Monday February 14, 2022 | VICTORIA, BC

by Mary P Brooke | Island Social Trends

People in BC will now be able to renew their personal ICBC vehicle insurance policies online. And those stick-on decals for licence plates will no longer be required.

It’s about convenience, and saving government money.

Eligible ICBC customers with policies expiring on or after May 1, 2022, will have the option to renew their policy using their computer, tablet or mobile device. While May 1 will be the official launch date, customers can renew their insurance up to 44 days earlier, meaning some people will be able to renew online as soon as March 17, 2022.

This announcement was made today by Mike Farnworth, Minister of Public Safety and Solicitor General and ICBC president and CEO Nicolas Jimenez.

Today during the live announcement Farnworth called these changes “the most transformative shift in ICBC’s history”.

“The online insurance renewal initiative offers British Columbians a more convenient way to renew their ICBC auto insurance,” said Mike Farnworth, Minister of Public Safety and Solicitor General.

Link to the ICBC Auto Insurance Renewal page.

Broker support:

With support from ICBC’s broker network, the new online insurance service will enable customers to renew their current personal auto insurance coverage, change their address, apply for discounts, update the drivers listed on their policy and modify how they use their vehicle. ICBC expects even more online features to be available in the future.

Brokers will continue to offer their expert advice on insurance coverage, whether in person, on the telephone or for online renewals, and will continue to assist ICBC customers with their Autoplan insurance needs.

Today Farnworth said: “There was considerable focus group testing and consultation group testing done on the implementation of online renewal. At the same time we also know and have looked at how it has worked in the other provinces — five other provinces that have done away with the decal, for example,” he said.

“In Saskatchewan and Manitoba it works, “said Farnworth in response to a question from Island Social Trends. “It’s also one of the reasons why the brokers will continue to review renewals when they’re made. So if they do spot something they’re able to do a followup.”

Apparently brokers will review each online application to look to see that online applicants haven’t missed anything, including available discounts.

No additional cost to renew online:

Online insurance renewals provide greater convenience, choice and flexibility for people.

“Whether our customers choose to visit an Autoplan broker location or renew remotely, the cost of their ICBC auto insurance will be the same,” it was stated by the ministry today.

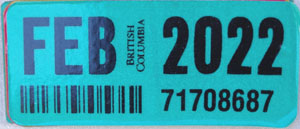

Decals not required:

Coinciding with the launch of online auto insurance renewals, May 1 also will mark the last day that B.C. drivers will be required to display a licence plate validation decal to show they have valid insurance. To support this transition, ICBC is making a one-time investment of as much as $1 million to enhance and expand the Automated Licence Plate Recognition program, which helps law enforcement in B.C. detect unlawful, unlicensed and uninsured drivers.

Decal elimination will align B.C. with other Canadian jurisdictions that have successfully removed the decal from circulation, including Alberta, Saskatchewan, Manitoba, Quebec and the Northwest Territories.

Automated licence plate recognition:

“Working through the RCMP, police agencies in B.C. will be enhancing and expanding the Automated Licence Plate Recognition program that exists today.”

BC is making a one-time investment of up to $1 million to enhance and modernize the Automated Licence Plate Recognition program, and purchase new hardware helping law enforcement in B.C. detect unlawful, unlicensed and uninsured drivers.

The cost of this investment will be offset by operational savings related to manufacturing and distribution of the decals.

Saving on decal costs:

ICBC’s annual manufacturing costs for decals come to just over $1.2 million (updated since the $2.3 million mentioned in the live news conference today).

Other costs associated with the decals, like shipping and handling, are estimated by the Public Safety ministry to be another $500,000 annually.

So that’s about $1.7 million in annual savings, going forward.

Enhanced Care has saved money for drivers:

B.C. drivers have saved significantly this year on their personal auto insurance with the launch of Enhanced Care – an average of nearly $500 or about 28 percent compared to last year.

Customer service:

“We know online insurance renewals are something our customers have been waiting for, and we’re pleased to announce that we’re on track to have this option go live next month,” said Nicolas Jimenez, president and CEO, ICBC. “Online insurance renewals add to the growing number of digital options available to customers, providing greater convenience, choice and flexibility for British Columbians.”

Pandemic-driven options:

During the pandemic, ICBC has enabled its customers to renew their insurance, make adjustments to their policy and complete other transactions by phone and email. This service will continue, giving customers the opportunity to renew without in-person interaction during the lead-up to online renewals and beyond.