Friday March 7, 2025 | VICTORIA, BC [Updated at March 9, 2025]

by Mary P Brooke | Island Social Trends

BC Budget 2025 was released on March 4.

Overall, the budget is a caretaker government, with a big contingency for things that may go wrong. This shows either a lack of vision and/or lack of time to properly assess the impacts and needed responses during a tariff war.

There is no itemization of the Food and Agriculture Ministry budget within BC Budget 2025. What appears to be a drop of $100 million since last year is explained as the previous year requiring crop-loss coverage.

Here are some comments and insights from various industry sectors, education, leadership organizations and political parties:

- “Short-term support for Canadians and Canadian businesses is key, and federal and provincial governments are already stepping up with retaliatory measures and financial tools like EI benefits and business support. But a longer-term strategy to increase the resilience and security of our economy is also deeply necessary.” ~ Keri McNamara, Clean Energy Canada

- “Tariffs will place another substantial and unnecessary burden on Canada’s already threatened salmon farming sector. Approximately 70 percent of B.C. farm-raised salmon annual production goes to American customers. About 1,100 ti 1,195 jobs could be lost.” ~ BC Salmon Farmers Association

- “The Premier and the Minister of Finance could have easily taken the time to deliver a budget with substantial tariff relief. … “Instead they pushed ahead with a hastily-arranged plan that provides nothing for the people of this province. …. There is no plan and no economic modeling showing the benefit of removing barriers to trade between Canada’s provinces, potentially the most potent weapon available to Canadians in the face of American tariffs.” ~ Peter Milobar, Finance Critic, BC Conservative Party of BC

- “At a time of unparalleled economic uncertainty, rising costs, and ongoing climate crisis, this budget treads water – offering a $4 billion contingency fund but failing to deliver the creative solutions needed for transformative change…. In this moment of deep uncertainty, we need government investment in systemic solutions, not another ICBC rebate cheque.” ~ BC Green Party

- “With a trade war now underway, the BC Government introduced a budget earlier today that continues to invest in provincial services while attempting to shore up the provincial economy. Incremental new spending has been targeted for local government priorities, including homelessness response, addiction treatment, street disorder and affordable housing. Longer term challenges lay ahead, however with a growing debt and still unknown impacts from tariffs to the provincial economy and government revenue.” They also indicate that the government has listened to UBCM requests though these aspects of Budget 2025: HEART & HEARTH homelessness response; addictions treatment and recovery; street disorder; and affordable homes (though shifting to building new homes for middle-income earners). ~ Union of BC Municipalities

- “When a crisis arises that warrants a significant government response, such as a major shift in North American trade norms, the government’s fiscal position has an impact on how robust that response can be. In the future, CPABC will continue to encourage the B.C. government to adopt a long-term fiscal anchor and avoid structural deficits to ensure the province remains well-equipped to handle current and future challenges.” ~ Chartered Professional Accountants of BC

- “Now, more than ever, we need the government to support teachers so we can support kids—they shouldn’t have to feel the impact of an international trade war. … This spring, BC teachers will be at the bargaining table with the government, and it’s time for the employer to be open to new solutions and funding that will meaningfully improve working and learning conditions in our schools. The government needs to deliver on their promises and commitments to BC’s teachers and their students.” ~ Clint Johnston, President, BC Teachers Federation

- “The Canadian Federation of Independent Business (CFIB) is disappointed by Budget 2025 forecasting a record $10.9 billion deficit, with no new fiscal measures to directly support small businesses. With the implementation of 25% tariffs by the US — a watershed moment in the Canada-US trade relationship — small businesses are bracing for impact.” ~ CFIB Director of Legislative Affairs, Ryan Mitton

- “We are disappointed by the absence of dedicated support for the forest sector. … These broad-based tariffs apply to all forest product exports—including pulp, paper, packaging, engineered wood, and mass timber—adding further pressure on workers, companies and communities already affected by softwood lumber duties. … COFI is concerned that Budget 2025 doesn’t plan to meet the government’s commitment to harvest 45 million cubic metres, as outlined in the government’s election platform and Forest Minister’s Mandate Letter.” ~ Kim Haakstad, President & CEO BC Council of Forest Industries

- “(Minister Bailey) acknowledged the curveball (of tariffs), noting that the budget was put together with tariffs in mind. There is also $4 billion in contingency funds set aside annually for three years to address unforeseen challenges. It’s a strategy that makes sense, but one business groups will be watching closely…. The circumstances are new but the fundamentals have not changed. Businesses need certainty. … The provincial government has plenty of levers it can use to help the private sector and keep BC’s economy running. Business drives innovation, especially in times of crisis. The best thing government can do is get out of the way and give space to entrepreneurs tp exercise their creativity.” ~ Greater Victoria Chamber of Commerce

- “We did not see measures to reduce red tape and attract investment. What we did see is a record high deficit without the imposition of tariffs, and the size of the debt doubled over the next four years. So it’s a very bleak fiscal outlook. … We’re hoping there will be a significant budget update once the imposition of these tariffs is fully realized it would be prudent for the government to come back and be transparent about what the impact is and then what their plan is going forward. … (On safety measures): We were hoping to see a broader economic vision and a pathway. (As a co-chair of the Premier’s BC Task Force on Trade and Economic Security): We’re had the opportunity to have a fair bit of input and recommendations on things like internal trade, streamlining permitting, and major projects that the government announced. The government has been in the process of collecting that information and collating it. We’re hoping to see those submissions back. The work of the next several weeks and months will be not only what the BC economy and government can do to address the immediate threat of the tariffs but also in the medium and long term — what the economy needs to do and what the government needs to do to make the economy more resilient. There have been dozens and dozens of recommendations about what the government could do to make the economy more resilient. We are waiting to see what those outcomes are going to be.” ~ Bridgitte Anderson, President & CEO, Greater Vancouver

Reader comments:

In response to the March 4th Island Social Trends Editorial about Budget 2025:

- “I totally agree with the statement: C’mon, Trump is not that mysterious. He has his eye on critical minerals, energy, borders (including ignoring them) and manufacturing. And if he would collapse the Canadian economy he believes he could annex Canada. “This is so obvious, yet I keep hearing how unpredictable Trump is. He is totally predictable, and his goals are clear. He wants to get critical minerals and resources from as many countries as possible for free. He also wants to bring all manufacturing into the US at the expense of other countries. He wants everyone to buy from the US and is anti-trade. His heroes are McKinley (an imperialist who was expansionist and loved tariffs, hence the renaming of Denali back to Mt. McKinley) and Hitler. He also admires dictators like Putin and Kim Jong-un. He believes that he can go back to the McKinley days when there was no income tax, and the US relied on tariffs. He could care less about others.” ~ Tom Myrick, Sooke, BC

- “No problem just a $10.9 billion deficit.” ~ Ellen Lewers, Sooke, BC

- Send readers comment about Budget BC to editor@islandsocialtrends.com

===== RELATED:

- ‘Hurt’ and ‘pain’ is thoughtless political talk (March 7, 2025)

- BC Budget 2025 waits to meet the moment (March 4, 2025)

- Premier Eby addresses the new tariff reality (March 4, 2025)

- BC Budget 2025 waits to meet the moment – EDITORIAL (March 4, 2025)

- NEWS SECTIONS: 43rd BC PARLIAMENT | CANADA-USA

Full Budget news release & supportive facts:

The following is a presentation of the BC government’s Ministry of Finance Budget 2025 news release from March 4, with notes [in bold] as to what Island Social Trends has learned about the budget.

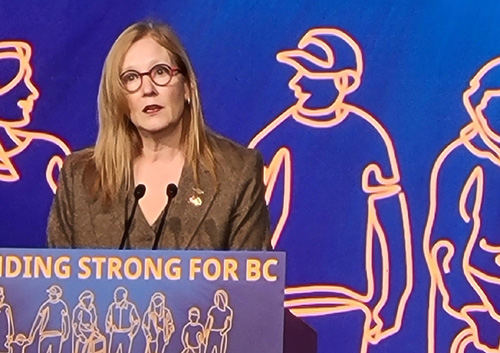

Standing strong for B.C.: Budget prepares to defend British Columbians

VICTORIA – The provincial government has released Budget 2025: Standing Strong for B.C., a measured plan to protect jobs and the public services people rely on, while preparing British Columbia’s economy to withstand the unpredictable impacts of unjustified tariffs.

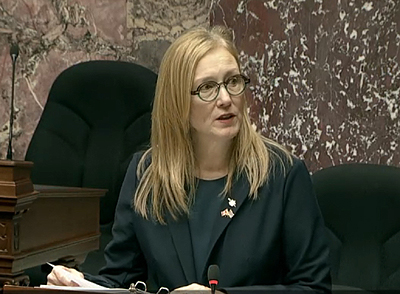

“With uncertainty on the horizon, it is prudent to protect the essentials and prepare for what comes next by investing in our greatest resource, the people of British Columbia,” said Brenda Bailey, Minister of Finance. “While our economy is built to withstand the threat of U.S. President Donald Trump’s tariffs relatively better than most other provinces, the impact would still be significant. Our budget prepares us to carefully navigate these uncharted waters so we can put people first and support businesses as we build a stronger, more self-sufficient future.”

Budget 2025 manages B.C.’s finances and invests in critical public services to meet growing demand. It provides $9.9 billion more in operating funding over three years, including $7.7 billion in new funding for health care, education and social services. The budget also includes $4 billion in annual contingencies to address unpredictable costs, including a new collective bargaining mandate, pressures on critical services and for emerging needs, such as potential tariff response measures.

The budget provides $4.2 billion to respond to growing demand for health-care services, improve access to primary care, continue hiring health-care workers, reduce wait times at emergency departments and hospitals, and open and operate new and renovated hospitals and facilities. It also provides funding to support addictions treatment and recovery programs.

To address health-care needs throughout the province, $15.5 billion in capital funding is provided over the fiscal plan to help build and upgrade hospitals, long-term care facilities and cancer centres.

Budget 2025 provides $370 million over three years to support students in the K-12 education system, including hiring additional teachers, special-education teachers, teacher psychologists and counsellors. The budget also invests $4.6 billion over the fiscal plan in capital funding to build and upgrade schools. [This increase is to primarily cover staff wage increases. No uplift to school board operating budgets which the Ministry points out includes senior executive staff salaries e.g. Superintendent. Or as the BC Teachers Federation put it by acknowledging modest increases to meet contractual obligations and hopefully prevent cuts, but called on the BC government to bring forward a bold vision for public education that improves student learning conditions and teachers’ working conditions.]

Funding is increasing for services for children and youth with support needs, children and youth in care and adults with developmental disabilities.

“In times of uncertainty, we will be there for British Columbians. We are continuing to invest in the services people rely on to take care of their families, get the care they need, when they need it, and provide a good future for everyone across the province,” Bailey said. “Our government is focused on building an economy that creates the wealth that is needed to deliver more jobs with bigger paycheques and protect our public services in the face of the threat of unjustified tariffs.”

Growing a stronger and more diverse economy will help protect people from instability outside B.C.’s borders, with investments that will bring good-paying jobs to the province as part of sustainable industries.

Budget 2025 invests $30 million over three years to support high-quality jobs through the Integrated Marketplace Initiative’s work to accelerate innovation in B.C., and boosts tax credits for the province’s film sector and home-grown interactive digital media and video game industry.

It includes funding of $95 million in critical highway and bridge maintenance over three years to help people and goods move safely across the province, with another $47 million over the fiscal plan to support BC Transit networks outside of the Lower Mainland.

Capital funding of $15.9 billion over three years will support transit, infrastructure and highway improvements to connect communities throughout the province. [The Premier wants these to move ahead as quickly as possible so that any cost-increases related to inflation and/or tariffs are mitigated.]

Total capital investments of $59.9 billion over the fiscal plan are anticipated to support 180,000 good-paying direct and indirect jobs over three years.

People continue to deal with the challenge of daily costs, especially when it comes to finding a home they can afford. Budget 2025 commits an additional $318 million over three years to BC Builds as part of the Province’s goal of delivering thousands more rental homes for middle-income people. [Attention to affordability is being re-channeled through further attention to ‘missing middle’ housing. Other than another $110 ICBC rebate, there will be no hand-out affordability credits.]

B.C. remains focused on making sure people, not speculators, can find affordable housing by increasing the Speculation and Vacancy Tax to 3% for foreign owners and untaxed worldwide owners, and 1% for Canadian citizens and permanent residents.

The number of lower-income working families receiving help with their monthly rent payment will nearly double as part of $375 million in additional funding for rental support programs over three years.

With this increase, the average supplement families receive under the Rental Assistance Program will rise from $400 to $700 per month. An additional 1,600 seniors will receive rental support through the Shelter Aid for Elderly Renters (SAFER) program, with average supplements growing by 30%. This is the second increase to funding for SAFER recipients in the past year. [When people receive SAFER payments that has the ‘unintended’ consequence of automatically reducing their eligibility for other government supports. Government is aware of this and has done nothing about it. The Office of the BC Seniors Advocate is aware of the problem.]

Stronger-than-expected returns on investments means ICBC can provide another $110 rebate this year to help personal and commercial drivers with costs amid an uncertain economic climate. [Last year there were some problems distributing the rebate to people whose policy renewal dates overlapped the rebate-release date.]

The Province is investing $325 million over three years to support safer communities.

This includes $235 million in justice and public safety programs for people to get timely access to justice, a new program to fight vandalism and other property crime, increased police funding and more police officer training seats.

Budget 2025 provides additional funding to expand HEART and HEARTH programs to help more people living outdoors access housing and better support services so the Province can work with communities to help people move indoors and close down encampments.

“We can’t leave our future to the whims of unpredictable forces beyond our borders,” Bailey said. “This is our opportunity to stand up for B.C. families, workers and communities to build a stable and sustainable economy for years to come.”

Budget 2025 presents declining deficits from $10.9 billion in 2025-26 to $10.2 billion in 2026-27 and $9.9 billion in 2027-28. [Compare to the Budget 2024 numbers: “Projected deficits decline over the fiscal plan from $7.9 billion in 2024-25 to $6.3 billion in 2026-27, with debt expected to increase but remain affordable.”]

Government Links:

Read the 2025 Budget and Fiscal Plan: https://www.bcbudget.gov.bc.ca/