Thursday June 30, 2022 | LANGFORD, BC

by Mary P Brooke | Island Social Trends

Property taxes make the wheels turn. That’s the main source of revenue for any municipality.

Municipal property tax rates are set by the City of Langford. The revenue from these taxes is used for public services such as police and fire protection, street lighting, road and drainage maintenance and operating parks and recreational facilities. Your tax notice may also include local services levies calculated on a parcel basis or on the frontage of your property, rather than on its assessed value.

The City of Langford has taken pride over the years in keeping the tax rate as low as possible.

Tax notices were sent by mail:

In the City of Langford, property tax notices were mailed by the end of May, and taxes are due on Monday July 4, 2022. That’s right after the Canada Day long weekend.

For next year, if you want to receive your tax notice by email, complete the e-notice tax form. If you are updating your email address, call the Property Tax Department at 250-391-3410. The deadline for registration for 2023 electronic tax notices is April 30, 2023.

Penalties for late payment:

Any current outstanding balance after July 4, 2022 — including unclaimed Home Owner Grants — are subject to penalty fees (5% on July 5, and an additional 5% on September 1).

Each year there are some people who for a range of reasons pay late, and therefore find their taxes subject to the penalty process.

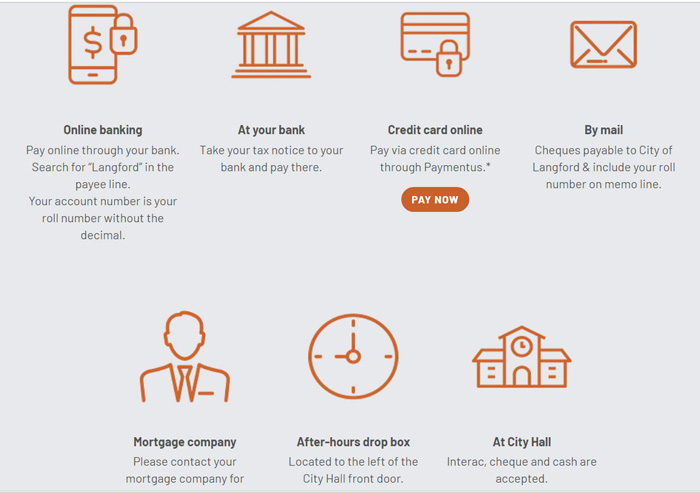

How to pay:

There are seven ways to pay your City of Langford property taxes.

That fullsome list of ways is; online banking, at your bank, credit card online, by postal mail, through your mortgage company, into the after-hours drop box at city hall (877 Goldstream Ave), or in person at Langford City Hall (by Interac, cheque or cash).

Paying your taxes online is what the City prefers. They don’t accept e-transfers.

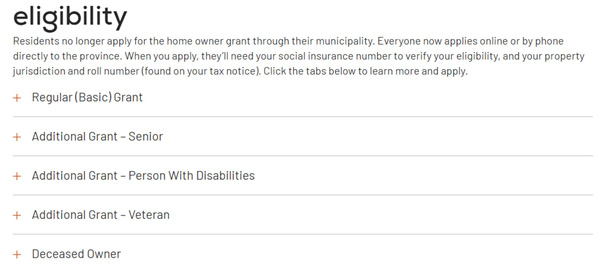

Claiming your homeowner grant:

The City reminds taxpayers to claim your Home Owner Grant.

The provincial home owner grant program is a property tax relief program to assist eligible owners reduce the burden of residential property taxes. The home owner grant reduces the amount of property tax you pay for your principal residence and must be claimed each year, if eligible. Unclaimed grants constitute unpaid current taxes and are subject to penalty.

Residents no longer apply for the home owner grant through their municipality. Everyone now applies online or by phone directly to the province. When you apply, they’ll need your social insurance number to verify your eligibility, and your property jurisdiction and roll number (found on your tax notice). Click the Home Owner Grant information tabs on the City of Langford website to learn more and apply.

The home owner grant may be available retroactively if you qualified last year and didn’t apply.

Didn’t get your tax notice?

If you are signed up to receive your 2022 tax notice via email and have not received it, please check your junk mail folder. You could add “e.services@langford.ca” to your safe sender list.

Property tax deferment:

The Provincial Property Tax Deferment program is a low interest loan program that helps qualified B.C. homeowners pay their annual property taxes on their principal residence. Click the “Learn More” button below for available programs.

The Provincial Tax Deferment program is fully administered by the province, not the City. All property tax deferment applications are submitted online through eTaxBC. For assistance, contact the province at l-888-355-2700 or taxdeferment@gov.bc.ca.

Speculation and Vacancy Tax:

The Speculation and Vacancy Tax is a provincial tax and is not administered by the City. For more information regarding the Provincial Government’s Speculation and Vacancy Tax.

Homeowners & renters:

Property taxes are paid by residential (and commercial) property owners.

Renters are also effectively paying property tax through their rental payments.

===== OTHER LANGFORD NEWS:

26th annual Langford charity golf tournament tops $175K (June 23, 2022)

Central Langford greenspace gets 1.35-acre boost (June 21, 2022)

Local film leadership hopes for film studio in Langford (June 20, 2022)

Langford Station: a new beginning (June 14, 2022)

Langford mayor heading to Ukraine with GlobalMedic team (June 8, 2022)