Monday August 31, 2020 ~ NATIONAL

by Mary P Brooke, Editor ~ Island Social Trends

Small businesses are the backbone of our economy but they continue to face economic challenges and uncertainty during the COVID-19 pandemic.

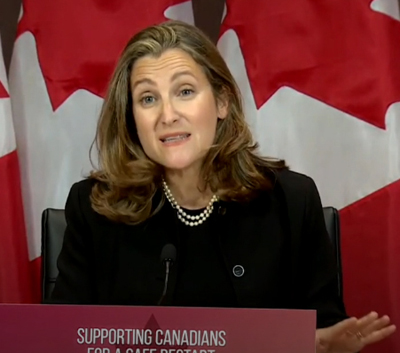

Deputy Prime Minister and Minister of Finance, the Honourable Chrystia Freeland, today announced that the application deadline for the Canada Emergency Business Account (CEBA) has been extended from August 31 to October 31, 2020.

She expressed keen support for business, noting that small business is the backbone of the Canadian economy.

CEBA has been popular for it’s lure of a 25% portion not being repayable if the loan is otherwise paid back in full by December 31, 2022. The interest-free loans are $40,000 each, with $10,000 not required for payback if the remaining $30,000 is paid by year-end 2022.

Due to the complexity of application, however, applications have been slow-going. And there’s a bizarre process that if you don’t get approved you’re not told, but it you are approved the money just suddenly appears in your business bank account.

Qualifications include having a minimum of $50,000 in non-deferable annual expenses (such as rent, utilities, and salaries). For smaller businesses that is a high bar to achieve.

So there’s been criticism that the CEBA loans are easily attained by businesses who don’t actually need them for toughing out the pandemic economic challenges.

Working with financial institutions:

The government says it is working closely with about 234 financial institutions to make the CEBA program available to those with qualifying payroll or non-deferrable expenses that have so far been unable to apply due to not operating from a business banking account.

Further details on these changes will be released in coming days, including a new business account opening process through which qualifying businesses will be able to apply.

Only 25% of fund disbursed so far:

As of August 27, 2020 more than 730,000 CEBA loans have been approved, representing more than $29 billion in credit disbursed but that’s only about 25% of the available fund.

This slow-going could in part be due to how complex and nuanced the application process has been, including having to go through financial institutions which adds more layers of complexity.

BCAP program for operational support also extended:

Freeland also announced that the Business Credit Availability Program (BCAP) is extended to June 2021. Through BCAP, the government is supporting the flow of additional credit that businesses need to maintain operations and keep employees on the payroll.

Export Development Canada (EDC) and the Business Development Bank of Canada (BDC) will continue to work with lenders to support access to capital for Canadian businesses of all sizes in all sectors and regions.

Economic response during COVID:

The federal government says that CEBA and BCAP are both part of the Government of Canada’s COVID-19 Economic Response Plan, “which is helping Canadians and businesses deal with the economic impact of the ongoing pandemic”.

“The measures under this plan are helping businesses protect the jobs that Canadians depend on, keep their doors open, and bounce back as the economy gradually recovers,” it was stated today.

However, it has in fact taken several revisions since the pandemic hit back in March to develop and re-adapt various supports for business. Over the months, the government has recognized more realities about how small businesses in particular operate and try to survive in the Canadian economy (both pre-pandemic and now).

COVID second wave:

The evident likelihood of a COVID-19 second wave (uptick in infections) this fall is probably behind the extensions of the CEBA and BCAP programs.

This also comes in parallel timing to the reshaping of the current Canada Emergency Response Benefit (CERB) into a flavour of the Employment insurance (EI) program, which is set to be rolled out as part of the September 23 Throne Speech in Ottawa.

A vaccine — if one is developed — is not likely to be manufactured and delivered well into 2021 (also discussed in Freeland’s press briefing today).