Friday May 1, 2020 ~ NATIONAL

by Mary Brooke ~ West Shore Voice News

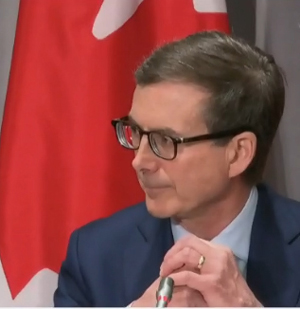

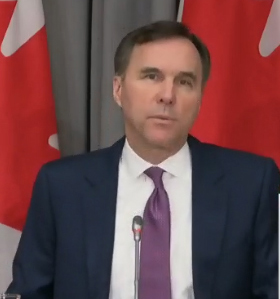

Someone in Canada today skyrocketed to becoming a household name. Announced today as the incoming Governor for the Bank of Canada, Tiff Macklem clearly stole the show in a press conference hosted by Finance Minister Bill Morneau alongside current Bank of Canada Governor Stephen Poloz.

In normal times this would have seemed like more of an upset than it already did. But putting someone in the top job who is not only willing but evidently eager to take on the economic challenges of a pandemic with new and big ideas is not only the right move, it should indicate to Canadians that under the current federal government there is the desire and drive to get people and communities through this pandemic to the other side.

A stable or at least enabled economic engine at this time of economic crisis (as generated by a natural disaster health crisis) is Canada’s best hope for a successful recovery.

A further indicator for confidence in the financial direction of the country once the current crisis passes, is that Macklem says his key focus for the bank will be economic landscape of Canada through the lens of climate change — how that will shape the economy, productivity, spending, and ultimately prices.

Macklem is taking on this role at a critical time for our country, a time of “unprecedented challenge,” said Finance Minister Bill Morneau this morning in the live press conference. “The bank’s role is to serve the best interests of the economic life of the nation.”

Under the leadership of outgoing Bank of Governor, Morneau said that Poloz’s service was “rooted in dedication and professionalism and the utmost commitment to serve the good of Canada” and that Poloz acted “without hesitation to be swift and innovative… knowing when to step beyond the bounds of convention, in the moment”.

Under Poloz, Canada “preserved its excellence and worldwide standing”, said Morneau. Under Poloz for seven years, Canada built a sterling banking reputation around the world. Under his leadership, the first woman — Viola Davis — is now featured on a banknote (the $10 bill).

It could be said that Poloz was a banker for the people, and that Macklem is more of a banker’s banker but with an edge for getting his hands dirty as required. Each the right pick for their time, it appears. Morneau has been Finance Minister through five years of Liberal governance; Poloz was already Governor when Morneau came into political life.

Macklem said there is a “need to try and overwhelm the crisis” to stabilize the economy and “restore confidence.” In the medium term, he will have to develop “an exit strategy from the extraordinary levels of stimulus that are currently being provided,” as it was put by senior RBC Economist Josh Nye today in a report from that bank.

Macklem was Senior Deputy Governor from 2010-14. He helped the Bank of Canada respond to the financial crisis of 2008-2009. Currently he is Dean of the Rotman School of Management at the University of Toronto.

His new post starts June 3, the day of the Bank of Canada’s next scheduled rate announcement. The benchmark rate is presently at 0.25%, which means that savings don’t bear much benefit but that borrowing is cheap. When asked today by media if he would consider applying negative-interest in Canada, he said it would be tough to convince people to see active reductions in their savings.

Macklem grew up in Montreal, the son of the chief financial officer of the Henry Birks and Sons Ltd. (Canada) jewelry empire. With many years served in the Bank of Canada in previous positions, Macklem was a top candidate for governor in 2013, but Poloz got the job.

Similarly, the bank’s current deputy governor Carolyn Wilkins — who has worked alongside Poloz but was never overshadowed — was considered high on the list of successors. Possibly the dramatic dynamics of the time require someone from outside the current circle, which often happens in business.