Wednesday December 11, 2024 | VICTORIA, BC [Posted at 7:02 am | Last update December 12, 2024]

by Mary P Brooke | Island Social Trends

Link to the live webcast December 11, 2024

A drop of 50 basis points in the Bank of Canada’s interest rate was expected by many observers of things economic, and that has happened.

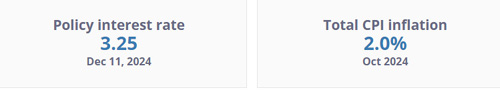

Today’s Bank of Canada December 11, 2024 rate announcement — the last of 2024 — features an interest rate of now 3.25% (down from 3.75%).

The Bank of Canada says this drop is “to support growth and keep inflation close to the middle of the 1-3% target range”.

This is the fifth rate drop since April of this year.

These are challenging times. A downward interest rate is expected to help small business and mortgage holders and the post-pandemic economic recovery overall.

“Growth output is softer than predicted in October,” says Bank of Canada Governor Tiff Macklem. A more gradual approach to monetary policy is the way forward but monetary policy “no longer needs to be restrictive”, the Governor said.

“A more gradual approach” includes taking Bank of Canada decisions one meeting at a time, he said.

“At the last two meetings we took bigger than normal steps,” said Macklem today.

Trying to restore people’s lives:

Economic conditions are relatively stagnant and productivity continues to fall short of what the economy needs. Small and medium size businesses are expressing concern as are most households who have suffered the inflation-driven increased cost of nearly everything since the pandemic and Bank of Canada interest rates that pumped up higher and higher starting in spring 2022.

Today’s rate decrease will be welcomed by households and small businesses but it seems like a little bit of help that comes a lot too late.

The housing market may feel some relief, but may also wait even longer before committing to financing for major development projects.

The GST tax holiday for two months (December 14, 2024 to February 15, 2025) will bring a modest short-term consumer benefit. The benefit to business will be marginal given the overhead cost to temporarily adjust POS systems, deal with accounting system variation at year-end 2024 and again in 2025, and the loss of the usual short-term benefit to holding the GST before remittance.

Impact of US tariffs:

“The possibility the incoming US administration will impose new tariffs on Canadian exports to the United States has increased uncertainty and clouded the economic outlook,” the Bank of Canada says today.

“This is a major new uncertainty,” said Bank of Canada Governor Tiff Macklem today in the bank’s webcast at 7:30 am (PT).

“We’re doing some analysis to get prepared for that possibility,” says Macklem about the threat of increased tariffs from the USA.

“It’s going to be difficult for businesses to take decisions against that background,” says Macklem. The Bank will be doing surveys (among business) heading into January.

Population growth:

Population growth is expected to be slower in 2025 and the ‘new spending’ by newcomers will be less in the economy, says Macklem.

But the baseline of the economy will still grow, he said.

Commercial bank response:

Within a few hours, Canada’s major banks began announcing a drop in their prime lending rate.

TD Bank has lowered their prime lending rate to 5.45% effective December 12, 2024.

Comment by BC Premier Eby:

The BC economy led Canada across all provinces for GDP growth, said Premier David Eby on Monday December 9.

“The economy has been badly hurt by the decisions of the central bank in Ottawa, to raise interest rates. That hurts British Columbians more than it hurts other people in other provinces,” said Eby during a media session in Vancouver.

“And despite that, we still grew the fastest in Canada,” he added. “I’m going to push hard to make sure we’ve got a federal partner that recognizes that British Columbia taxpayers pay out dollars to support people across Canada through equalization payments,” said Eby.

Eby said that the federal government needs to support BC “in kind”, the way other provinces are getting support payments from the federal government.

Rates in 2024:

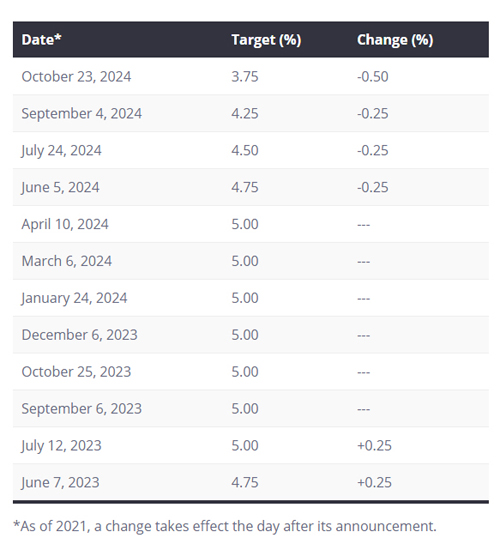

After the central bank rate holding at 5% from July 12, 2023 to June 5, 2024, here is what has happened with the Bank of Canada rate in 2024:

- On June 5 the rate was lowered by 25 basis points from 5% to 4.75%.

- Then on July 24 the rate was dropped a further 25 basis points to 4.5%.

- On September 4 the rate was dropped another 25 basis points to 4.25%.

- On October 23 the rate was dropped 50 basis points to 3.75%.

- On December 11 the rate has been dropped by 50 basis points to 3.25%.

Still challenged:

Other than households and businesses carrying variable interest rate financial services (loans and lines of credit), most people have not directly benefited from the four rate drops already seen this year.

Credit card companies don’t automatically respond with interest rate reductions. People with fixed rate mortgages are not impacted until it comes time for renewal.

The price of nearly everything has been pushed up by inflation for over two years, causing a real decline in household disposable income.

Some might think that lowering the rate would help spur activity but there is very little ‘juice’ left in the economy for anything but cautious financial decisions.

The Bank of Canada repeatedly states their aim to try (by using their blunt tool of setting the central bank interest rate) to keep the rate of inflation within their target inflation range of 2% to 3%.

“Inflation is now around 2% and is expected to remain near the middle of the Bank of Canada’s control range of 1% to 3% over the projection,” the Bank of Canada stated back on October 23. Today the Bank says: “CPI inflation has been about 2% since the summer, and is expected to average close to the 2% target over the next couple of years.”

Looking ahead to 2025:

The Bank of Canada may hold the rate at its current 3.25% in their January 29 announcement or drop it even further. Somehow all this action seems a bit too little a lot too late.

Having a target “adds an important anchor to the whole system”, says Macklem. Senior Deputy Governor Carolyn Rogers says she expects to hear more input from Canadians going forward, given the impact on the Canadian economy over the past few years.

Macklem will be making a year-end speech in Vancouver next week. Today he says the Bank expects to see a further uptick in household spending.

The Bank of Canada 2025 schedule for policy interest rate announcements is as follows.

- Wednesday, January 29

- Wednesday, March 12

- Wednesday, April 16

- Wednesday, June 4

- Wednesday, July 30

- Wednesday, September 17

- Wednesday, October 29

- Wednesday, December 10

Time on the clock:

All interest rate announcements are scheduled to take place at 9:45 am Eastern time (6:45 am Pacific), and the Monetary Policy Report will be published concurrently with the January, April, July and October rate announcements.

===== RELATED:

- Last interest rate announcement of 2024 coming up December 11 (December 4, 2024)

- Canada’s Premiers discuss border & tariffs with Trudeau (November 27, 2024)

- GST winter tax holiday misses political mark, frustrates businesses, and fails many families (November 23, 2024)

- Bank of Canada half-point interest rate drop (October 23, 2024)

- Bank of Canada lowers interest rate to 4.25% (September 4, 2024)

- Bank of Canada drops interest rate for 2nd time in 2024 (July 24, 2024)

- Eby continues to target Bank of Canada about interest rates (July 17, 2024)

- First Bank of Canada rate drop in four years (June 5, 2024)

- NEWS SECTIONS: BUSINESS & ECONOMY | POLITICS