platform next week.

PST is a mechanism used in most provinces to direct more revenues into provincial coffers.

The current PST rate in BC is generally 7%, a level it’s been at for many years. It is charged on virtually all retail or end-user purchases of goods and services. Combined with the 5% GST, that sees most purchasers paying 12% for items purchased in stores or online.

BC Liberals also have a PST plan:

Today the BC Liberals have announced they would eliminate PST for one year if they form the next government. Then after one year they would set it at 3% (still less than half of the current 7%). They say it would save $1,700 for the typical family in one year, and almost $1,000 the year after.

However, the BC Liberal proposal saves money for people who have money to spend. It’s an approach that would favour those with more resource over those with less.

PST exceptions:

More specifically, the following goods and services are the exception to the standard 7% PST:

- Accommodation (PDF) is 8% plus up to 3% municipal and regional district tax

- Aircraft (PDF) is 7% or 12%

- Boats (PDF) is 7% or 12%

- Liquor (PDF) is 10%

- Manufactured buildings (PDF) is 7% of 45% – 55% of the purchase or lease price

- Vapour products is 20%

- Vehicles (PDF) is 7% – 10%, 12%, 15% or 20%

During COVID, some changes:

As already announced on September 2, the following tax changes announced in Budget 2020 are postponed and will not take effect until April 1, 2021:

- Eliminating the PST exemption for carbonated beverages that contain sugar, natural sweeteners or artificial sweeteners (i.e. soft drinks will have PST charged after April 1, 2021);

- Expanded registration requirements for Canadian sellers of goods, along with Canadian and foreign sellers of software and telecommunication services (which would see PST payable on ecommerce).

And on September 17, government announced a temporary provincial sales tax (PST) program where corporations may apply to receive an amount equal to the PST they paid between September 17, 2020 and September 30, 2021 on qualifying machinery and equipment.

Speculation in the campaign:

The speculation in this second week of the election campaign is that any increase in PST would help pay for more of the government’s initiatives as it guides British Columbians through the COVID-19 pandemic over the next few years.

Reducing the PST would be a gesture to British Columbians who are struggling economically during the pandemic that the government has their back. But it also reduces revenues to the government for all its range of services to people.

Consumer spending during COVID:

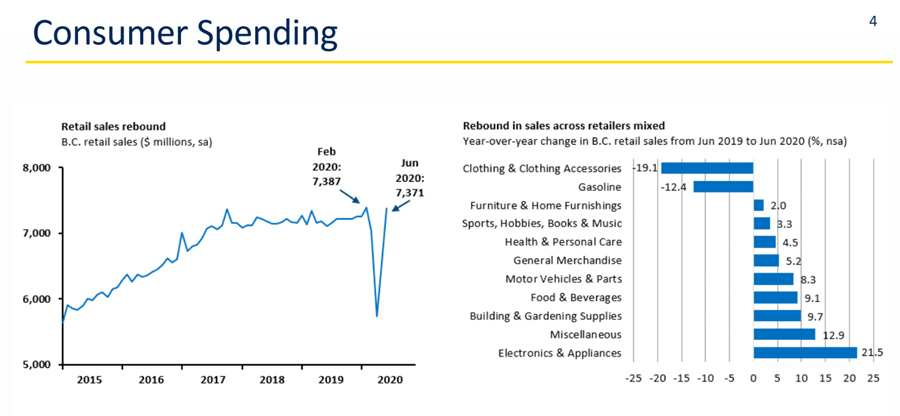

In an economic report presented by Finane Minister Carole James in September, it was evident consumer spending during the pandemic (2nd quarter) has seen significant increases in many areas related to the crisis.

Spikes were seen in the purchase of household appliances and bigger homes (all about spending more time at home, and more spaciously), as well as vehicles and repairs (perhaps with a shift from use of public transit to avoid close contact with others during the pandemic).

In the first wave of the pandemic people spent significantly less on clothing, fashion accessories and gasoline for vehicles.