Tuesday February 17, 2026 | VICTORIA, BC

by Mary P Brooke | Island Social Trends

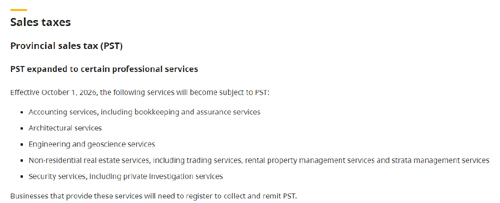

In BC the application of Provincial Sales Tax (PST) has long been charged only on a select list of products. Now it will also be charged on a specified list of services, starting October 1, 2026.

All services are already subject to the federal GST.

PST is 7% in BC and GST is 5% across Canada.

Most people are familiar with PST being charged on most retail purchases.

Easy process for government:

Designating more things as PST-taxable probably seems like a straightforward way for the BC Government to collect revenues using an existing taxation collection system.

Pushing up prices:

But the sort of services on which PST will be applied impacts businesses when they pay for accounting and bookkeeping services as well as a range of professional services in the housing development sector like architectural design, engineering, and geoscience (to which PST will apply on 30% of the purchase price), rental property and strata management, transaction commissions related to buying and selling non-residential real estate, and private investigation.

All of that new application of PST will get passed onto customers and clients and filter through into a higher cost for nearly everything including housing and managed rental properties that will find ways to pass it on to tenants.

Some things no longer ‘essential’:

A few things that the government deems as no longer essential services will see PST newly applied. That list includes:

- basic cable television services, toll-free telephone services, and residential landline telephone services,

- clothing patterns, yarn, natural fibres, synthetic thread, and fabric that are commonly used in making or repairing clothing, and

- other services related to clothing and footwear (basic laundry services will remain exempt).

More changes to come:

As well, longstanding exemptions will be eliminated in areas of minor and/or diminishing significance, effectively introducing the tax to these services.

As if to justify this change, the Province says the expansion of the PST to include these services is “generally consistent with how the tax applies to these services in most provinces.”

Aimed at deficit reduction:

The PST changes are one aspect of a strategy toward narrowing the gap in the Province’s gap in its structural deficit.

The 2026/2027 fiscal year operating budget deficit is expected to reach an all-time high of $13.3 billion.

The provincial government expects the expansion of the PST to include select professional services, which will increase revenues by:

- $261 million in 2026/2027,

- $534 million in 2027/2028,

- $563 million in 2028/2029.

For the eliminated exemptions, revenue is expected to increase by:

- $23 million in 2026/2027,

- $44 million in 2027/2028,

- $43 million in 2028/2029.

See more detail about the PST income tax change in Budget 2026 (BC Ministry of Finance link).

===== RELATED:

- Finance Minister: serious disciplined BC Budget 2026 will protect core services (February 15, 2026)

- NEWS SECTIONS: BUDGET 2026 | 43rd PARLIAMENT Of BC