Tuesday June 22, 2021 | LANGFORD, BC [ UPDATE June 25: the correct phone number for information about the Home Owner Grant is 1-888-355-2700 ]

by Mary P Brooke | Island Social Trends

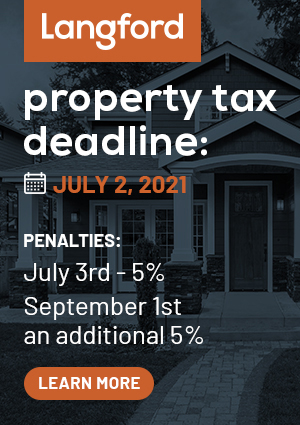

If you own a home, you know this as tax season. This year property taxes for all municipalities throughout BC are due on July 2, 2021 (right after the July 1 Canada Day holiday). If you’re a renter, you are actually also paying local and regional property taxes through your rent (by way of whoever owns your property).

New for 2021: The Provincial Home Owner Grant program is now fully administered by the Province, not the City. All Home Owner Grant applications must be submitted online through the province’s website. The Home Owner Grant application process has changed, but program details and eligibility requirements have not changed.

Langford Property Taxes:

In the City of Langford, annual property tax notices are sent to all property owners by the end of May. Property taxes cover the calendar year and are due July 2, 2021.

If you pay after July 2 there are penalties. As of July 3 you would owe an additional 5% penalty. Any amounts still outstanding at September 1 will incur an additional 5% penalty.

How to pay your property taxes:

For the 2021 tax year, Langford urges property owners to pay online if possible. But here is the full range of ways to pay:

- Online Banking – Pay online through your bank. Search for “Langford” in the payee line. Account number is your roll number without the decimal.

- At your bank – Take your tax notice to your bank and pay there.

- Credit card online – Pay via credit card online through Paymentus* (*=Service charges apply)

- By mail – Cheques payable to City of Langford & include your roll number on memo line.

- Mortgage company – Please contact your mortgage company for details.

- After-hours drop box: Located to the left of the City Hall front door.

- At City Hall – Interac, cheque and cash are accepted.

Property tax deferment:

The Provincial Property Tax Deferment program is a low interest loan program that helps qualified B.C. homeowners pay their annual property taxes on their principal residence.

Please note that the Provincial Tax Deferment program is now fully administered by the province, not the City. All property tax deferment applications are submitted online through eTaxBC. For assistance, please contact the province at l-888-355-2700 or taxdeferment@gov.bc.ca .

How your property is taxed:

- Each year, the municipality, school districts, regional district, hospital district, and other public agencies need revenue for the services they provide to the residents of Langford.

- Each public agency with taxing authority sets a budget for the amount of tax revenue it requires. Tax rates vary among property classifications and are calculated by dividing the budget needs of the agency by its assessment base.

- The appropriate tax rate is then applied to individual property assessments, and the tax levy is calculated.

- Municipal property tax rates are set by the City of Langford. The revenue from these taxes is used for public services such as police and fire protection, street lighting, road and drainage maintenance and operating parks and recreational facilities. Your tax notice may also include local services levies calculated on a parcel basis or on the frontage of your property, rather than on its assessed value.

- School tax rates applicable to residential properties are set by the provincial government. Residential school taxes are based in part on the number of residences, as well as the total assessed value of residential property in the province, creating a different tax rate in each school district.

- School tax rates applicable to non-residential properties are also set by the provincial government. The rates vary by property classification, but are uniform throughout the province within each non-residential property class.

- Other taxes shown on the tax notice raise revenues on the budget needs set by local government bodies such as the Capital Regional District, Capital Regional Hospital District, BC Assessment Authority, Municipal Finance Authority and Regional Transit Commission.

Going paperless:

If this is your first time signing up for e-notices, please complete the form on the Langford tax information page. If you are updating your email address, please call the Property Tax Department at 250-391-3410. The deadline for registration for 2022 electronic tax notices is April 30, 2022.