Saturday March 28, 2020 ~ BC

COVID LIFESTYLE INSIGHTS: by Mary Brooke ~ West Shore Voice News

So you’re at home self-isolating. Lots of virtual connection going on with friends and family, and for many as well also for continued employment at home.

Electricity has been a fundamental plank of modern life ‘forever’. So essential it is, try to imagine how you’d get by now in social isolation without it. OK, maybe not think about that.

But planning for how you’re going to pay for continued billings (possibly higher due to increased usage), that’s important now. Along with all the other important new things to deal with during this COVID-19 pandemic that is upon us.

BC Hydro was quick to point out (in a news release on March 13, 2020) that bill payment arrangements can be made, so that one bill is paid over two or three installments. That’s helpful. But it still implies that your situation allows for enough income coming in to manage during a bill-payment marathon.

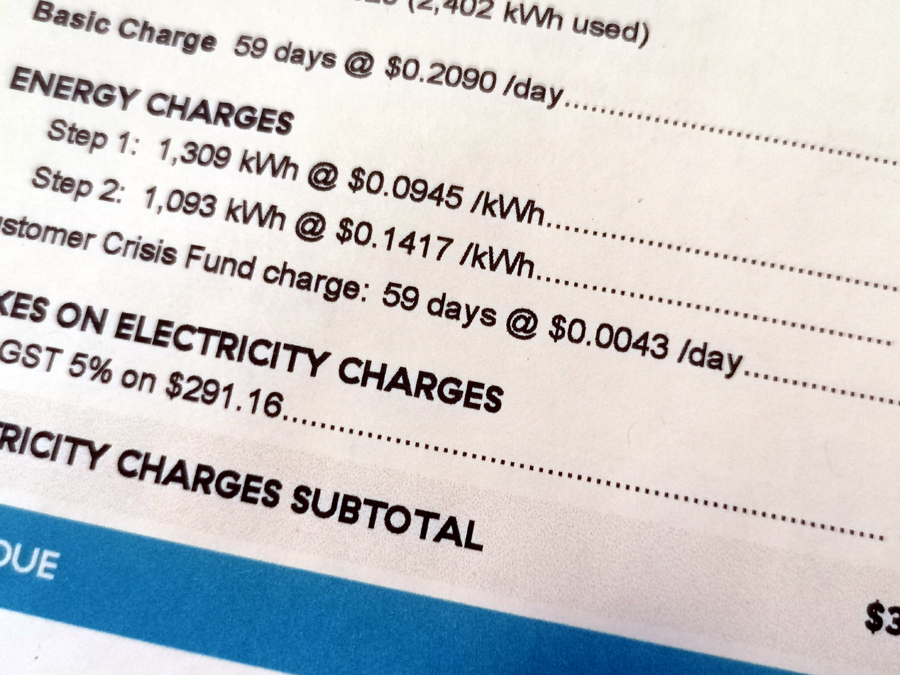

As well, BC Hydro mentions their Customer Crisis Fund, which has actually been in place for a while. Check back over your old billing statement — you’ve already been paying into it. So this is no freebie from the utility all of a sudden for the COVID-19 pandemic.

The BC Hydro Customer Crisis Fund current rate is $0.0043/day (or about 25¢ on a $300 residential hydro bill), though that’s down from the $.00820/day where it was pegged for most of 2019.

The crisis fund — at least at this point — only applies if you’re facing a disconnection notice, despite the way it is presented during COVID-19 as a saving grace: “Customers facing temporary financial hardship and possible disconnection of their service due to job loss, illness, or loss of a family member may also be eligible for BC Hydro’s Customer Crisis Fund, which provides access to grants of up to $600 to pay their bills.” Leaving your bill until it’s close to disconnection is not a ‘game of chicken’ that people would play for fun.

So the next thing is to cut back on electricity usage, which is tough when you’re working from home, keeping the family entertained on gadgets, and running the TV more and more as news continues to be updated.

Most of us already know the usual recommendations for conserving electricity, such as running the laundry load with cold water instead of warm or hot, turning out lighting that is not needed, turning down the thermostat at night (which also conserves gas, oil or geothermal), running the dishwasher only when full, using solar lighting for outdoor activity areas, and so on.

But when you’re stuck at home during a pandemic, there are other considerations. Apparently we’re now supposed to wash our clothes at warmer temperatures (to kill any viruses possibly brought in from shopping trips, etc.), we are probably spending more time online and on the phone (which cranks up the number of recharging periods for your phones, tablet and so on), you’re probably running the TV and dishwasher more than before (more time to watch TV and you’re now making all your own meals), and you’re probably driving your hot water tank harder (more hand washing with warm water, more showers, more laundry, more general cleaning, and so on).

Deferring your hydro bill (or any regular billing) sounds good for now. But short of having no future economy at all, it will still come due. Even without reliable income during COVID-19, it’s probably better to try and get those bills paid somehow, rather than face a tsunami of bills due (or overdue) when the economy starts gearing up again.

“This is not forever, this is for now,” as BC Public Health Officer Dr Bonnie Henry has said over the last many weeks. Lifestyle management — including bill payments — is probably something better paced than deferred. You wouldn’t (or couldn’t) hold your breath longer than possible. Likewise, your personal finances can’t be put on indefinite hold during COVID-19. Small easy breaths, small managed payments… that’s probably the way to move forward during the pandemic sprint.

Bottom line — if you expect the economy to eventually bounce back — and of course we all do — then keep up with your bill payments as best you can. Otherwise, the sheer energy and commitment of time and attention it takes to fiddle around the edges of adjusting every bill in the pile becomes a job in itself.

The federal Canada Emergency Response Benefit (CERB) program as announced March 25 and the BC provincial top-ups (updated March 27) frankly are a Godsend; we are fortunate to have progressive governments t in this time of need. Whether those financial support come soon enough in April has yet to be seen; the sheer volume (and complexity) of application, processing and delivery of those payments could see the actual arrival of funds in May for some Canadians. We may look back on April 2020 as a very chaotic month for family financing where everyone will just have to ‘make do’ somehow.

West Shore Voice News subscribers get daily thoughts by email.

Digital Subscriptions available anytime.

Most of us are probably already thinking about how to deal with the looming specter of the floodgates opening after the pandemic and too many things needing to be paid all at once. As Dr Henry also says: “This is a marathon, not a sprint.” One step at a time, with the expectation of more steps to come, for a while.

~ MPB