Friday December 18, 2020 | VICTORIA, BC [Updated 12:22 pm and 1:55 pm]

by Mary P Brooke, editor | Island Social Trends

This morning is day one for access by British Columbians to the website where families, single parents and individuals can apply for the BC Recovery Benefit.

Benefit eligibility is based on net income from your 2019 tax return. You must apply to receive the benefit.

The application website is here: BC Recovery Benefit . You will need various pieces of information (including net income from your 2019 tax return, Social Insurance Number, driver’s licence number).

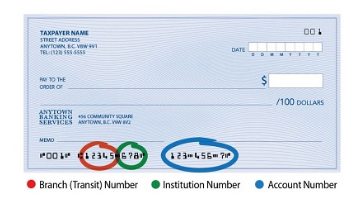

You will be asked for your personal chequing account information so that the funds can be deposited directly into your bank account.

Applications can also be done over the phone starting Monday December 21, by calling 1-833-882-0020.

Site working slowly:

The website has experienced a bit of overload. Application for the benefit can be done up to June 30, 2021, so there’s no rush. But given the long hard pandemic year and Christmas being right around the corner, there is understandably high demand on the server today.

“The system is online and you can apply now — it is just working a bit slowly for some people. But is it working,” says BC Ministry of Finance communications director Lisa Leslie. “As of 11 am, more than 20,000 British Columbians have successfully applied,” she told Island Social Trends this morning.

Preparing for the load:

“We had tripled our server capacity but there is a lot of public interest,” says Leslie. “We are asking people to be patient and keep refreshing their page as the system gets back up to speed,” she said.

Meanwhile, even by refreshing and getting through to the site, there is still an interruption (uavailability) to proceed further, at least at one point in the initial interface. Some people may decide to give it a rest and come back at a later time.

One resident in Colwood said the application process took him three hours from start to finish. The page kept refreshing, requiring data that was enter to be re-entered. But he did end up with a confirmation number at the completion of it.

About the benefit:

The amount you’re eligible for will be automatically calculated based on your income when you apply.

For families and single parents: $1,000 for eligible families and single parents with a net income of up to $125,000. Reduced benefit amount for eligible families and single parents with a net income of up to $175,000.

For individuals: $500 for eligible individuals with a net income of up to $62,500. Reduced benefit amount for eligible individuals with a net income of up to $87,500.

Who benefits:

An estimated 3.7 million individuals and families — or 90 percent of all BC adults — are eligible for the benefit, says the BC Ministry of Finance.

Finance Minister proud of the program:

Earlier this week, BC Finance Minister Selina Robinson was pleased that cabinet and government are delivering on the recovery bonus promise that was outlined during the fall 2020 election campaign leading up to the 42nd Provincial General Election on October 24.

That the government got this in place ahead of Christmas is a real feather in Premier Horgan’s cap.

During the campaign it was mentioned that income thresholds would be part of eligibility and payout amounts under this program, but it was not indicated at that time about submitting an application — the implication was that based on tax data already in the government system that the benefit would be automatically issued ‘around Christmas or early in the new year’, as it was mentioned several times by the premier in his media availabilities.