Wednesday July 8, 2020 ~ NATIONAL

Analysis by Mary Brooke, editor ~ West Shore Voice News

Things will continue much as they are for a while in Canada’s economic response to the pandemic.

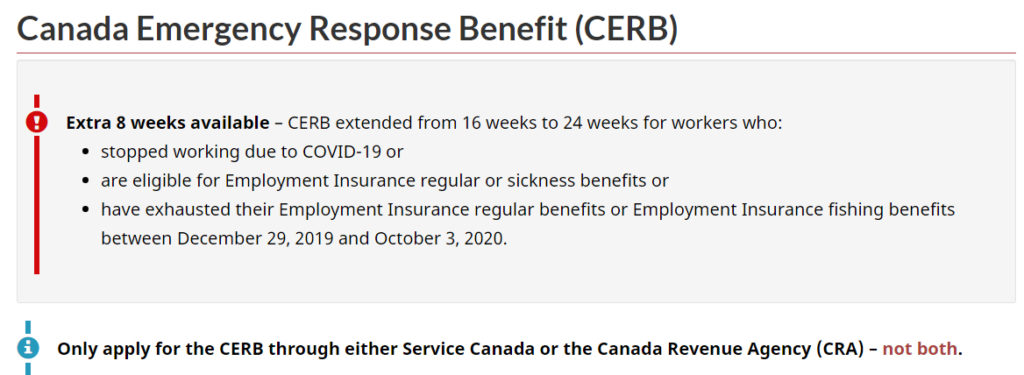

The Canada Emergency Wage Subsidy (CEWS) and the Canada Emergency Response Benefit (CERB), which have been repeatedly extended and expanded in recent months and so far there is no indication of when or how they will be adapted or ended.

A deficit of $343 billion in 2021 was projected today by Finance Minister Bill Morneau in the House of Commons. Spending could reach as much as $612 billion by 2021, he stated.

The economic shutdown that was gently enforced across the country in March and April with public health messaging as a way to keep people in self-isolation and away from exposure to the COVID-19 virus essentially put the Canadian economy into a coma.

Trudeau’s preview of the snapshot & new COVID-19 data modelling:

Prime Minister Justin Trudeau gave a preview of the fiscal snapshot in a media announcement ahead of Morneau’s details delivered in the House of Commons.

Trudeau also previewed a new COVID-19 data modelling being revealed later in the day, saying the pandemic scenario is stabilizing in Canada based on counts and rates of cases, hospitalizations and deaths “because Canadians did their part and followed public health instructions”.

It was noted, by the World Health Organization (WHO) in recent days that Canada has ‘done well’ in managing the pandemic.

Both Trudeau and Morneau identify Canada’s good financial position ‘heading into the pandemic’ as a big reason that the right measures could be taken, including shutdown of the economy as part of flattening the COVID-19 epidemiological curve.

Reviving the economy from immobilization:

Now the necessary goal is how to revive the economy from its deep sleep without damaging the individuals, households, businesses and communities who have suffered during the downtime and who are needed ‘on the other side’ for taking part in economic recovery.

Most people receiving CERB benefits need those benefits to continue, as there are not a lot of jobs opening up quickly, self-employment revenues are down, and those who are functioning well enough working from home are staying away from the potential exposure to COVID-19 that would come with broader social interaction.

The government says it will make “necessary changes to the program later this summer so people can have the help they need while supporting the recovery.”

CERB & CEWS continue, though imperfectly:

CERB was originally expected to cost about $25 billion, with today’s projection now being $80.5 billion through 2020 and 2021 based on the extension to October 4 (supported by the NDP).

The CEWS, which covers 75 percent of employee wage costs for struggling businesses (who must themselves still somehow find the other 25 percent most likely within conditions of reduced revenues), is now expected to cost $82.3 billion, up from an initial estimate of $73 billion.

CEWS has been largely undersubscribed in recent months. Apparently industry groups say the weak uptake of CEWS by businesses is due to a delayed rollout of the program, but there was good reason for that. Businesses amidst the strain of a pandemic were expected to provide in-depth documentation about their businesses which probably required acces to accountants who were probably overloaded during the normal tax season, and of course would require payment which may not have been possible for some small and mid-size businesses whose doors were shut and had no revenues coming in.

One way that the Liberals might adjust the program to encourage more applicants would be to drop much of its means-testing that has been the stalwart and impediment for almost all of the programs they’ve rolled out.

Even CERB required a major readjustment up to $2,000 and significant adjustments to recognize and include self-employed people, gig workers and even students (for whom a separate student benefit package was ultimately developed). As NDP Leader Jagmeet Singh said, it would work better to send money to everyone (a form of basic income coverage) and then claw back misappropriated money at tax time. That would be the better way to ensure that no one was missed, Singh said back in April (and still repeats).

Speaking to reporters on Wednesday, Morneau said an update to the CEWS program would be coming “in the very near term,” while acknowledging the government will need to strike a balance between supporting vulnerable workers and avoiding unnecessary damage to the federal balance sheet.

“We know there are some things we need to change” about the wage subsidy, he said.

The NDP role in identifying real need:

The NDP pressure was indeed successful for Canadians to achieve the $2,000 payment every four weeks, proving at least five things, that:

- the minority government scenario is working in Canadians’ favour,

- the NDP have accurately gauged the pulse of how everyday Canadians really live,

- the equivalent of $500 per week seems to be adequate to help most people manage,

- Canadians are interested in seeing some sort of basic income be established in the Canadian social safety net (no benefits are issued without a person being tracked in the tax system, so there is little room for worry about not tracking down abuse at tax time), and

- it’s time for a more open-hearted and open-minded approach to dealing with Canadians respectfully (without a hard-nosed approach of means-testing).

Today NDP Leader Jagmeet Singh said he is still worried about people being able to pay their bills and who are struggling to put food on their tables during the pandemic. “If people are struggling, the economy will also struggle,” he stated in a media session ahead of the House of Commons session. He also called once again for taxes to levied on US-based online media giants such as Amazon and Netflix don’t pay any taxes in Canada, and who have made massive financial gains during the pandemic.

Political balance:

Most Canadians want to work (the Conservatives premise) and most Canadians are motivated by fair treatment (the NDP approach). The Liberals would be wise to continue following the guidance they are getting through the political system from both of those Opposition parties.

Canadians can feel good that the governance system in Canada is working in this regard; ‘the voters are always right’ phrase comes again to mind, with regard to the election of October 2019 that put Trudeau back in as prime minister but forced the parties to work collaboratively.

People and jobs:

Morneau did not outline a long-term plan today for unwinding or tweaking the two major programs, saying instead that he would be focused generally on supporting economic recovery.

That will come as good news to most people and businesses who only see an uncertain future at this time.

“Right now is really the time to be thinking about people and jobs,” he said.

Financial crisis of 2020 driven by public health emergency:

There is really no comparison between the Great Recession starting 2008 and this 2020 crisis. The former was a financial industry fiasco which took almost 10 years for many people and small businesses to recover; it unfairly burdened working people and small businesses around the matter of their savings, pensions and ability to handle debt financing while anyone in good financial shape (deep pockets and/or not overly indebted) remained unscathed.

This 2020 scenario is a health emergency which impacts everyone, though variably, in all respects — health-wise, socially, financially and in terms of overall opportunity. As in most any emergency, those who are most vulnerable to its impacts are affected the most.

Cracks in society and financial realities:

The general expression about this is that COVID-19 has exposed cracks in the socioeconomic realities of Canada. The keyword there is ‘exposed’, as the cracks were there and had been for a long time.

The lack of awareness about the real financial struggle of many Canadians was quite evident in the federal government’s initial rollout of programs which fell desperately short of need due to a lack of awareness of the reality people had been living for decades. The ways that small businesses operate, a preponderance of people in the gig economy (out of necessity because of a lack of ‘fit’ into the mainstream), and how women and racilized Canadians have been consistently shut out in subtle ways became suddenly evident.

The reality that access to child care underpins economic success for women and families was laid bare. Also the role of schools as a system that (in addition to academic education and standardization of socialization) allows parents to go to work was seen in a cleaner light.

Conservatives propose a ‘back to work bonus’:

Today the Conservatives proposed construction solutions “to get people back on their feet”. Conservative Leader Andrew Scheer spoke to media ahead of the House of Commons sessions, explaining that “a back to work bonus — a CERB top up — would give workers the support they need to transition back into the workforce and ensure that local businesses are able to fill shifts and get back on their feet”.

“During the pandemic, Trudeau has made major failures and has been slow to act,” said Scheer in his opening remarks today.

“Economic recovery depends on Canadians,” said Scheer. He called on Trudeau to “use today’s economic snapshot to implement the back to work bonus, to fully fund the auditor general’s office so Canadians can see how their tax dollars are being spent, and to put forward a transparent plan to guide Canada’s recovery.”

Conservatives do support that for Canadians who lost their jobs through no fault of their own during the pandemic should continue to receive their full $2,000 CERB. Their bonus idea is that workers who make between $1,000 and $5,000 per month would qualify for the Back to Work Bonus, a CERB top-up that would be gradually phased out (by 50 cents for every extra dollar earned over $1,000).

However, if then CERB benefits are no longer issued to a person, that could lead some people off an economic cliff. The success of such a program would heavily on the continued strength and performance of the private sector, something which presently comes with no guarantees due to the uncertainty of how the COVID-19 will continue to circulate in the community. The CEWS wage subsidy program is presently only available to businesses for 24 weeks; if their business has not picked up and stabilized by then, employees could be laid off once again.