Sunday October 3, 2021 | VICTORIA, BC

by Mary P Brooke, Editor | Island Social Trends

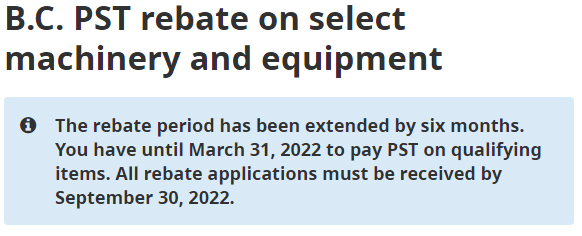

A StrongerBC program that refunds businesses the Provincial Sales Tax (PST) paid on select machinery and equipment will be extended for an additional six months, as announced September 29, 2021.

This extension will give businesses another chance to reduce costs and make new investments to adapt to the changes the pandemic has required, and to set them up to take advantage of future opportunities, the government said in a news release this past week.

Short-term recovery, long-term growth:

“When we consulted with the business community on our StrongerBC Economic Recovery Plan, they told us a PST rebate would help them make the kind of capital investments that would not just be about short-term recovery, but also long-term growth,” said Selina Robinson.

“As the program deadline approaches, we see there is still a need, so we are extending the program to give more businesses time to apply.”

New deadline is March 31, 2022:

Businesses will have until March 31, 2022 — an additional six months — to purchase qualifying items like tools, furniture, computers, software and zero-emission vehicles and charging equipment.

Incorporated businesses can make up to three separate claims for a 100% rebate of the PST paid on all qualifying items purchased between September 17, 2020 to March 31, 2022.

All rebate applications must be received by September 30, 2022.

Who can apply:

This is a business-focused rebate. All incorporated businesses may apply, *except for* a specific list that includes schools, school boards and universities, including business, trade and vocational schools, as well as charities, non-profits and hospitals.

The goods must be obtained substantially (more than 90 percent) for the purpose of gaining or producing income and be purchased or leased in BC.

Businesses are invited to become incorporated (if not already incorporated) in order to qualify for this rebate program.

Comes after consultation:

The Ministry of Finance spokesperson says that the Minister and Ministry officials have regular contact with the business community.

The initial consultation with business was through the development of the StrongerBC Economic Recovery Plan.

“We heard that a PST rebate would help them make the kind of capital investments that would not just be about short-term recovery but also long-term growth,” it was stated by the Ministry this past week.

“We also know that the recovery was different for everyone. There are businesses who may only now be ready to make the kind of growth-fueling investments that this program supports so we are giving them the time they may need.”

Deadline extension:

As the program deadline approached, we saw that there was still a need, so we are extending it for another six months to give businesses time to apply, the ministry said.

The Ministry says it is aware that the COVID-19 pandemic has “brought on new challenges for businesses and for some that means new expenses”.

PST relief:

Relief from paying the PST helps businesses reduce costs, both new and recurring. The government also feels that the rebate of those fees helps encourage businesses to make new investments.

Of course, businesses need to have the funds to spend in the first place, before being able to take advantage of a PST rebate.

Wide range of items:

The PST rebate is applicable to items like tools, furniture, equipment, computers, software and zero emission vehicles.

“The rebate applies to some of the most commonly used capital cost allowance classes from the federal income tax system,” says the Finance Ministry. The eligible asset classes are listed in more detail here: https://www2.gov.bc.ca/gov/content/taxes/sales-taxes/pst/rebate-machinery-equipment

Most rebates so far to construction, transportation and retail:

So far the construction industry has been the largest recipient by sector, followed by the transportation and retail sectors, the Ministry has said in a statement to Island Social Trends.

As one case in point, the Ministry feels that “even a very small business that decides to invest in a new zero-emission vehicle can see tax savings of more than $3,000”.