Saturday December 13, 2025 | LANGFORD, BC [Posted at 3:50 pm]

Political news analysis by Mary P Brooke | Island Social Trends

The 2026 budget deliberation season has begun in Langford.

Maintaining current service levels in the City of Langford will almost certainly require a property tax increase in 2026. That’s due to cost of living increases and service levies that are beyond the city’s control (e.g. fees paid to West Shore Parks and Recreation, the Greater Victoria Public Library, and EComm 911).

Most of Monday night’s debate at the City of Langford’s Committee of the Whole (COW) meeting (December 8, 2025) was to introduce any concerns around the council table, and to flesh out a general approach to the Budget 2026 deliberations that will unfold over the months ahead.

The meeting was attended in person by all of Mayor and Council: Mayor Scott Goodmanson, Councillors Kimberley Guiry, Colby Harder, Mark Morley, Lilian Szpak, Mary Wagner, and Keith Yacucha.

Preliminary budget drivers:

Staff outlined the preliminary drivers of the Five-Year Financial Plan to the Committee, which would result in a proposed 15.97% property tax increase.

However, this socially-attentive council led by Mayor Scott Goodmanson is aware that keeping taxes artificially low (as was done by previous councils as a way to create a tax-level comfort zone for property owners) would reduce current service levels and likely just push fiscal burdens into future years.

Bearing the weight of previous council decisions:

It could be said that the 2022-2026 council had its hands tied by the decisions of previous councils which drew funds from internal reserves (amenity fund) in order to keep property taxes artificially low.

But as was pointed out at the December 8 meeting, this favoured one set of Langford residents (largely longer-term property owners) over others and for the City has resulted in debt servicing costs and other burdens.

City of Langford property tax increases over the last five years have been:

- 2.95% (2021) / previous council

- 2.95% (2022) / previous council

- 12.41% (2023) / current council

- 15.63% (2024) / current council

- 9.77% (2025) / current council

As the current council as tried to deliver on enhancements in city services and amenities starting in 2023, they’ve often had to deal with legacy challenges from the previous council.

Examples of that would be the Westhills Langford (YMCA/YWCA) Aquatic Centre (aka ‘buying a pool’ as political critics would put it) and drawing funds from the amenity reserve as a way to artificially suppress tax increases up to 2022 (which led to a jump in taxes in years after that). As well, Langford had operated with relative disregard to an outdated Official Community Plan and without any detailed strategic plans; in the past three years the current council has taken on the overhead to realign the guidelines by which the municipality grows.

Regionally, the 10 south Vancouver Island municipalities (including Langford) that now have to pay Ecomm for 911 levies did nothing about that situation for years (it was first announced in 2019).

Key budget items:

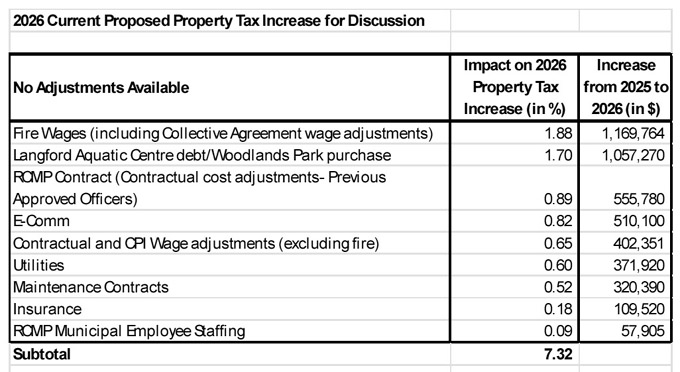

Staff presented a detailed breakdown of the proposed increase, highlighting items that fall under Council’s full discretion, partial discretion, and those that are non-discretionary due to existing contracts or previous decisions.

As is the case for most municipalities, policing and firefighter staffing costs are the largest items in the budget. For Langford, the largest carrying cost is for capital/assets already purchased, and then (after policing and firefighting), the Westhills pool deal comes next, followed by the Woodlands Park purchase, Vancouver Island Integrated Major Crime Unit, eliminating transfer from capital works reserve to cover capital debt servicing and city hall staffing.

After that comes projects like Lake Idea Anne remediation, CPI wage increases (excluding fire), Goldstream Avenue fountain repairs, maintenance contracts (e.g. roads, garbage), savings for IT replacements, and 2026 election costs.

The amount that has been paid annually to the Royal Roads Innovation studio startup will now be $75,000 for 2026 (half of what it was in previous years). The City of Langford does now make increasing use of the Royal Roads meeting space at the Langford campus on Goldstream Avenue wich helps spread out the city’s public engagement footprint.

The E-Bike rebate program is further down the list, as is staff travel and training, RCMP detachment municipal employee staffing, recreation facilities property management, animal control contract, Bylaw department E-bike purchase.

For reference, for 2026, a 1% tax increase equals $622,061.

Political crunch:

After this tax increase catch-up phase (2022 to 2026) — to take care of past missteps and to begin dealing with modern urban amenity growth, the current tax increase projection as presented by staff for three to five years that follow could be approximately 5% to 6 %.

Politically speaking this means that the council elected in 2022 (many of whom hope to be re-elected in 2026) have done the hard work of sorting out challenging legacy impacts. If not fully explained to the public in a way that is easy to understand, that could work politically against incumbents seeking re-election.

Four tax increase levels to consider:

While three options for consideration of many motions (budget or otherwise) is a comfortable level of work for staff and a tidy approach for council deliberation, council ended up supporting the desire to take a look at four tax increase options — all of them below the staff-proposed 15.9%.

Langford’s Director of Fiance pointed out that a tax increase of 7.32% is the minimum required to maintain current operational and debt-servicing levels.

Dropping the tax increase to 3% (a range similar to 2021 and 2022) would result in significant service level reductions.

Debate by mayor and councillors ensued as to:

- Whether increases of 3%, 6% or 9% should be considered for Budget 2026 and the 2026-2030 Five Year Financial Plan — that motion was presented by Councillor Colby Harder, seconded by Councillor Keith Yacucha; or

- Whether a tax increase of 11% should also be considered — that amendment was presented by Councillor Mary Wagner, seconded by Councillor Kimberley Guiry.

Wagner’s central point on considering 11% was based on maintaining current levels of City services and amenities (all of which requires staffing and maintenance) so that the impact on taxpayers is minimized.

Either the 9% or 11% tax increase level would allow for some room for future growth.

As it happened, Council (sitting as Committee of the Whole) ended up supporting Wagner’s motion (with Harder and Yacucha voting against).

Councillor Lillian Szpak (who sat on previous councils and has the most political experience on this council) ended up supporting Wagner’s motion.

Impact on renters:

Hopefully, council and the public won’t lose sight of the fact that when property taxes go up that rent for accommodation also goes up by the same (or higher) amount. That’s so property investors (of which there are many in Langford) can satisfy their mortgage obligations.

This puts a tremendous squeeze on renters who — in many if not most cases — have incomes that don’t escalate in-keeping with the cost of living let alone tax increases on property that they don’t own.

Not only are the pressures financial but also social — e.g. more members of a household living together, or taking in roommates.

Economic and social realities:

Council is aware of the pressures on households by continued cost of living increases (paired with wages/earnings that frequently don’t keep up) and pressures on businesses that help keep people employed.

As Langford grows (currently a population over 50,000 which is expected to reach 100,000 within 25 years), Council often articulates how that requires enhancing a wide range of services and amenities that urban residents expect in their community.

Advancements in transportation (routes and improvements), active transportation (including sidewalks and safe routes to school), parks and trails (including more greenspace), arts and culture, and overall economic development are key strategies developed by this council under Mayor Goodman’s leadership that will — over time — deliver a more modern standard of community experience for Langford residents.

Deliberations begin in January:

Presentation of the first draft of the 2026-2030 Financial Plan will take place in January.

On the 2026 City of Langford meeting schedule that currently shows as happening on January 20 and 26 as well as February 10 and 19.

Incidentally, both Councillor Harder and Councillor Yacucha (who were not in favour of the December 8 motion to also consider a 11% tax increase) also sit on the Community Advisory Committee which will likely see budget restraints as well this year as they preside over the grants that Council says are so relied-upon for the advancement of causes in the community at relatively little expense to the city (usually greatly supported by volunteer labour).

Langford public budget survey:

In the new year there will be opportunities for public participation including a survey for residents to provide their input.

To receive updates regarding the 2026 budget process and be notified as to when the survey is live, Langford residents are encouraged to check out LetsChatLangford.ca (signup if not aleady registered).

===== RELATED:

- Langford hosts consultant-led info session on policing & public safety (December 12, 2025)

- Langford 2025 property taxes now in the collection phase (June 4, 2025)

- Langford funding for police services within 2025 budget constraints (March 26, 2025)

- City of Langford council deliberates on Budget 2025 and 5-year financial plan (February 23, 2025)

- City of Langford 2025 Budget Survey online to Feb 9 (January 21, 2025)

- Langford council approves six-acre land purchase for natural park (January 14, 2025)

- Langford buying manufactured home park to add six urban forest acres (January 9, 2025)

- Langford to buy Westhills Langford Aquatic Centre building & parking lot (December 17, 2024)

- Langford seeks public input on purchasing the Westhills YW/YMCA (November 9, 2024)

- NEWS SECTIONS: LANGFORD | BUDGET 2026 | BUSINESS & ECONOMY | FAMILY & SOCIETY | URBAN PLANNING & DEVELOPMENT