Wednesday July 17, 2024 | VICTORIA, BC [via HALIFAX, NS] | UPDATED 12 noon PDT

Socioeconomic political analysis by Mary P Brooke | Island Social Trends

In a post on X last night, BC Premier David Eby said that Canada’s Premiers — at their summer meeting in Halifax — discussed the high cost of groceries and hopes that the Bank of Canada will continue to lower their central policy interest rate.

Today Eby used his few prime time minutes in the Canada’s Premiers wrap-up media session to further hammer away at how the Bank of Canada needs to wake up and smell the angst.

Impacts of interest rate hikes:

People are being crushed by the impact of interest rates that were ramped up rapidly over an 18-month period in 2022 and 2023, which has forced households, businesses and communities to put some things on pause — or worse, cut back in ways that are detrimental to health, families, business stability or community services.

Various life choices and directions of growth and development have been altered or even stymied.

‘Get real, and do it fast’ might be the way that Eby was saying nearly directly to the Bank of Canada today. He’s frustrated at the lack of apartment building construction due to the cost of interest rates, and all the other impacts on people in his province.

“The federal government should join British Columbia in frankly calling on the Bank of Canada to lower interest rates,” said Eby in a challenge to the current federal Liberal government.

“I know the bank needs to be free from political interference and they should be. But the bank is clearly not recognizing the impact of their high interest rates on costs facing Canadians, especially in British Columbia,” said Eby today in mid-summer 2024 just ahead of the next Bank of Canada interest rate announcement on July 24.

“We look at what’s driving inflation in our province, it is overwhelmingly the cost of housing,” said BC’s Premier while addressing media today. “And what is driving the cost of housing? High interest rates.”

“We’ve had rental housing projects put on hold because of high interest rates, meaning there’s less rental housing at a time that we’ve added 180,000 people to our province last year. We’ve got people facing massive and staggering interest rate costs on their debt related to mortgages, related to other borrowing that they have, and it is profoundly damaging the Canadian economy,” said Eby.

“It’s damaging the economy in British Columbia. That is the intention of a high interest rate policy, is to damage the economy so people have less money, they spend less money,” Eby explained.

“But now we’re in a situation where high interest rates are driving high housing costs, which are driving high inflation, and it is a vicious cycle that has to stop!” said BC’s premier who took office toward the end of 2022.

“They have to recognize how their policy is actually impacting people on the ground,” he concluded on that point.

Election context:

The NDP people-first approach to governance in BC somewhat behooves Eby to meet people in the moment of this crisis, and that is very clearly bearing down on the provincial budget whether government admits to that or not.

The danger of shifting to a Conservatives of BC government — or worse, BC United — in this fall’s provincial election means that the social programs built up by the NDP government since 2017 would likely be cut back in various ways, as an accounting-style back-to-balance fiscal approach will do.

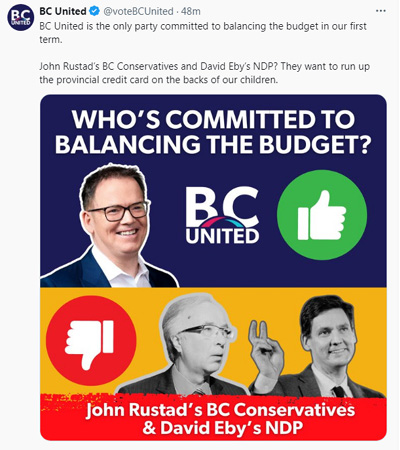

“BC United is the only party committed to balancing the budget in our first term,” was posted in social media today by BC United.

Three provincial premiers are facing a re-election challenge this fall: Blaine Higgs (Conservative) in New Brunswick, David Eby (NDP) in BC, and Scott Moe (Conservative) in Saskatchewan.

Next interest rate announcement:

The next Bank of Canada interest rate announcement is coming up next week on July 24 at 6:45 am PDT.

On eight scheduled dates each year, the Bank of Canada announces the setting for the overnight rate target in a press release explaining the factors behind the decision. This year, each of those releases is being followed by a live media session, which the Bank has says is an effort to communicate better with Canadians.

===== RELATED:

- Canada’s Premiers prioritize housing, affordability, skills training, infrastructure, energy and emergency preparedness (July 16, 2024)

- Canada’s Premiers to discuss key issues in Halifax July 15 to 17 (July 11, 2024)

- Trudeau pushes ahead while Premiers still want federal funds without encroachment (April 19, 2024)

- Western premiers united around economics, security & trade (June 27, 2023)

- Canada’s Premiers meeting July 10-12 in Winnipeg (June 13, 2023)

- Canada’s premiers: priorities for economic recovery & health care (July 13, 2022)

- NEWS SECTIONS: POLITICS | BC 2024 PROVINCIAL ELECTION

===== ABOUT THE WRITER:

Island Social Trends Editor Mary P Brooke has been covering BC news alongside the BC Legislative Press Gallery since 2020, and before that since 2008 on a regional basis on south Vancouver Island.

Her print news publications are permanently archived at the Sooke Region Museum: MapleLine Magazine (2008-2010), Sooke Voice News (2011-2013), and West Shore Voice News (2014-2020).

Mary P Brooke reports through a socioeconomic lens with political analysis as these are the two things that impact people’s lives the most — how society and economy interact and how political decisions make a difference.