Wednesday July 24, 2024 | VICTORIA, BC [Updated 8:10 am PDT]

Socioeconomic reporting by Mary P Brooke | Island Social Trends

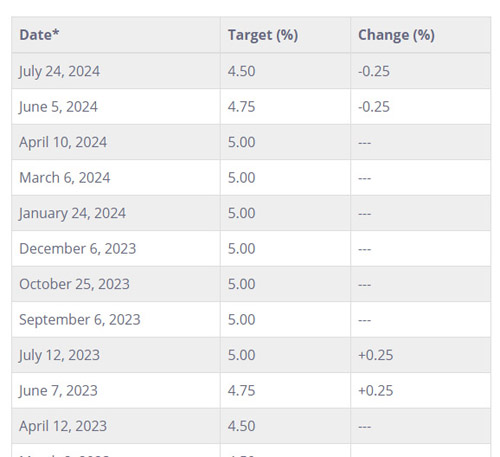

A cautious policy interest rate drop of 0.25% was announced this morning by the Bank of Canada on June 5, and another drop of 0.25% today July 24.

The Bank of Canada’s key interest rate was lowered to 4.75% in June, down from 5.0% (where it had been since July of 2023). That was the first rate reduction since March 2020. Today’s lowering to 4.5% is the second lowering of the interest rate this year.

Today Bank of Canada Governor Tiff Macklem said in his media session that there was “a clear consensus to lower the rate by 0.25%”. Any further decisions will be taken “one meeting at a time”.

Last month, Bank of Canada Governor Tiff Macklem indicated that more interest rate reductions were to come, but cautiously. A lower rate of inflation in June 2024 was the primary reason for the bank’s move to lower the rate today.

“Shelter price inflation remains high, driven by rent and mortgage interest costs, and is still the biggest contributor to total inflation,” said the Bank of Canada in their July 24, 2024 statement.

“Household spending, including both consumer purchases and housing, has been weak,” the Bank said today in its July 24, 2024 policy rate statement.

Today Macklem said regarding the impact of inflation and interest rates on “poor people”: “You can’t cut back on necessities. It’s a bigger part of their basket. Less savings, smaller saving buffers. The best thing monetary policy can do is get inflation down,” he said today.

But in fact, people have indeed been cutting back on ‘necessities’ like food; in many cases that’s because there is no wiggle room in household budgets. This will likely lead to health impacts that emerge later on, putting pressure on the health-care system not to mention people’s well-being.

Rates will not go back to pre-COVID levels, said Bank of Canada Governor Tiff Macklem said last month.

The next rate announcement is scheduled for September 4, 2024.

BC Premier on interest rates:

On June 5 during media questions, BC Premier David Eby took yet another shot at the Bank of Canada regarding how difficult things have been for families and households as a result of the many interest rate increases over 2022-2023 (and holding now half-way into 2024) which has bled into impacting the cost of housing as well. Eby reiterated his frustration again last week, on July 17.

Last year Eby took the lead — followed by other premiers — in commenting on the many consequences for families and small businesses as a result of the grinding impact of higher interest rates.

Last month, Eby posted on social media about the June 5 rate cut: “This is overdue but welcome. High rates have increased housing costs and will wrack people up for renewal, the biggest driver of inflation in BC.”

Today Deputy Governor of the Bank of Canada, Carolyn Rogers, told media that the housing shortages are due to “structural imbalances” in the sector that pre-date the interest rate increases of 2022 and 2023.

Gradual recovery:

“The path for interest rates is likely to be gradual,” said Macklem in June.

“Price pressures in some important parts of the economy—notably shelter and some other services—are holding inflation up,” the bank says today.

Growth in the first quarter at 1.7% was weaker than expected; the bank’s own forecast had been 2.8%.

Macklem said that indicates that individual households were reducing their spending. But of course the whole point of higher interest rates is to keep people and businesses from spending.

BC Premier David Eby has been vocal about the impact of high interest rates on the construction development of much-needed rental apartment buildings. Many developers are waiting until they can better afford the financing.

Recession no longer likely:

“So far it’s looking like a soft landing,” said Macklem last month regarding preventing a recession.

===== RELATED:

Eby continues to target Bank of Canada about interest rates (July 17, 2024)

First Bank of Canada rate drop in four years (June 5, 2024)