Thursday June 8, 2023 | VICTORIA, BC [Updated 6 am June 9, 2023]

by Mary P Brooke | Island Social Trends

Over 200 people attended a Greater Victoria Chamber of Commerce luncheon today to hear remarks from the Deputy Governor of the Bank of Canada, this being one day after the latest interest rate announcement.

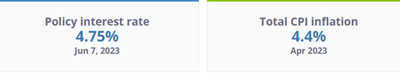

Yesterday the bank rate was increased by another 25 basis points to 4.75%. The Bank is this year still continuing it efforts to tamp down inflation after ratcheting up the interest rate seven times in 2022 and again for an eighth time in January 2023.

The audience paid rapt attention. | Click here to hear the full speech June 8, 2023 by Deputy Governor Paul Beaudry in Victoria.

The pause didn’t last long:

Interest rates sat at 0.25% for quite a while after the fallout from the 2008 Great Recession.

In 2022, the interest rate was first increased in response to inflation on March 3, by 0.25% to 0.50%. Then on April 14 there was a significant jump all at once to 1.0%. That was quickly followed by a jump to 1.75% on June 2, 2022. That was followed by a massive jump of one full percent up to 2.5% on July 14. On September 8, the rate was pushed up again, to 3.25%, where it sat for a short time, being followed by an increase to 3.75% on October 27 and to 4.25% on December 8, 2022.

When the rate was increased to 4.55% on January 26, 2023 the Bank of Canada implied that the new level was probably it for a while. But they did say they would keep an eye on the progress of pushing down the rate of inflation to between the 2% and 3% range.

Today Beaudry confirmed that, saying the bank had been sitting back for four months to assess the impacts of their aggressive series of hikes. But it wasn’t enough.

Puzzled about the labour market:

In recent weeks — echoed by Beaudry yesterday — the Bank leadership has expressed being somewhat puzzled over why the labour market is still so robust (with a very low unemployment rate) and why consumers are spending some robustly.

They have turned the screws again this week in what they feel will be suitable pressure for people to slow down on spending and for hiring to ease up a bit.

“Jobs are very abundant,” said Beaudry in his media session after the luncheon. “People being scared of losing their jobs” is one way that “dampens down consumption more”, said Beaudry.

He doesn’t seem to think that a new influx of jobs in relatively new sectors like AI, green tech and biomed is impacting the balance in the job market that the Bank is expecting to see.

Slowing down consumption:

The lives of people and well-being of businesses are impacted by these decisions. Today Beaudry expressed being aware of that, but that the Bank of Canada must look at the overall economic temperature of the country. He says the Bank still wants to “see a slow down” in the consumption levels of individuals and households.

For people who can barely make ends meet each month (including having to cut back on groceries and juggling bill payments), it seems like there isn’t much more of a slowdown to be had. But the Bank’s eye is on mortgage lending and the housing market more broadly. In plain language, they want fewer people buying homes or carrying mortgages with interest rates beyond what can be serviced without default.

Another hike likely in July:

It sounds like another rate hike is likely in July, based on Beaudry’s remarks (and those of Bank of Canada Governor Tiff Macklem yesterday) that their policy-driven target of 2% to 3% inflation has not been met.

The Total CPI inflation went up to 4.4% (from 4.3%) most recently, which today Beaudry said was “heading in the wrong direction”.

Who was there:

Emcee for the noon-hour event today at the Victoria Conference Centre was Greater Victoria Chamber of Commerce CEO Bruce Williams. Brief remarks were made by financial advisor and Greater Victoria Harbour Authority Vice-Chair Mark Mawhinney.

Some brief final remarks were given by Chris Werk, Chair, Greater Victoria Chamber of Commerce who said a donation would be given to the Greater Victoria Housing Society in lieu of a gift to today’s speaker.

Attending from the City of Victoria was Mayor Marianne Alto and several city councillors. Attending from City of Langford Council was Mayor Scott Goodmanson and Councillor Mary J Wagner. Attending from District of Sooke Council was Dana LaJeunesse.

Camosun College President Lane Turner attended, as did Camosun’s Vice-President Partnerships Geoff Wilmhurst. The University of Victoria was also represented.

Several representatives of the Destination Greater Victoria organization attended including CEO Paul Nursey and Executive Director of Corporate Communications and Community Relations, Astrid Chang.

There were representatives from several financial institutions including CIBC, RBC, Scotiabank, and TD.

Victoria-Beacon Hill MLA Grace Lore attended the luncheon.

A burden:

After Beaudry’s address, Williams quipped that businesses are finding the cost of money to be a burden and said he hopes the Bank of Canada will bring the rates down ‘as much as possible and as soon as possible’.

Media session:

After the luncheon event, the Bank of Canada held a national press conference. The June 8, 2023 Bank of Canada webcast is posted online.

===== ABOUT ISLAND SOCIAL TRENDS:

Island Social Trends (and the previous publications MapleLine Magazine 2008-2010, Sooke Voice News 2011-2013, and West Shore Voice News 2014-2020) delivers socioeconomic news insights about life on the west shore of south Vancouver Island. All news is posted at IslandSocialTrends.ca . Editor Mary P Brooke. Published by Brookeline Publishing House Inc. | Never miss a story: PREMIUM SUBSCRIPTION SIGNUP