Friday March 25, 2022 | VICTORIA, BC

by Mary P Brooke, Editor | Island Social Trends

A one-time ICBC rebate is coming to vehicle-insurance policy holders in BC.

The windfall comes in May. The amount will be $110 to people with personal-use vehicle policies, or $165 to people with commercial-vehicle insurance policies.

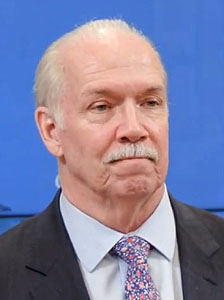

The announcement of this positive news was delivered today by Premier John Horgan and Public Safety Minister and Solicitor General Mike Farnworth.

During the pandemic of the past 24 months (starting March 2020), many people drove vehicles less. That reduced the number of motor vehicle incidents (MVI’s), Farnworth explained today.

Now that the economic recovery is pretty much in full swing, people are back out doing more things and using their vehicles more in-keeping with regular patterns.

Better-than-expected investment returns:

The funds available from ICBC are due primarily to more funds earned on investments (while people weren’t driving and getting into MVIs). Horgan was pleased that funds can be returned to the people who paid into ICBC in the first place. It shows a good measure of fair-play with British Columbians.

On the heels of other rebates:

There were two other ICBC COVID-19 relief rebates to customers during the pandemic in 2020-2021. Farnworth said those were about $300 in total, on average.

As well, due to restoration of proper financing within ICBC in relation to BC budgets (i.e. clean up of the so-called ‘dumpster fire’ caused by the pre-2017 government siphoning profits from ICBC into general revenues), ICBC was able to reduce policy rates for most drivers which has produced an average annual saving of $490 for drivers in BC. The Enhanced Care refunds were provided to eligible customers after the launch of the new insurance model on May 1, 2021.

As of Dec. 31, 2021, most customers renewing their full-coverage personal auto insurance under Enhanced Care have had annual average savings of $490, or 28% per policy renewal, compared to the previous model.

Timing:

This rebate will total more than $395 million and comes at time when the global increase in gas prices and other cost pressures have affected day-to-day life for British Columbians.

“People are facing increased costs through no fault of their own, but as a chain reaction that started with Putin’s illegal war in Ukraine,” said Premier John Horgan. “As a result of our work to fix ICBC, we’re in a position to put money back in people’s pockets to help a little with these increased costs.”

ICBC is in a position to provide the relief rebate as a result of its forecast annual net income of $1.9 billion for the fiscal year ending March 31, 2022. The remaining income will be reinvested into ICBC’s capital reserves to ensure rates remain affordable for the long term.

Who’s eligible:

Most ICBC customers with a basic auto insurance policy during the month of February will be eligible for the $110 relief rebate. Most commercial customers will receive a rebate of $165 because they generally incur higher expenses.

ICBC says its goal with the rebate is to provide financial relief to the largest amount of customers as possible – exceptions include personal insurance customers with temporary operating permits and policies related to golf carts, off-road vehicles, rental vehicles and trailers.

Exceptions for commercial customers include commercial rental vehicles, road-building and industrial machines, including forklifts and commercial trailers.

More information about the ICBC Relief Rebate.

Cost of living:

“This rebate is going to help a lot of people in this province,” said Farnworth. “This is another opportunity to put money back in the pockets of the hardworking people who make this province a great place to live.”

Eligible ICBC customers can expect to receive their rebate in May if they are registered for direct deposit with ICBC or as a refund to their credit card. All other customers will receive cheques in June.