Wednesday November 22, 2023 | VICTORIA, BC

by Mary P Brooke | Island Social Trends

The BC Speculation Tax has been extended to 13 municipalities in seven more regions of the province, as announced today by Finance Minister Katrine Conroy and Housing Minister Ravi Kahlon.

The Province is taking action to fight real estate speculation and turn more empty units into homes for people by expanding the speculation and vacancy tax to 13 new municipalities. “It’s wrong that we have investors who own multiple homes and leave them empty while young families struggle to find housing,” said Kahlon.

The speculation and vacancy tax will be applied to the following municipal boundaries, as the government aims to help ensure more empty homes are made available for the people who work and live there:

- Vernon, Coldstream;

- Penticton, Summerland;

- Lake Country, Peachland;

- Courtenay, Comox, Cumberland;

- Parksville, Qualicum Beach;

- Salmon Arm; and

- Kamloops.

Residential property owners in these communities will need to declare for the first time in January 2025 based on how they used their property in 2024. This gives owners in the new areas time to decide how to meet exemption requirements before the tax takes effect. | Full news release Nov 22, 2023 | Press conference livestream Nov 22, 2023

Flexibility:

Exemptions include primary residences, properties with a long-term tenant and life events, such as separation or divorce.

More than 99% of people living in B.C. are exempt from paying the tax.

Keeping up with population growth:

“Right now, the fundamental challenge we have is that we have a strong economy and people from all over the world across Canada coming to British Columbia but our housing has simply not kept pace,” said Kahlon in a media session at the legislature today.

“I’ve said many times, that we need the private sector to build certain types of housing but we really need to build more non-market housing and that has been our focus. We can’t solve the problem with one solution alone.”

“When you have many people looking for limited amount of rental spaces you’re going to see prices go up. And that’s why the strategy that we’ve launched — all the pieces that we’ve launched — work together to ensure that we can right-size the amount of supply to the demand in our communities,” said Kahlon in reply to a question from Island Social Trends.

Enormous success:

“We’ve had enormous success in places where the speculation and vacancy tax has been applied. Thousands of homes are now being lived in because of this. It’s been making a difference in the lives of people and we have to keep going. This tax targets investors who buy homes & leave them empty. Homes are meant to be lived in,” said Kahlon.

“There is a housing crisis across the country and it is creating economic challenges, including people feeling pushed out of their communities and labour shortages,” said Conroy. “With so many people struggling to find secure housing, we have to keep taking action – we can’t afford to pull back. The speculation tax is one of the ways we can help increase affordable housing options for people and communities.”

An independent review released in 2022 found that the tax had helped deliver more than 20,000 homes in Metro Vancouver alone.

The report included recommendations that government consider taking a phased approach to expanding the speculation and vacancy tax to additional communities to build on the success of the measure and deliver more homes for people.

“While some would cancel the speculation tax – giving a handout to speculators and turning homes into empty condos – we know people can’t afford that,” said Kahlon today.

BC Homes for People:

Expanding the speculation tax is part of B.C.’s Homes for People plan that includes actions to fight speculation, deliver more homes within reach for people, and speed up delivery of new homes.

“There’s something wrong when people are buying up investment homes and keeping them empty while others are living in vehicles and can’t find housing,” said Ravi Kahlon, Minister of Housing.

“Homes are meant to be lived in by people in our communities, not used for speculation. While some would cancel the speculation tax – giving a handout to speculators and turning homes back into empty condos – we know that people can’t afford that. We’re taking action to make more homes available for people throughout the province.”

Background:

- The speculation and vacancy tax was initially expanded to six new communities in 2022 for the 2023 tax year.

- With the addition of these 13 communities, the tax will apply to a total of 59 communities.

- Since 2018, more than $313 million was raised through the tax to go back into affordable housing in regional districts where the speculation and vacancy tax is applied.

- During the same period, the B.C. government invested $3.9 billion in housing initiatives in the regional districts where the speculation-tax communities are located.

- The speculation and vacancy tax rate is 2% for people who don’t pay the majority of their taxes in Canada, or 0.5% for Canadian citizens or permanent residents who pay the majority of their taxes in Canada.

RELATED ARTICLES BY ISLAND SOCIAL TRENDS:

- Federal 2023 fall economic statement disappoints on housing; too slow for BC (November 22, 2023)

- Late Monday evening session to deal with housing legislation (November 20, 2023)

- New housing legislation will support population growth in Sooke (November 17, 2023)

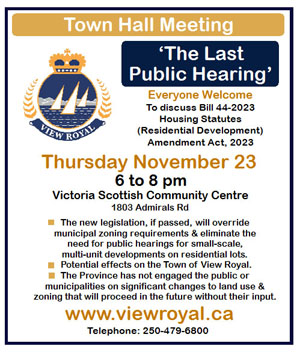

- View Royal & Oak Bay push back on housing legislation (November 17, 2023)

- Housing supply boost with off-the-shelf multiplex designs (November 16, 2023)

- Saanich is up to the task of building more homes quickly, says Mayor (Opinion-Editorial – November 13, 2023)

- Housing legislation takes affordability into account, says Minister Kahlon (November 10, 2023)

- Smart combo: more housing near transit hubs (November 8, 2023)

- Pushback on housing legislation over cost impacts, municipal load, development chill (debate by the Opposition, Nov 9, 2023)

- BC legislation to streamline delivery of homes, services, infrastructure (November 7, 2023)

- Hoped-for housing explosion based on multi-unit zoning (November 2, 2023)

- Clamping down on short-term rentals to free up housing stock (October 16, 2023)

- BC Legislature Fall 2023 session: housing, emergency management, crime, international credentialing, reconciliation (October 1, 2023)

- BC housing initiatives announced twice this week (September 29, 2023)

- POLITICAL NEWS ARCHIVE (Island Social Trends)