Monday December 14, 2020 | VANCOUVER, BC

by Mary P Brooke, editor | Island Social Trends

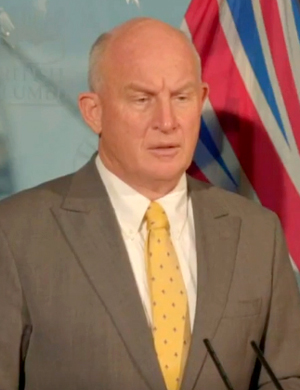

At this point it’s just an application to the BC Utilities Commission (BCUC) but Mike Farnworth, Public Safety Minister and Solicitor General, seems very sure it will produce a reality of vehicle insurance rebates for BC motorists in 2021.

“The rate filing will lay out why this is the right thing to do,” said Farnworth.

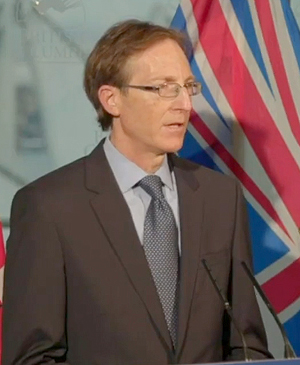

Minister Farnworth, with ICBC president and CEO Nicolas Jimenez alongside, addressed media today in Vancouver, with great enthusiasm about righting the financial woes of the ICBC ship and in so doing also bringing a no-fault insurance system which will result in reduced rates for drivers.

Jimenez said all the numbers are there to back up the application.

Moving to an enhanced care system will save $1.5 billion that would have gone to fighting cases in court, Farnworth explained today.

Saving about $400 for each driver:

With the introduction of ICBC’s new Enhanced Care coverage next spring, drivers will save on average 20%, or approximately $400, on their full basic and optional vehicle insurance.

As a key part of these savings, ICBC will apply to the British Columbia Utilities Commission (BCUC) on Tuesday December 15, 2020, for a significant decrease to basic insurance rates.

“A new auto-insurance system with more affordable premiums and greater care benefits is on the way for British Columbians,” said Mike Farnworth, Minister of Public Safety and Solicitor General. “If approved by the BCUC, this basic insurance rate decrease will be the largest in our province in more than 40 years. British Columbians deserve auto insurance that is affordable and takes care of them when they need it, and this is exactly what Enhanced Care will deliver.”

Enhanced Care model:

Enhanced Care will make auto insurance in B.C. more affordable, with the goal of keeping it that way. To support this, government has directed that ICBC’s basic rate application cover the next two years, which will help provide British Columbians with predictability on the basic insurance rate change through to at least 2023. The basic rate application also sets out how ICBC will begin building a rate stabilization fund to help ensure better rate stability in the future.

“ICBC is committed to more affordable insurance premiums and rate stability for British Columbians now and into the future,” said Nicolas Jimenez, president and CEO, ICBC. “The vast majority of British Columbians can expect to start seeing significant savings on their auto insurance in 2021, in addition to Enhanced Care refunds.”

Reduction on basic insurance rates only:

ICBC’s application is for basic insurance rates only and will seek a 15% decrease, which the vast majority of customers will receive. In addition to the savings put forward in the basic application, ICBC will also reduce its optional third-party liability rates starting February 1, 2021. This means customers with optional third-party liability coverage with ICBC who renew on or after that date will experience some of the savings from Enhanced Care then.

No application required for optional insurance adjustments:

ICBC does not have to file an application for adjustments to optional insurance, to which changes are made throughout the year in response to market conditions. Most drivers with ICBC basic and optional coverage can expect average savings of 20%, or approximately $400, once Enhanced Care launches on May 1, 2021.

One-time refund:

When Enhanced Care takes effect in the spring, millions of British Columbians will receive a one-time, pro-rated refund. It will be calculated using the difference between a driver’s current Autoplan coverage and the new, lower-cost Enhanced Care coverage, for the portion of their existing policy that extends past May 1, 2021.

Enhanced Care coverage $7.5 million:

With the vast majority of legal costs being removed from the insurance system, auto insurance will be more affordable. Enhanced Care will also provide British Columbians with significantly improved care and recovery benefits if they are injured in a crash, regardless of fault, with overall benefits of a maximum of at least $7.5 million. Following months of consultation with health-care and disability advocacy stakeholders, government expects to confirm further details of the care and recovery benefits in early 2021.

Background:

Enhanced Care savings: refund on the way

With the vast majority of legal costs removed from the system, Enhanced Care will provide average overall basic and optional insurance savings of about 20%, or $400. Some drivers will save even more, while some will have less-than-average savings.

Young or inexperienced drivers

For years, young or inexperienced drivers have paid higher premiums due to their increased risk of causing a crash and therefore their increased risk of being sued in B.C.’s current litigation-based system. Enhanced Care coverage will remove the vast majority of legal costs, resulting in higher-than-average savings for many young or inexperienced drivers.

ICBC customers with higher optional third-party coverage

Most drivers who purchase higher limits of optional third-party liability coverage currently – either $3 million or $5 million of coverage – can also expect to have higher-than-average savings. Under Enhanced Care, anyone injured in a crash in B.C. will no longer need to pursue litigation through the courts to receive all of the care benefits and compensation they need. This makes the cost of optional third-party liability coverage significantly lower. However, it will still be an optional coverage available to help protect customers – for example, when they drive out of province or cause non-vehicle property damage.

Drivers with ICBC’s basic and optional insurance

Customers who purchase basic and optional insurance through ICBC will have average savings of 20%, or $400. While customers who only have basic insurance coverage with ICBC (about 12% of personal insurance customers) will not benefit from the decreases in ICBC’s optional insurance coverage, they will still have average basic insurance savings of about $150. If those customers have optional liability coverage with a private insurer, they may also have a decrease in the cost of that coverage should the private insurer choose to pass on the savings.

Motorcyclists and niche customers

Some other customers will have savings that are lower than average, such as those who use seasonal vehicles like motorcycles and trailers, collector vehicles (since their insurance is typically less expensive) or customers who live in areas of the province where auto insurance is already less expensive. Other small or niche customer segments may have limited to no savings if their risk has not materially changed under Enhanced Care, such as vehicles that mostly operate outside of B.C., including long-haul vehicles and out-of-province buses. In those cases, drivers are still at risk of being sued under another jurisdiction’s auto insurance system.

Enhanced Care refund

When Enhanced Care coverage takes effect May 1, 2021, millions of British Columbians will be owed a one-time, pro-rated refund of the difference between their current Autoplan coverage and the new, lower-cost Enhanced Care coverage, for the portion of their existing policy that extends past May 1, 2021.

For example, a customer who renewed their annual insurance policy on Nov. 1, 2020, would have an expiry date of Oct. 31, 2021. After Enhanced Care coverage comes into effect on May 1, 2021, this customer will get a pro-rated refund for the difference between their existing rate and the new, lower rate for the six months of their policy that overlaps with Enhanced Care coverage (from May to October 2021). On average, their refund for those six months would be approximately 10%, or $200.

When this customer renews their first full annual policy under Enhanced Care coverage on Nov. 1, 2021, they will have the full benefit of the savings in their annual premium. At that time, this customer will save, on average, about 20% or $400, compared to what they paid for their full basic and optional policy the previous year (excluding their Enhanced Care refund).

Customers who purchase optional third-party liability coverage with ICBC after Feb. 1, 2021, may already have a portion of their Enhanced Care savings before May 1, and therefore will receive a lower refund amount.

These refunds will be issued in a timely fashion following the implementation of Enhanced Care. More details will be made available on the refund process in the coming months.