Tuesday June 20, 2023 | LANGFORD, BC

by Mary P Brooke | Island Social Trends

All the information that you need about paying your Langford property taxes is on the City of Langford tax information webpage.

Property tax notices were mailed out at the end of May (or sent by email from e.services@langford.ca if you’re on the tax notice email list). Taxes are due July 4, 2023.

Penalties after July 4:

Any outstanding balance after July 4, 2023 (including unclaimed Home Owner Grants) will have a penalty levied. As of July 5 five percent interest will be applied and an additional 5 percent applied at September 1.

Where your tax dollars go:

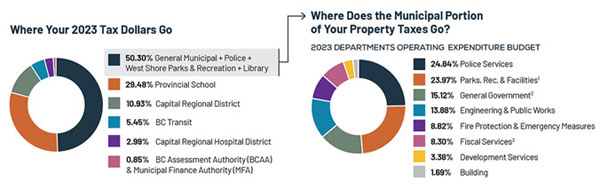

Earlier this year, a comprehensive presentation was given by the city’s director of finance, explaining various aspects of the 2023 budget. He began his presentation with an explanation of how property taxes are levied… i.e. how much goes to the city (for a wide range of municipal services) and how much is collected by the city but then forwarded to other agencies (like the Capital Regional District, BC Transit, BC schools, Capital Regional Hospital District, BC Assessment Authority, and Municipal Finance Authority).

The municipal portion covers the wide range of services that residents expect in their community, including: police services, parks and recreation, engineering and public works (including street lighting and road maintenance), fire protection and emergency measures, fiscal services, development services, buildings, and the overall cost of running government (e.g. salaries, offices, etc.).

Tax increase is higher this year:

Last month, City of Langford council approved a 12.41 percent tax hike for 2023. That was after much public angst as expressed during public participation and budget discussions, as well as occasionally by some placard-carrying protesters outside city hall.

In most previous years, tax increases approved by the previous council were kept to between two and two-and-a-half percent.

As was explained by the city and understood by the new mayor and council during the budget deliberations, there was a need to increase taxes to deal with the YM-YWCA contract, and to help replenish reserves that had been drawn down during the pandemic years in order to keep tax increases at a steady rate around two percent.

As the city grows (population is now over 50,000 and more people keep coming) the range of services that people expect in an urban centre do increase and often become more complex. Among other things, the city has hired several more staff to handle in the increased work load.

As Langford grows with many more families here, the school tax increases. School tax rates applicable to residential properties are set by the provincial government. Residential school taxes are based in part on the number of residences, as well as the total assessed value of residential property in the province, creating a different tax rate in each school district. Langford is in Sooke School District 62.

Mayor’s comments:

“There’s nothing we can (do to) make everyone happy, and I recognize that and I realize that no matter what the answer at the end is, there’ll be people who are upset,” said Langford Mayor Scott Goodmanson during the May 1 council meeting.

“Unfortunately, that is just the process unless you have a zero tax increase and then you’d have a lot of people mad for the services that were cut,” said Goodmanson.

During the budget process, Goodman expressed complete confidence in the Director of Finance, Michael Dillabaugh, and the finance department staff.

How to pay:

Taxes can be paid through online banking, at your bank, by credit card online, or by cheque through postal mail. Details are on the Langford Property Tax information page.